Answered step by step

Verified Expert Solution

Question

1 Approved Answer

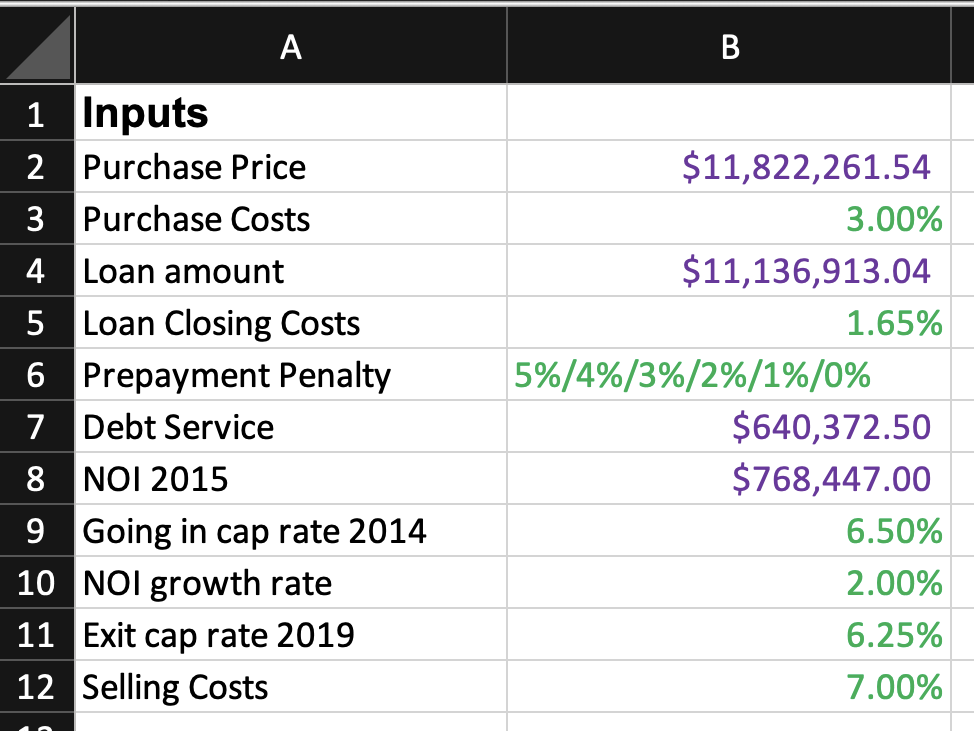

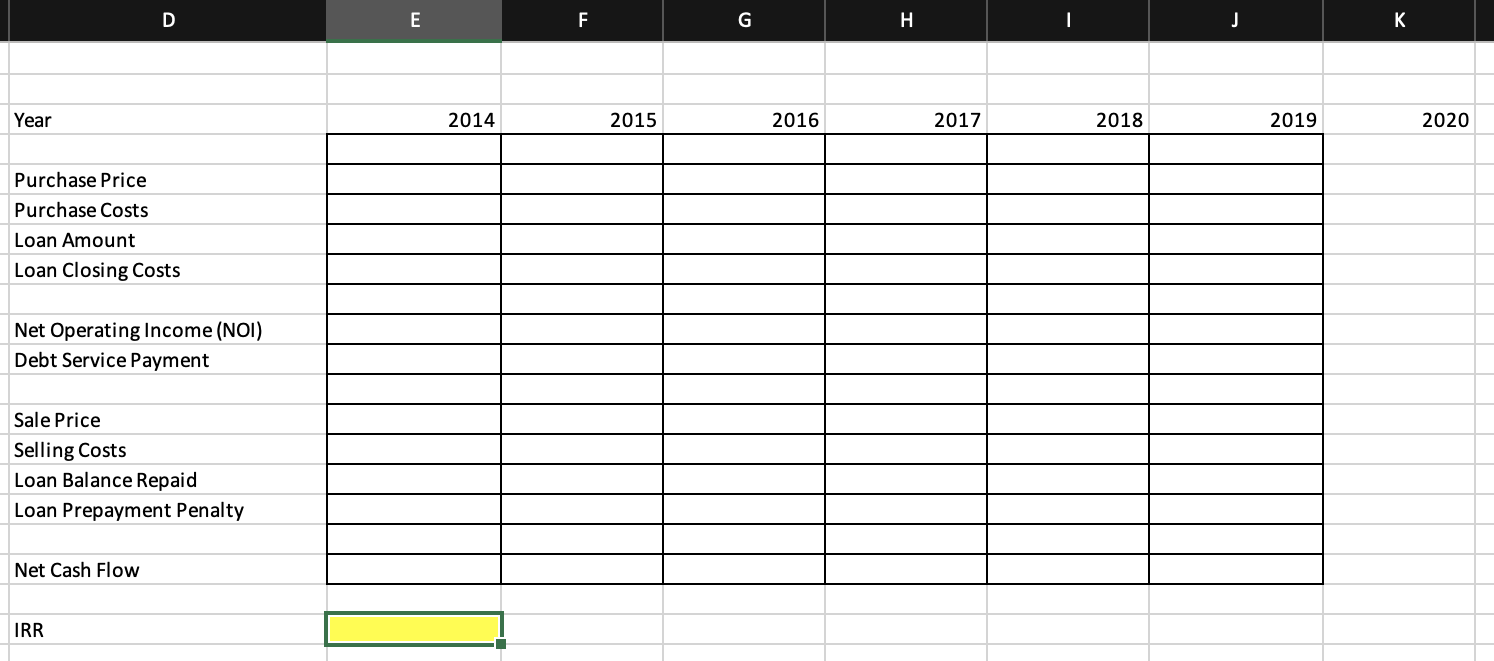

Please show excel solutions (4) Fill in the sheet titled Loan Analysis but ONLY include cash-flow related to Anns loan in the sheet NPV-IRR. Leave

Please show excel solutions

(4) Fill in the sheet titled Loan Analysis but ONLY include cash-flow related to Anns