Question

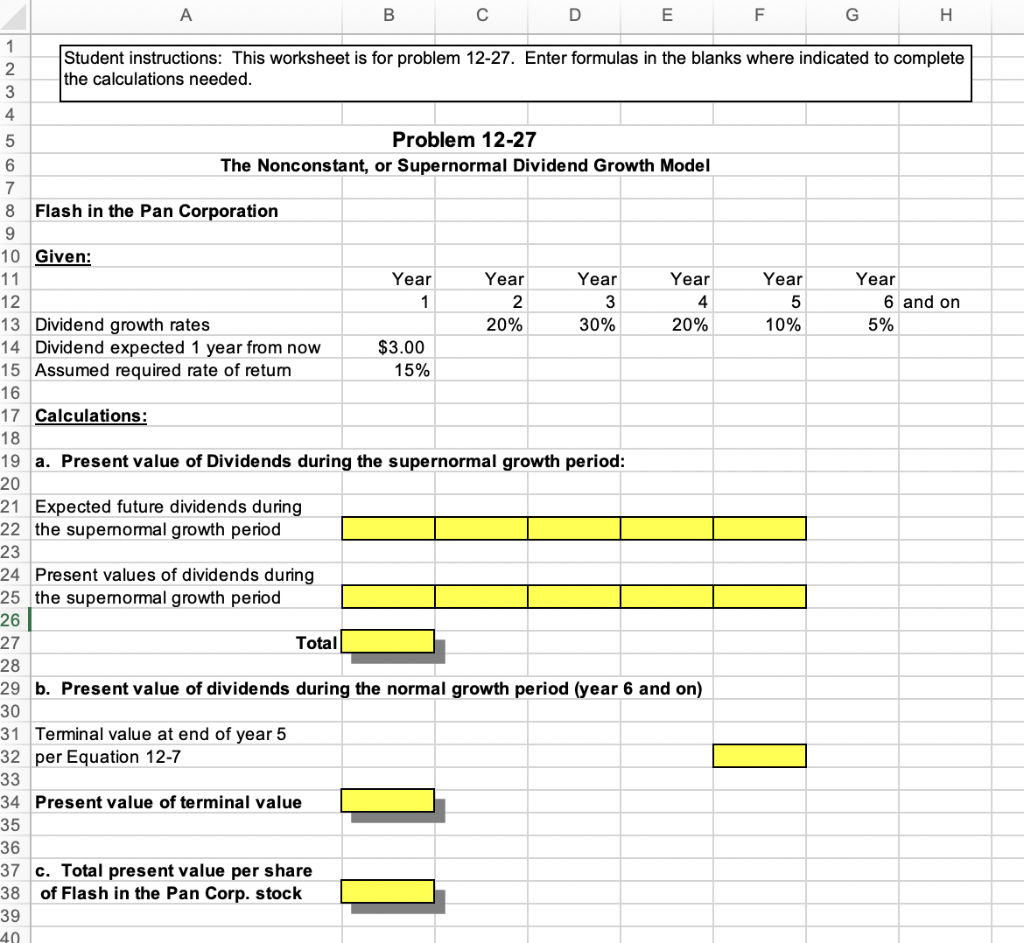

PLEASE SHOW EXCEL FORMULAS Suppose Flash in the Pan Corporation is expected to pay an annual dividend of $3 per share one year from now

PLEASE SHOW EXCEL FORMULAS

Suppose Flash in the Pan Corporation is expected to pay an annual dividend of $3 per share one year from now and that this dividend will grow at the following rates during each of the following four years (to the end of year 5): Year 2, 20 percent; Year 3, 30 percent; Year 4, 20 percent; Year 5, 10 percent. After this supernormal growth period, the dividend will grow at a sustainable 5 percent rate each year beyond year 5.

a.What is the present value of the dividends to be paid during the supernormal growth period? Assume that the required rate of return, ks, is 15 percent.

b.What is the present value of the dividends to be paid during the normal growth period (from year 6 through infinity)?

c.What is the total present value of one share of Flash in the Pans common stock?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started