Answered step by step

Verified Expert Solution

Question

1 Approved Answer

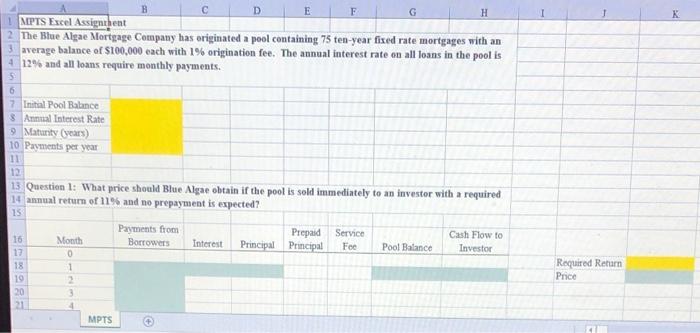

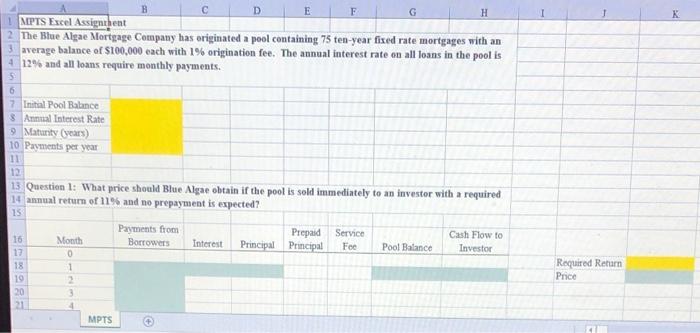

please show excel formulas! D K E F G H 1 MPTS Excel Assignment 2 The Blue Algae Mortgage Company has originated a pool containing

please show excel formulas!

D K E F G H 1 MPTS Excel Assignment 2 The Blue Algae Mortgage Company has originated a pool containing 75 ten-year fixed rate mortgages with an 3 average balance of $100.000 each with 1% origination fee. The annual interest rate on all loans in the pool is 4 12% and all loans require monthly payments. 6 7 Initial Pool Balance $ Annual Interest Rate 9 Maturity (years) 10 Payments per year 11 12 13 Question 1: What price should Blue Algae obtain if the pool is sold immediately to an investor with a required 14 annual return of 11% and no prepayment is expected? 15 Payments from Borrowers Service Month Interest Prepaid Principal Principal Fee Cash Flow to Investor Pool Balance 16 17 18 19 20 21 1 2 3 Required Retar Price 4 MPTS D K E F G H 1 MPTS Excel Assignment 2 The Blue Algae Mortgage Company has originated a pool containing 75 ten-year fixed rate mortgages with an 3 average balance of $100.000 each with 1% origination fee. The annual interest rate on all loans in the pool is 4 12% and all loans require monthly payments. 6 7 Initial Pool Balance $ Annual Interest Rate 9 Maturity (years) 10 Payments per year 11 12 13 Question 1: What price should Blue Algae obtain if the pool is sold immediately to an investor with a required 14 annual return of 11% and no prepayment is expected? 15 Payments from Borrowers Service Month Interest Prepaid Principal Principal Fee Cash Flow to Investor Pool Balance 16 17 18 19 20 21 1 2 3 Required Retar Price 4 MPTS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started