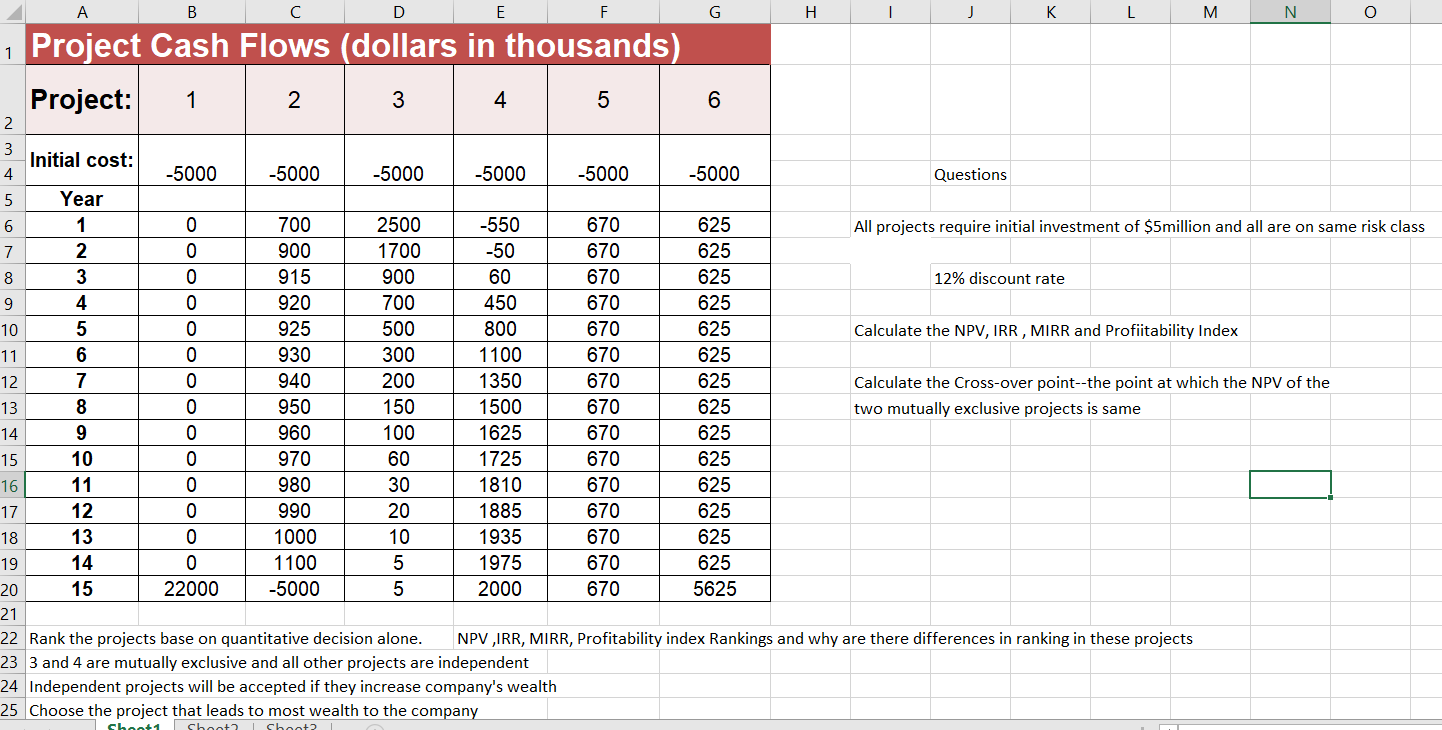

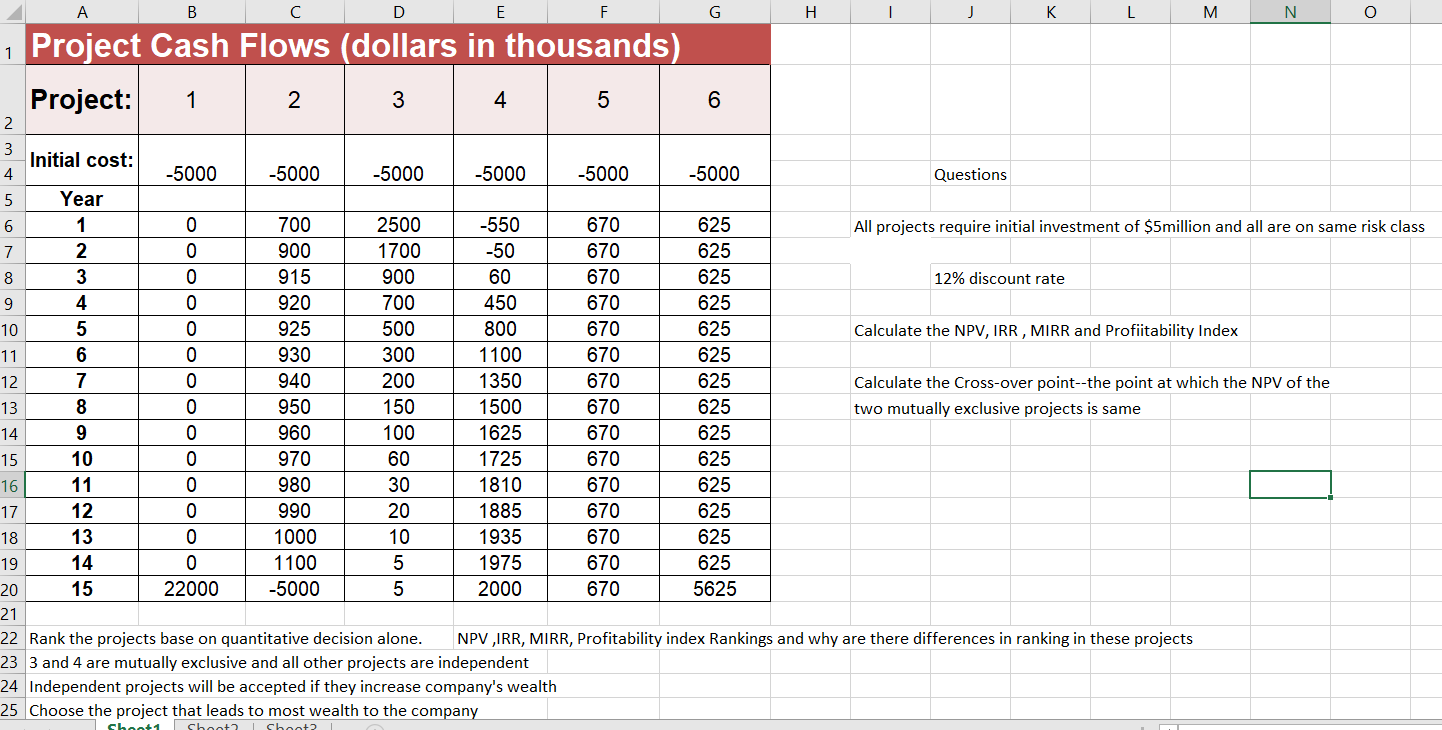

Please show excel formulas

A B D E F G H K L M N O 1 Project Cash Flows (dollars in thousands) Project: N 3 700 625 1 4 5 6 2 3 Initial cost: 4. -5000 -5000 -5000 -5000 -5000 -5000 Questions 5 Year 6 1 0 2500 -550 670 625 All projects require initial investment of $5million and all are on same risk class 7 2 900 1700 -50 670 625 8 3 915 900 60 670 625 12% discount rate 9 4 920 700 450 670 625 10 5 925 500 800 670 Calculate the NPV, IRR, MIRR and Profitability Index 11 6 0 930 300 1100 670 625 12 7 940 200 1350 670 625 Calculate the Cross-over point--the point at which the NPV of the 13 8 950 150 1500 670 625 two mutually exclusive projects is same 14 9 960 100 1625 670 625 15 10 970 60 1725 670 625 16 11 980 30 1810 670 17 12 990 20 1885 670 625 18 13 1000 10 1935 670 625 19 14 0 1100 5 1975 670 625 20 15 22000 -5000 5 2000 5625 21 22 Rank the projects base on quantitative decision alone. NPV IRR, MIRR, Profitability index Rankings and why are there differences in ranking in these projects 23 3 and 4 are mutually exclusive and all other projects are independent 24 Independent projects will be accepted if they increase company's wealth 25 Choose the project that leads to most wealth to the company Shoot1 Shoot Shoot? 