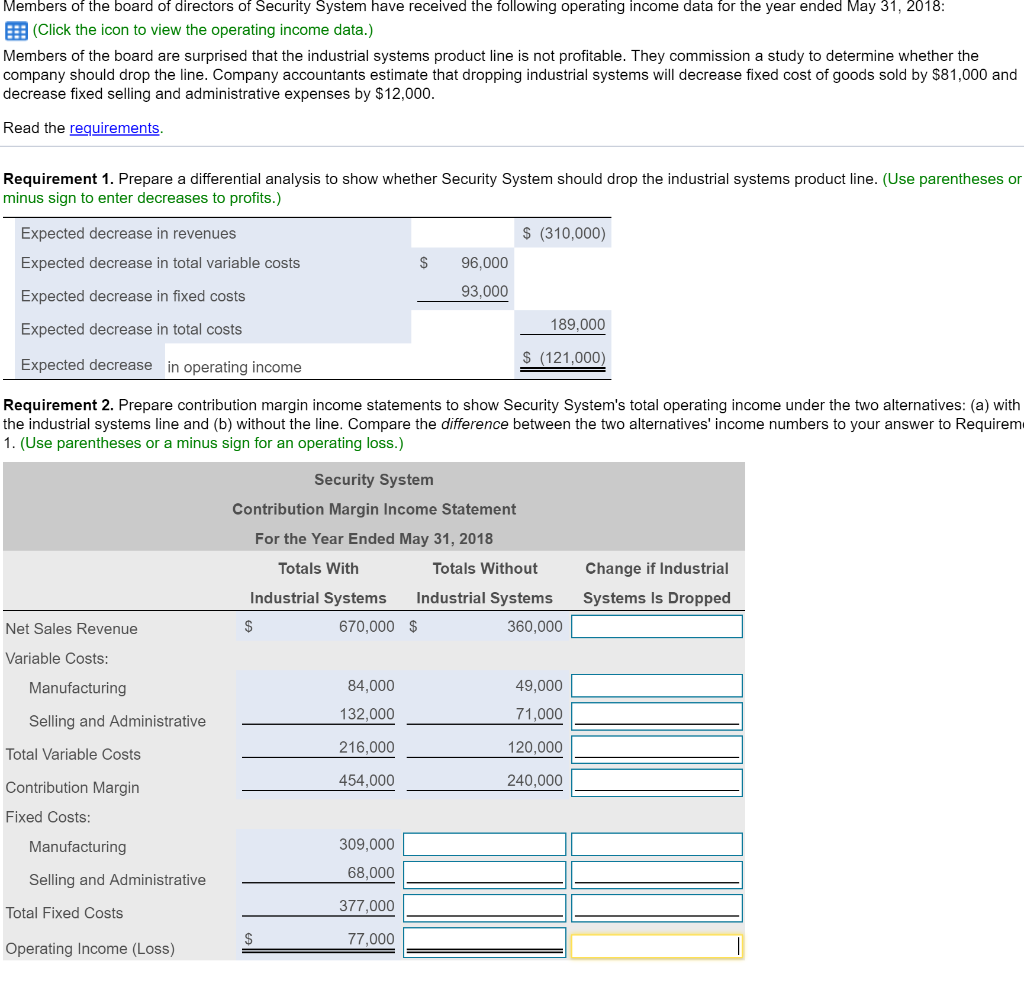

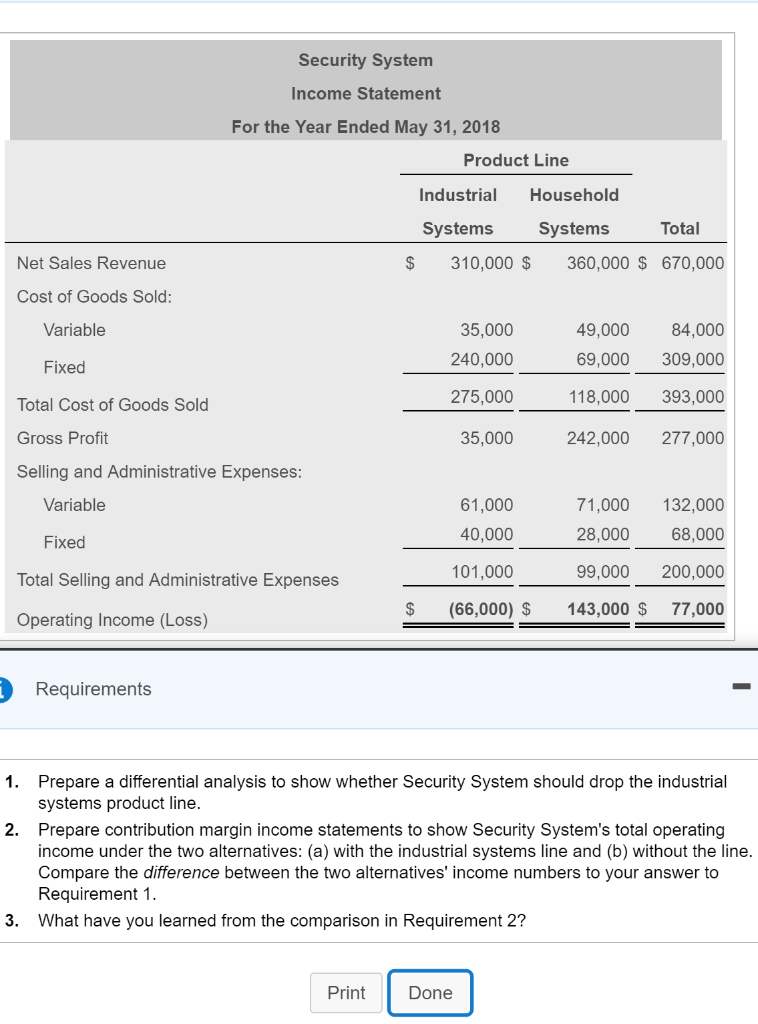

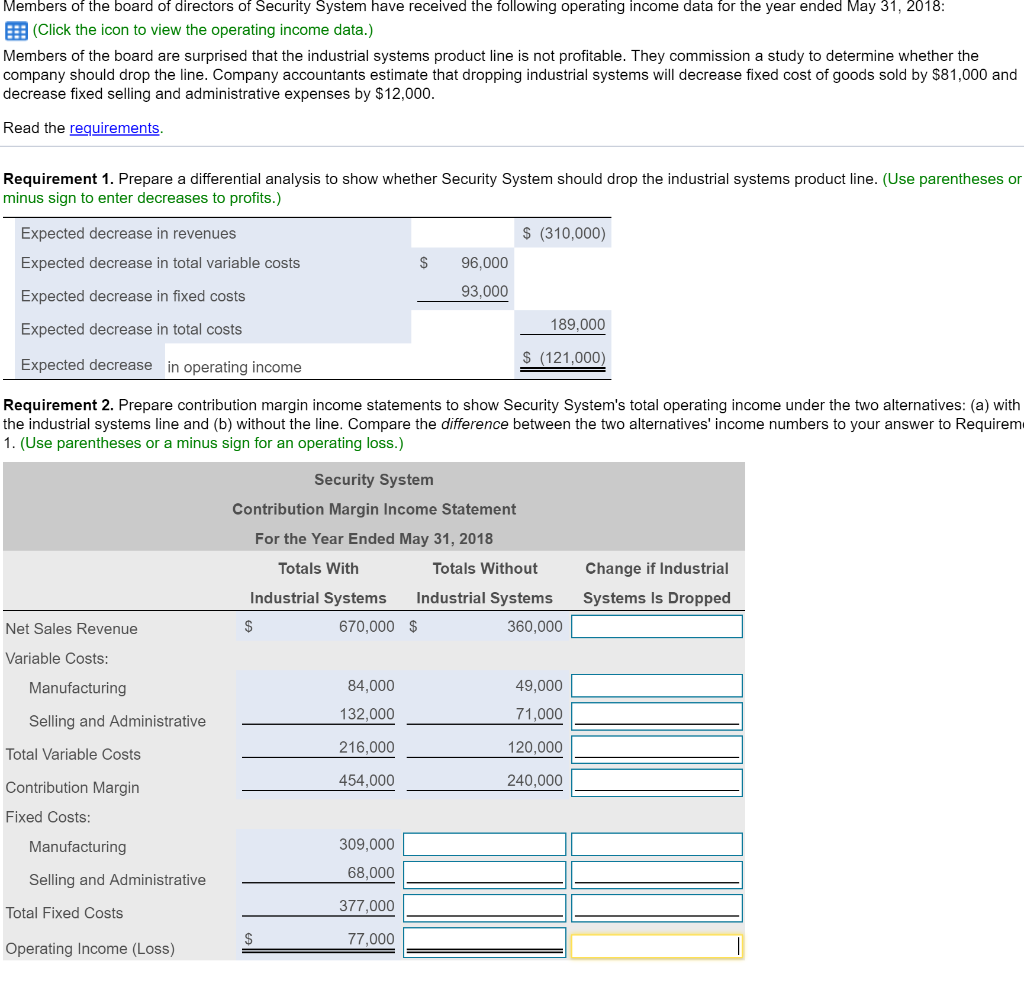

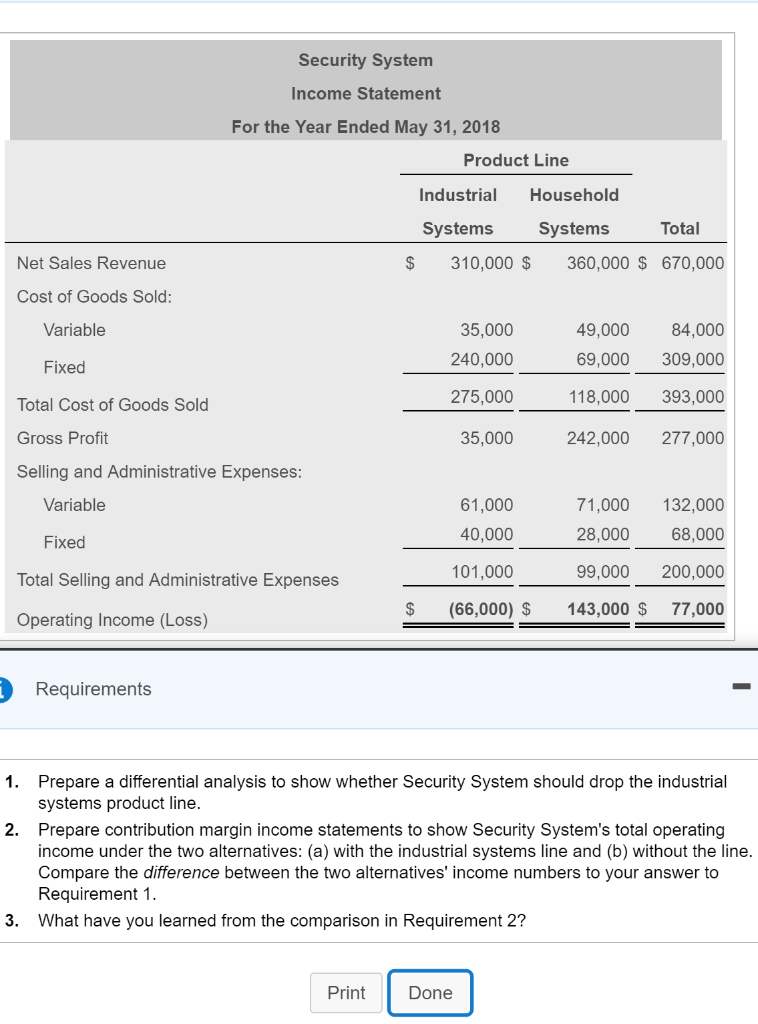

Members of the board of directors of Security System have received the following operating income data for the year ended May 31, 2018: E(Click the icon to view the operating income data.) Members of the board are surprised that the industrial systems product line is not profitable. They commission a study to determine whether the company should drop the line. Company accountants estimate that dropping industrial systems will decrease fixed cost of goods sold by $81,000 and decrease fixed selling and administrative expenses by $12,000. Read the requirements. Requirement 1. Prepare a differential analysis to show whether Security System should drop the industrial systems product line. (Use parentheses on minus sign to enter decreases to profits.) Expected decrease in revenues $(310,000) Expected decrease in total variable costs 96,000 