Please show Excel formulas.

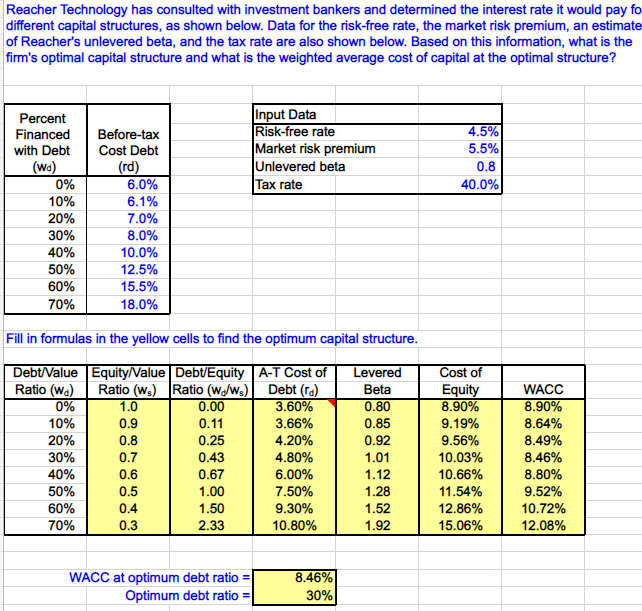

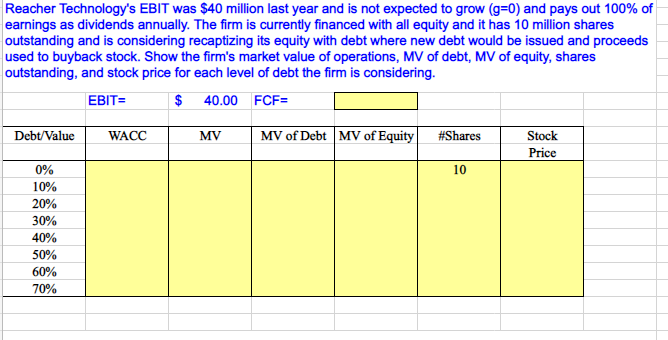

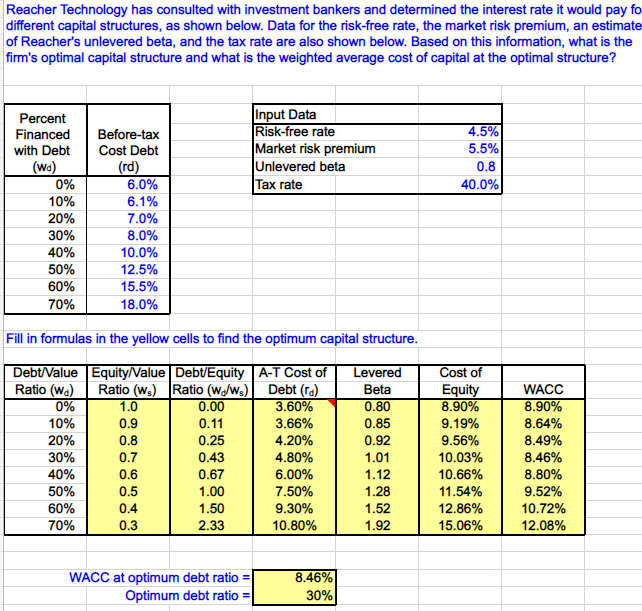

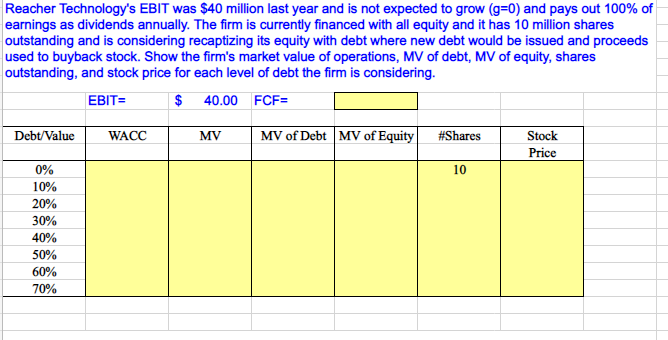

Reacher Technology has consulted with investment bankers and determined the interest rate it would pay fo different capital structures, as shown below. Data for the risk-free rate, the market risk premium, an estimate of Reacher's unlevered beta, and the tax rate are also shown below. Based on this information, what is the firm's optimal capital structure and what is the weighted average cost of capital at the optimal structure? Percent Financed Input Data Risk-free rate Before-tax Cost Debt 4.5% 5.5% with Debt Market risk premium Unlevered beta (Wa) (rd) 0.8 0% 6.0% Tax rate 40.0% 10% 6.1% 20% 7.0% 30% 8.0% 40% 10.0% 50% 12.5% 60% 15.5% 70% 18.0% Fill in formulas in the yellow cells to find the optimum capital structure. Debt/Value Equity/Value Debt/Equity A-T Cost of Levered Ratio (w) Ratio (wa) 0% Ratio (w/w) Debt (ra) Beta 1.0 0.00 3.60% 0.80 10% 0.9 0.11 3.66% 0.85 20% 0.8 0.25 4.20% 0.92 30% 0.7 0.43 4.80% 1.01 40% 0.6 0.67 6.00% 1.12 50% 0.5 1.00 7.50% 1.28 60% 0.4 1.50 9.30% 1.52 70% 0.3 2.33 10.80% 1.92 WACC at optimum debt ratio = Optimum debt ratio = 8.46% 30% Cost of Equity 8.90% 9.19% 9.56% 10.03% 10.66% 11.54% 12.86% 15.06% WACC 8.90% 8.64% 8.49% 8.46% 8.80% 9.52% 10.72% 12.08% Reacher Technology's EBIT was $40 million last year and is not expected to grow (g=0) and pays out 100% of earnings as dividends annually. The firm is currently financed with all equity and it has 10 million shares outstanding and is considering recaptizing its equity with debt where new debt would be issued and proceeds used to buyback stock. Show the firm's market value of operations, MV of debt, MV of equity, shares outstanding, and stock price for each level of debt the firm is considering. |EBIT= $ 40.00 