625 670 A B D E F G H K L M N O 1 Project Cash Flows (dollars in thousands) Project: N 3 700 625 1 4 5 6 2 3 Initial cost: 4. -5000 -5000 -5000 -5000 -5000 -5000 Questions 5 Year 6 1 0 2500 -550 670 625 All projects require initial investment of $5million and all are on same risk class 7 2 900 1700 -50 670 625 8 3 915 900 60 670 625 12% discount rate 9 4 920 700 450 670 625 10 5 925 500 800 670 Calculate the NPV, IRR, MIRR and Profitability Index 11 6 0 930 300 1100 670 625 12 7 940 200 1350 670 625 Calculate the Cross-over point--the point at which the NPV of the 13 8 950 150 1500 670 625 two mutually exclusive projects is same 14 9 960 100 1625 670 625 15 10 970 60 1725 670 625 16 11 980 30 1810 670 17 12 990 20 1885 670 625 18 13 1000 10 1935 670 625 19 14 0 1100 5 1975 670 625 20 15 22000 -5000 5 2000 5625 21 22 Rank the projects base on quantitative decision alone. NPV IRR, MIRR, Profitability index Rankings and why are there differences in ranking in these projects 23 3 and 4 are mutually exclusive and all other projects are independent 24 Independent projects will be accepted if they increase company's wealth 25 Choose the project that leads to most wealth to the company Shoot1 Shoot Shoot? 625 670