Answered step by step

Verified Expert Solution

Question

1 Approved Answer

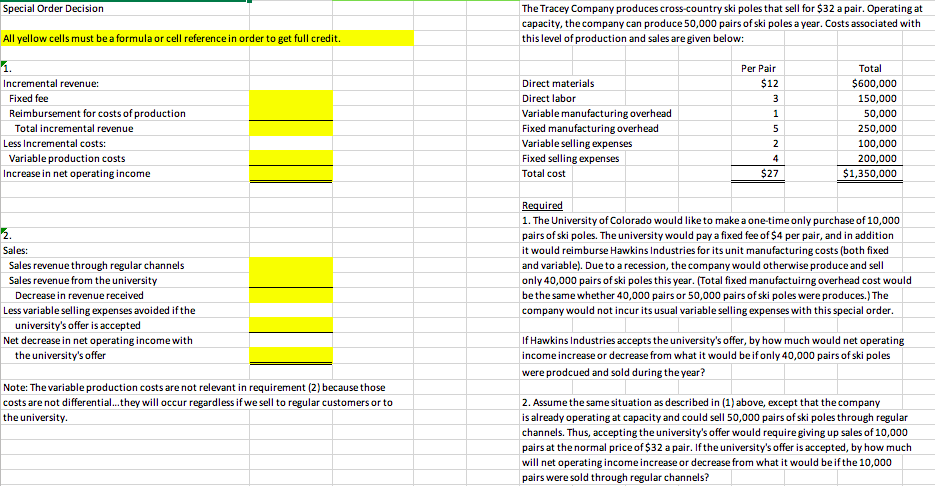

Please show excel formulas. Thank you. Special Order Decision All yellow cells must be a formula or cell reference in order to get full credit.

Please show excel formulas. Thank you.

Special Order Decision All yellow cells must be a formula or cell reference in order to get full credit. 1. The Tracey Company produces cross-country ski poles that sell for $32 a pair. Operating at capacity, the company can produce 50,000 pairs of ski poles a year. Costs associated with this level of production and sales are given below: Per Pair $12 Total Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expenses Fixed selling expenses Total cost $600,000 150,000 50,000 250,000 100,000 200,000 $1,350,000 Incremental revenue Fixed fee Reimbursement for costs of production Total incremental revenue Less Incremental costs: Variable production costs Increase in net operating income Required 1. The University of Colorado would like to makeaone-time only purchase of 10,000 pairs of ski poles. The university would pay a fixed fee of $4 per pair, and in addition it would reimburse Hawkins Industries for its unit manufacturing costs (both fixed and variable). Due to a recession, the company would otherwise produce and sell only 40,000 pairs of ski poles this year. (Total fixed manufactuirng overhead cost would be the same whether 40,000 pairs or 50,000 pairs of ski poles were produces.) The company would not incur its usual variable selling expenses with this special order 2. Sales: Sales revenue through regular channels Sales revenue from the university Decrease in revenue received Less variable selling expenses avoided if the university's offer is accepted If Hawkins Industries accepts the university's offer, by how much would net operating income increase or decrease from what it would be ifonly 40,000 pairs of ski poles were prodcued and sold during the year? Net decrease in net operating income with the university's offer Note: The variable production costs are not relevant in requirement (2) because those costs are not differential...they will occur regardless if we sell to regular customers or to the university 2. Assume the same situation as described in (1)above, except that thecompany is already operating at capacity and could sell 50,000 pairs of ski poles through regular channels. Thus, accepting the university's offer would require giving up sales of 10,000 pairs at the normal price of $32 a pair. Ifthe university's offer is accepted, by how much will net operating income increase or decrease from what it would be ifthe 10,000 pairs were sold through regular channels

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started