Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show excel step every step and please for each question if you can interpret the answers and what the significance for each answer means

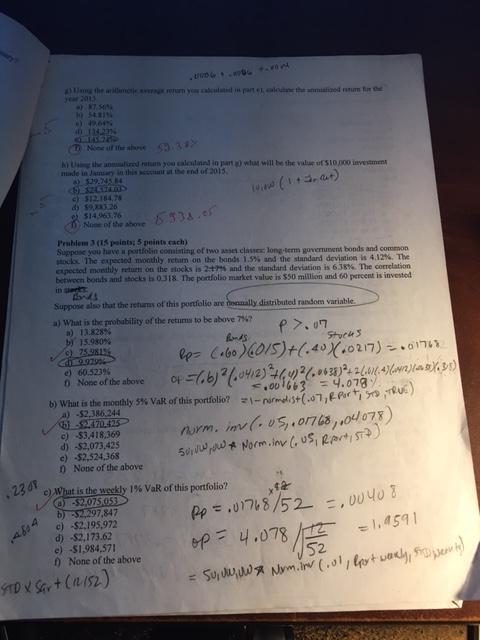

Please show excel step every step and please for each question if you can interpret the answers and what the significance for each answer means specifically part B and C. VaR (Value at Risk)

000+ Ung the arillanetic everage return your calculated in part e, salone the annuatized umfe year 2013 4) KT.54N NO SERIN 360 40 114,231 6129 None of the shove 55.38X N) Using the analized returns you calexland in part ) what will be the value of $10,000 investment made in Jamsary in this account at the end of 2015 4) $29.245 84

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started