93,000 Expected decrease in fixed costs 189,000 Expected decrease in total costs $ (121,000) Expected decrease in operating income Requirement 2. Prepare contribution margin income statements to show Security System's total operating income under the two alternatives: (a) with the industrial systems line and (b) without the line. Compare the difference between the two alternatives' income numbers to your answer to Requirem 1. (Use parentheses or a minus sign for an operating loss.) Security System Contribution Margin Income Statement For the Year Ended May 31, 2018 Totals With Totals Without Change if Industrial Industrial Systems Industrial Systems Systems Is Dropped 670,000 $ 360,000 Net Sales Revenue Variable Costs: 84,000 49,000 Manufacturing 132,000 71,000 Selling and Administrative 216,000 120,000 Total Variable Costs 454,000 240,000 Contribution Margin Fixed Costs 309,000 Manufacturing 68,000 Selling and Administrative 377,000 Total Fixed Costs 77,000 Operating Income (Loss) Security System Income Statement For the Year Ended May 31, 2018 Product Line Industrial Household Systems Systems Total 360,000 $ 670,000 Net Sales Revenue $ 310,000 $ Cost of Goods Sold: Variable 35,000 49,000 84,000 240,000 69,000 309,000 Fixed 275,000 118,000 393,000 Total Cost of Goods Sold Gross Profit 35,000 242,000 277,000 Selling and Administrative Expenses: 71,000 132,000 Variable 61,000 40,000 28,000 68,000 Fixed 99,000 101,000 200,000 Total Selling and Administrative Expenses (66,000) $ 143,000 $ 77,000 Operating Income (Loss) Requirements 1. Prepare a differential analysis to show whether Security System should drop the industrial systems product line. 2. Prepare contribution margin income statements to show Security System's total operating income under the two alternatives: (a) with the industrial systems line and (b) without the line. Compare the difference between the two alternatives' income numbers to Requirement 1. answer to 3. What have you learned from the comparison in Requirement 2? Print Done