loan in the sheet NPV-IRR. Leave cells unrelated to the loan cash flow blank.

(4.a) What is the annualized IRR for Anns loan?

(4.b) Is the IRR for Anns loan higher or lower than the advertised loan contract rate?

(4.c) Why?

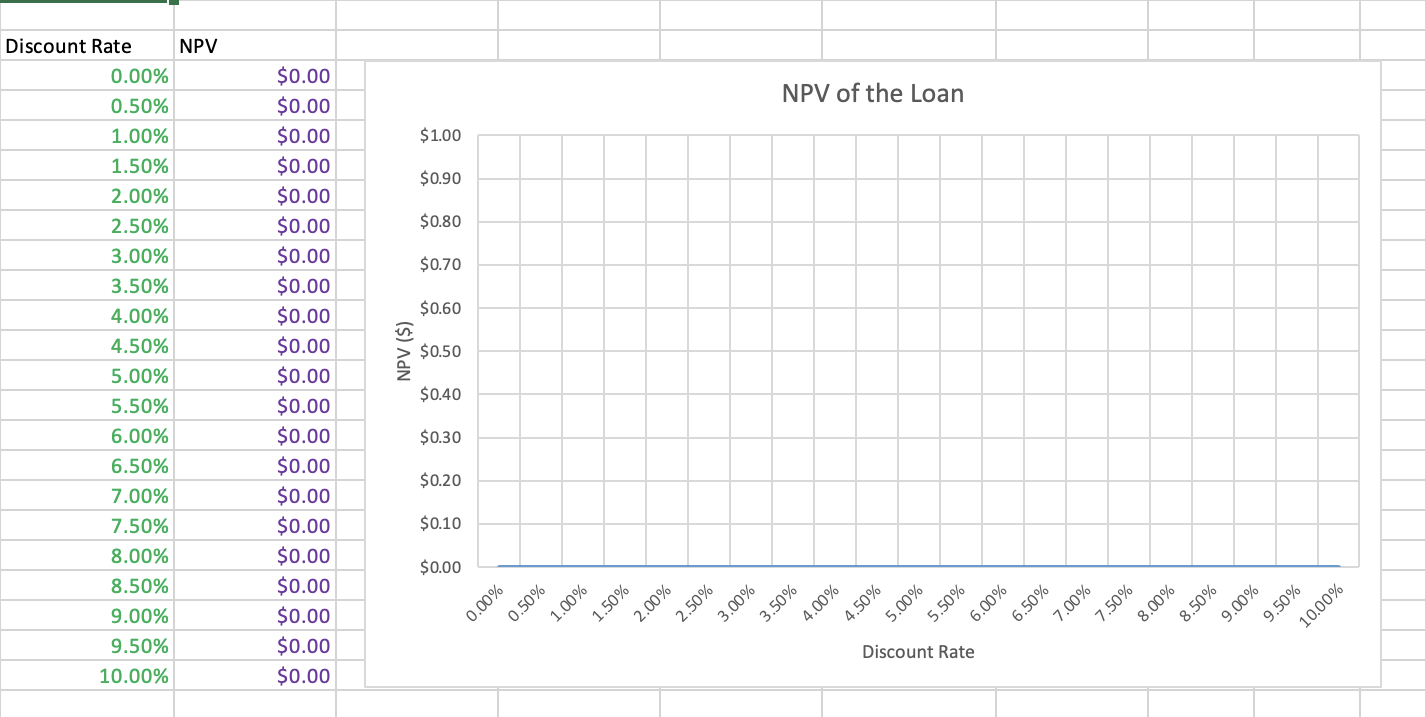

(4.d) Plot Anns NPV for Anns loan, for discount rates 0%-10%. Copy and paste the chart below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started