Answered step by step

Verified Expert Solution

Question

1 Approved Answer

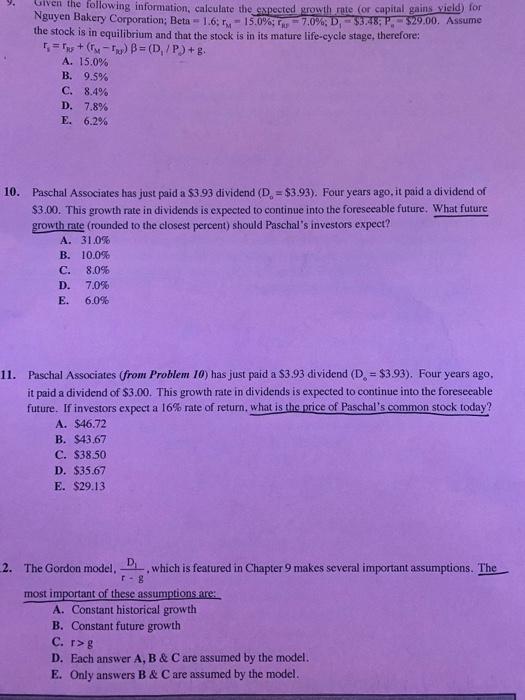

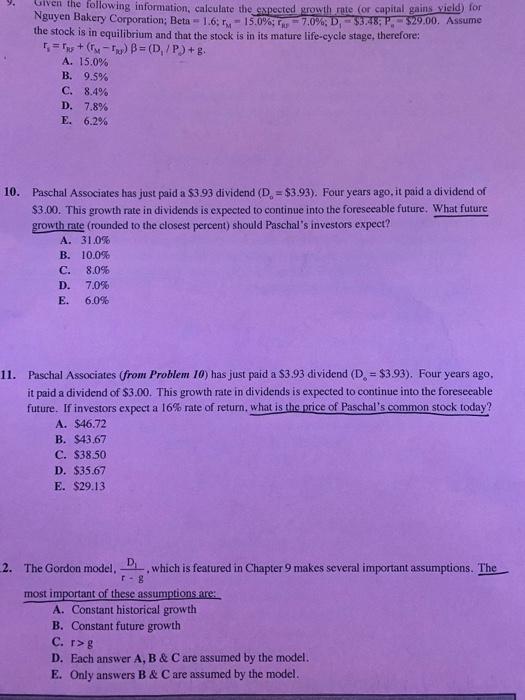

please show formula and work. thank you Given the following information, calculate the expected growth rate (or capital gains yield) for Nguyen Bakery Corporation: Beta

please show formula and work. thank you

Given the following information, calculate the expected growth rate (or capital gains yield) for Nguyen Bakery Corporation: Beta - 1.6 - 15.0% 70% D, 53:48:P. - $29.00. Assume the stock is in equilibrium and that the stock is in its mature life-cycle stage, therefore: T = + (-) B = (D/P) + g. A. 15.0% B. 9.5% C. 8.4% D. 7.8% E. 6.2% 10. Paschal Associates has just paid a $3.93 dividend (D. = $3.93). Four years ago. it paid a dividend of $3.00. This growth rate in dividends is expected to continue into the foreseeable future. What future growth rate (rounded to the closest percent) should Paschal's investors expect? A. 31.0% B. 10.0% C. 8.0% D. 7.0% E. 6.0% = a 11. Paschal Associates (from Problem 10) has just paid a $3.93 dividend (D. = $3.93), Four years ago it paid a dividend of $3.00. This growth rate in dividends is expected to continue into the foreseeable future. If investors expect a 16% rate of return, what is the price of Paschal's common stock today? A. $46,72 B. $43.67 C. $38.50 D. $35.67 E. $29.13 - 8 2. The Gordon model, which is featured in Chapter 9 makes several important assumptions. The most important of these assumptions are: A. Constant historical growth B. Constant future growth C. r> D. Each answer A, B & C are assumed by the model. E. Only answers B & C are assumed by the model

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started