FCF= Debt/Value MV MV of Debt MV of Equity # Shares Stock Price 0% 10 10% 20% 30% 40% 50% 60% 70% WACC Reacher Technology has consulted with investment bankers and determined the interest rate it would pay fo different capital structures, as shown below. Data for the risk-free rate, the market risk premium, an estimate of Reacher's unlevered beta, and the tax rate are also shown below. Based on this information, what is the firm's optimal capital structure and what is the weighted average cost of capital at the optimal structure? Percent Financed Input Data Risk-free rate Before-tax Cost Debt 4.5% 5.5% with Debt Market risk premium Unlevered beta (Wa) (rd) 0.8 0% 6.0% Tax rate 40.0% 10% 6.1% 20% 7.0% 30% 8.0% 40% 10.0% 50% 12.5% 60% 15.5% 70% 18.0% Fill in formulas in the yellow cells to find the optimum capital structure. Debt/Value Equity/Value Debt/Equity A-T Cost of Levered Ratio (w) Ratio (wa) 0% Ratio (w/w) Debt (ra) Beta 1.0 0.00 3.60% 0.80 10% 0.9 0.11 3.66% 0.85 20% 0.8 0.25 4.20% 0.92 30% 0.7 0.43 4.80% 1.01 40% 0.6 0.67 6.00% 1.12 50% 0.5 1.00 7.50% 1.28 60% 0.4 1.50 9.30% 1.52 70% 0.3 2.33 10.80% 1.92 WACC at optimum debt ratio = Optimum debt ratio = 8.46% 30% Cost of Equity 8.90% 9.19% 9.56% 10.03% 10.66% 11.54% 12.86% 15.06% WACC 8.90% 8.64% 8.49% 8.46% 8.80% 9.52% 10.72% 12.08% Reacher Technology's EBIT was $40 million last year and is not expected to grow (g=0) and pays out 100% of earnings as dividends annually. The firm is currently financed with all equity and it has 10 million shares outstanding and is considering recaptizing its equity with debt where new debt would be issued and proceeds used to buyback stock. Show the firm's market value of operations, MV of debt, MV of equity, shares outstanding, and stock price for each level of debt the firm is considering. |EBIT= $ 40.00 FCF= Debt/Value MV MV of Debt MV of Equity # Shares Stock Price 0% 10 10% 20% 30% 40% 50% 60% 70% WACC