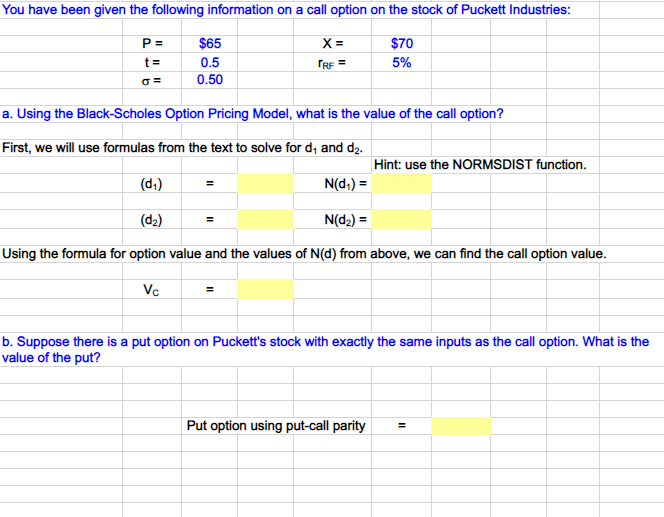

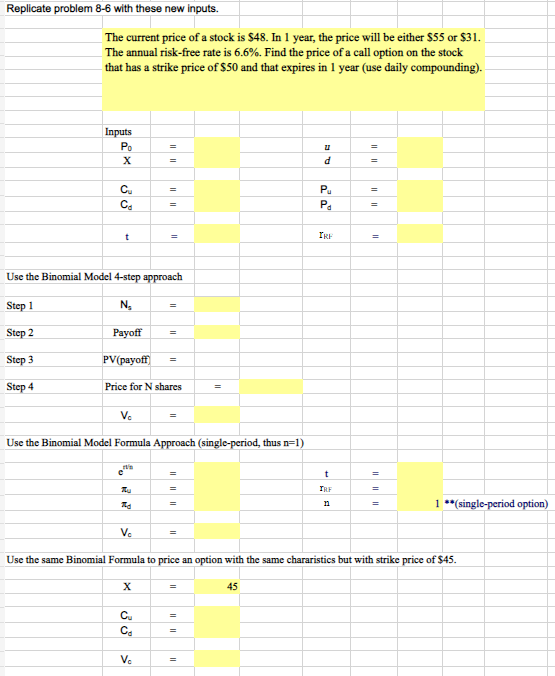

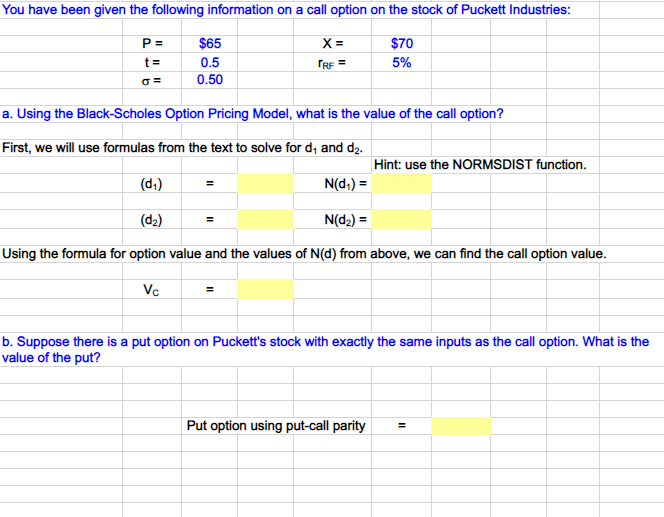

Please show Excel formulas.

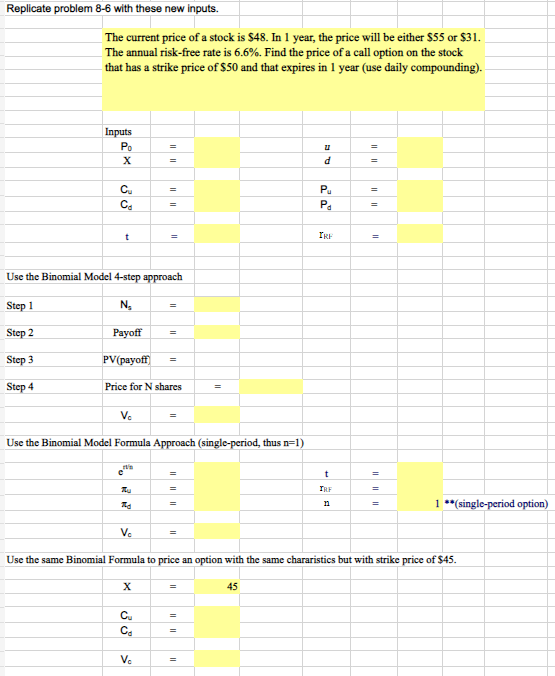

You have been given the following information on a call option on the stock of Puckett Industries: P= $65 X = $70 t= 0.5 TRE= 5% = 0.50 a. Using the Black-Scholes Option Pricing Model, what is the value of the call option? First, we will use formulas from the text to solve for d and d. Hint: use the NORMSDIST function. (d) = N(d)= (d) = N(d) = Using the formula for option value and the values of N(d) from above, we can find the call option value. Vc b. Suppose there is a put option on Puckett's stock with exactly the same inputs as the call option. What is the value of the put? Put option using put-call parity = Replicate problem 8-6 with these new inputs. The current price of a stock is $48. In 1 year, the price will be either $55 or $31. The annual risk-free rate is 6.6%. Find the price of a call option on the stock that has a strike price of $50 and that expires in 1 year (use daily compounding). Inputs Po = 21 X = d = Pu = P t = IRF Use the Binomial Model 4-step approach Step 1 N = Step 2 Payoff = Step 3 PV(payoff = Step 4 Price for N shares = V Use the Binomial Model Formula Approach (single-period, thus n=1) = t = = IRF = = n = V Use the same Binomial Formula to price an option with the same chararistics but with strike price of $45. X 45 Cu = = V = 33 |||||| = = ||||| = = 1 **(single-period option) You have been given the following information on a call option on the stock of Puckett Industries: P= $65 X = $70 t= 0.5 TRE= 5% = 0.50 a. Using the Black-Scholes Option Pricing Model, what is the value of the call option? First, we will use formulas from the text to solve for d and d. Hint: use the NORMSDIST function. (d) = N(d)= (d) = N(d) = Using the formula for option value and the values of N(d) from above, we can find the call option value. Vc b. Suppose there is a put option on Puckett's stock with exactly the same inputs as the call option. What is the value of the put? Put option using put-call parity = Replicate problem 8-6 with these new inputs. The current price of a stock is $48. In 1 year, the price will be either $55 or $31. The annual risk-free rate is 6.6%. Find the price of a call option on the stock that has a strike price of $50 and that expires in 1 year (use daily compounding). Inputs Po = 21 X = d = Pu = P t = IRF Use the Binomial Model 4-step approach Step 1 N = Step 2 Payoff = Step 3 PV(payoff = Step 4 Price for N shares = V Use the Binomial Model Formula Approach (single-period, thus n=1) = t = = IRF = = n = V Use the same Binomial Formula to price an option with the same chararistics but with strike price of $45. X 45 Cu = = V = 33 |||||| = = ||||| = = 1 **(single-period option)