Answered step by step

Verified Expert Solution

Question

1 Approved Answer

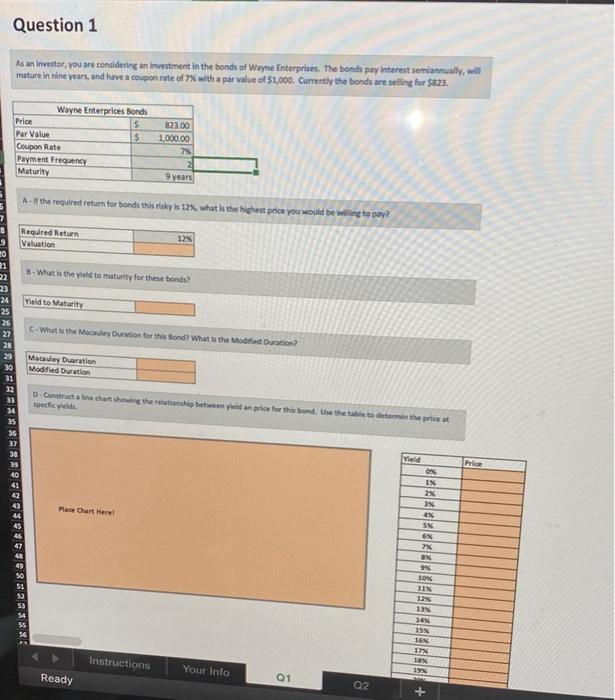

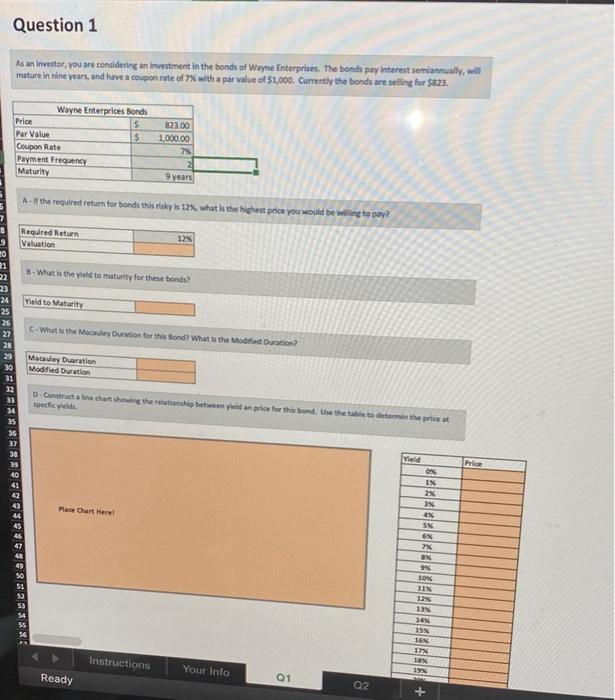

please show excel formulas! 9 20 21 22 23 24 25 26 27 28 29 Question 1 As an investor, you are considering an investment

please show excel formulas!

9 20 21 22 23 24 25 26 27 28 29 Question 1 As an investor, you are considering an investment in the bonds of Wayne Enterprises. The bonds pay interest semiannually, will mature in nine years, and have a coupon rate of 7% with a par value of $1,000. Currently the bonds are selling for $823. 30 ==********************* 31 32 33 34 Price Par Value Coupon Rate Payment Frequency Maturity 35 36 37 38 Required Return Valuation 47 Wayne Enterprices Bonds $ $ A-If the required return for bonds this risky is 125%, what is the highest price you would be willing to pay? 49 51 Yield to Maturity 53 B-What is the yield to maturity for these bonds? Macauley Duaration Modified Duration 823.00 1,000,00 7% 9 years C-What is the Macauley Duration for this Bond? What is the Modified Duration? Place Chart Here! Ready 12% D-Construct a line chart showing the relationship between yield an price for this bond. Use the table to determin the price at spectic yields Instructions Your Info Q1 Q2 Yleid 0% IN 2% 3% 4% S% 6% 7% #N 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% + Price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started