Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show excel formulas and follow excel format. Please show Excel formulas for answers in excel format. Thanks! The Project Consider the following scenario Epsilon

Please show excel formulas and follow excel format.

Please show Excel formulas for answers in excel format. Thanks!

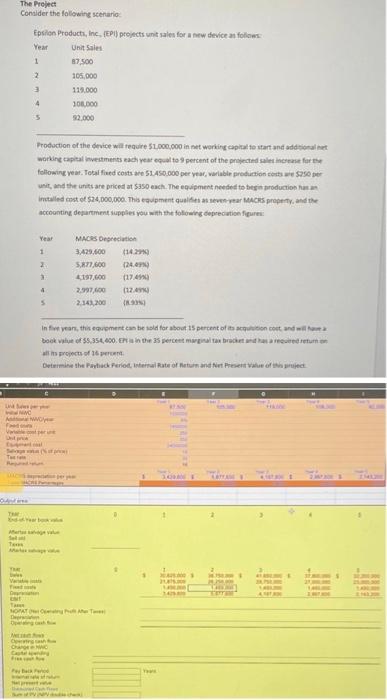

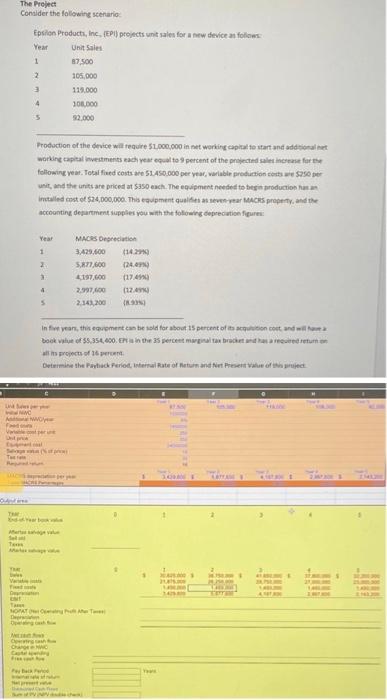

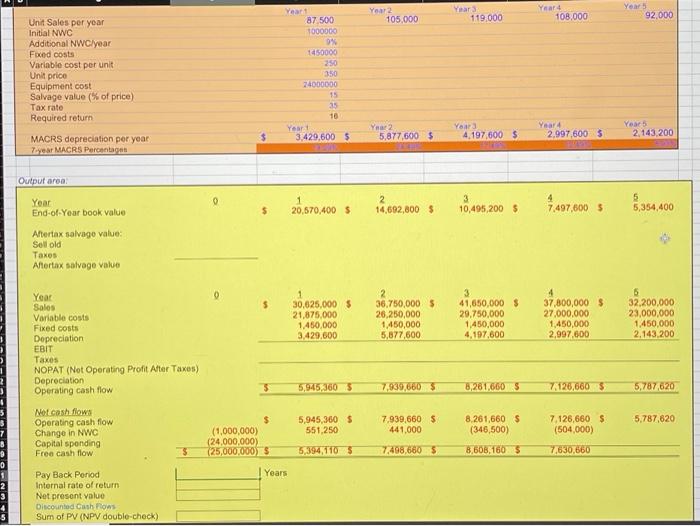

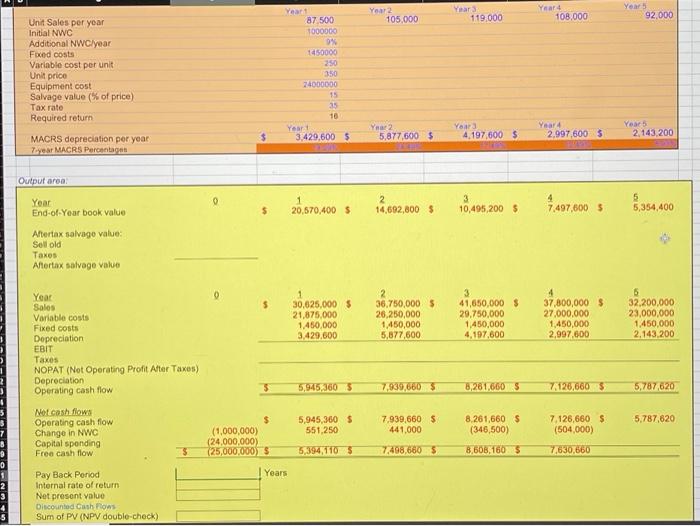

The Project Consider the following scenario Epsilon Products, Inc. (EPI) projects unt sales for a new device and follows Year Unit Sales 1 87.500 2 105,000 119.000 4 300.000 5 92.000 3 Production of the device will require $1.000.000 in working capital to start and additionat working capital investments nach year equal to 5 percent of the projected salt increase for following year. Totalfined costs are SL450.000 per year,variable production costs $250 per wind the units are priced at $350 aach. The equipment needed to begin production Installed most of $24,000,000. This equipment qualifiseer MACHS property and the accounting department supplies you with the following depreciation figures Year 1 2 MACS Depreciation 3.429.600 1149 5.877,600 124.07 4197.600 2.397.100 (12. 2.343,200 IN 2 4 5 In fit years, this equipment can be sold for about 15 percent of its tion cost and wila book value of 55,356,400. Ena in the 35 percent mais brachtens record return all is of 16 Determine the Patek Period internal Rate of Naturmand Nut Present of T Te DED TE FILE De T MOTO CMS Year 2 105,000 Year 119,000 Year 4 108,000 Years 92.000 Unit Sales per year Initial NWC Additional NWC/year Food costs Variable cost per unit Unit price Equipment cost Salvage value (%of price) Tax rate Required return Yeart 87.500 1000000 0% 1450000 250 350 24000000 15 35 10 Year 3,429,600 $ Year 2 5,877,600 5 Yoara 4.197,600 $ Year4 2.997,600 $ Yours 2,143,200 $ MACRS depreciation per year 7year MACRS Percentagan Output area 0 Year End-of-Your book value 2 14,692,800 $ 4 7,497,6005 5 5,354,400 $ 20,570,400 5 10,495,200 $ Altertax salvage value: Sell old Taxes Aftertax salvage value 0 $ 1 30,625,000 $ 21,875,000 1.450,000 3,429,600 2 36.750,000 $ 26,250,000 1,450,000 5,877,600 3 41,650,000 $ 29,750,000 1,450,000 4,197,600 37.800,000 $ 27.000.000 1,450,000 2,997,600 5 32.200,000 23,000,000 1,450,000 2.143,200 Year Sales Variable costs Fixed costs Depreciation EBIT Taxes NOPAT (Not Operating Profit After Taxos) Depreciation Operating cash flow 3 5,945,3605 7,939,6605 3,261,6005 7,126,660$ 5,787,620 Not.cosh flows Operating cash flow Change in NWC Capital sponding Free cash flow 5,945,300 $ 551,250 7,939,660 S 441.000 5,787,620 8.261,660 $ (346,500) 7.126,6605 (504,000) $ (1,000,000) (24,000,000) (25,000,000 $ 5 5,394,1105 7,498,6605 8,608,1605 7,630,660 Years 0 1 2 3 Pay Back Period Internal rate of return Net present value Discounted Cash Flows Sum of PV (NPV double-check) 5 The Project Consider the following scenario Epsilon Products, Inc. (EPI) projects unt sales for a new device and follows Year Unit Sales 1 87.500 2 105,000 119.000 4 300.000 5 92.000 3 Production of the device will require $1.000.000 in working capital to start and additionat working capital investments nach year equal to 5 percent of the projected salt increase for following year. Totalfined costs are SL450.000 per year,variable production costs $250 per wind the units are priced at $350 aach. The equipment needed to begin production Installed most of $24,000,000. This equipment qualifiseer MACHS property and the accounting department supplies you with the following depreciation figures Year 1 2 MACS Depreciation 3.429.600 1149 5.877,600 124.07 4197.600 2.397.100 (12. 2.343,200 IN 2 4 5 In fit years, this equipment can be sold for about 15 percent of its tion cost and wila book value of 55,356,400. Ena in the 35 percent mais brachtens record return all is of 16 Determine the Patek Period internal Rate of Naturmand Nut Present of T Te DED TE FILE De T MOTO CMS Year 2 105,000 Year 119,000 Year 4 108,000 Years 92.000 Unit Sales per year Initial NWC Additional NWC/year Food costs Variable cost per unit Unit price Equipment cost Salvage value (%of price) Tax rate Required return Yeart 87.500 1000000 0% 1450000 250 350 24000000 15 35 10 Year 3,429,600 $ Year 2 5,877,600 5 Yoara 4.197,600 $ Year4 2.997,600 $ Yours 2,143,200 $ MACRS depreciation per year 7year MACRS Percentagan Output area 0 Year End-of-Your book value 2 14,692,800 $ 4 7,497,6005 5 5,354,400 $ 20,570,400 5 10,495,200 $ Altertax salvage value: Sell old Taxes Aftertax salvage value 0 $ 1 30,625,000 $ 21,875,000 1.450,000 3,429,600 2 36.750,000 $ 26,250,000 1,450,000 5,877,600 3 41,650,000 $ 29,750,000 1,450,000 4,197,600 37.800,000 $ 27.000.000 1,450,000 2,997,600 5 32.200,000 23,000,000 1,450,000 2.143,200 Year Sales Variable costs Fixed costs Depreciation EBIT Taxes NOPAT (Not Operating Profit After Taxos) Depreciation Operating cash flow 3 5,945,3605 7,939,6605 3,261,6005 7,126,660$ 5,787,620 Not.cosh flows Operating cash flow Change in NWC Capital sponding Free cash flow 5,945,300 $ 551,250 7,939,660 S 441.000 5,787,620 8.261,660 $ (346,500) 7.126,6605 (504,000) $ (1,000,000) (24,000,000) (25,000,000 $ 5 5,394,1105 7,498,6605 8,608,1605 7,630,660 Years 0 1 2 3 Pay Back Period Internal rate of return Net present value Discounted Cash Flows Sum of PV (NPV double-check) 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started