Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show formula that would be used to solve the problem. The excel screen shot is only a sample of the data given, therefore you

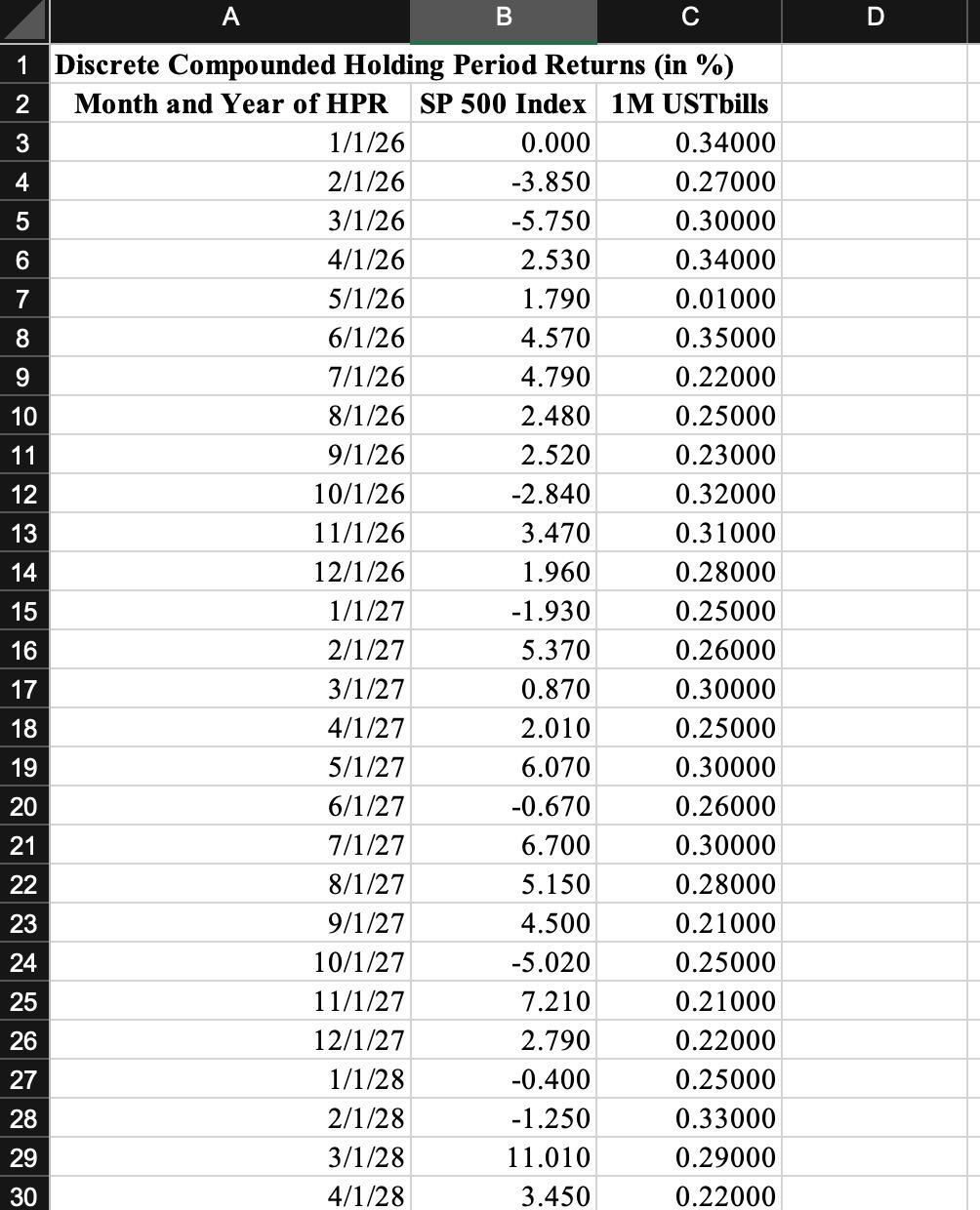

Please show formula that would be used to solve the problem. The excel screen shot is only a sample of the data given, therefore you will not be able to fully work out the problem.

2. Compute the total return from investing $100 in each instrument, S&P 500 and the one-month U.S. Treasury bills, over this period. S&P 500 U. S. Treasury Bills Total Return A B C D 1 Discrete Compounded Holding Period Returns (in %) 2 Month and Year of HPR SP 500 Index 1M USTbills 3 1/1/26 0.000 0.34000 4 2/1/26 -3.850 0.27000 5 3/1/26 -5.750 0.30000 6 4/1/26 2.530 0.34000 7 5/1/26 1.790 0.01000 8 6/1/26 4.570 0.35000 9 7/1/26 4.790 0.22000 10 8/1/26 2.480 0.25000 11 9/1/26 2.520 0.23000 12 10/1/26 -2.840 0.32000 13 11/1/26 3.470 0.31000 14 12/1/26 1.960 0.28000 15 1/1/27 -1.930 0.25000 16 2/1/27 5.370 0.26000 17 3/1/27 0.870 0.30000 18 4/1/27 2.010 0.25000 19 5/1/27 6.070 0.30000 20 6/1/27 -0.670 0.26000 21 7/1/27 6.700 0.30000 22 8/1/27 5.150 0.28000 23 9/1/27 4.500 0.21000 24 10/1/27 -5.020 0.25000 25 11/1/27 7.210 0.21000 26 12/1/27 2.790 0.22000 27 1/1/28 -0.400 0.25000 28 2/1/28 -1.250 0.33000 29 3/1/28 11.010 0.29000 30 4/1/28 3.450 0.22000 2. Compute the total return from investing $100 in each instrument, S&P 500 and the one-month U.S. Treasury bills, over this period. S&P 500 U. S. Treasury Bills Total Return A B C D 1 Discrete Compounded Holding Period Returns (in %) 2 Month and Year of HPR SP 500 Index 1M USTbills 3 1/1/26 0.000 0.34000 4 2/1/26 -3.850 0.27000 5 3/1/26 -5.750 0.30000 6 4/1/26 2.530 0.34000 7 5/1/26 1.790 0.01000 8 6/1/26 4.570 0.35000 9 7/1/26 4.790 0.22000 10 8/1/26 2.480 0.25000 11 9/1/26 2.520 0.23000 12 10/1/26 -2.840 0.32000 13 11/1/26 3.470 0.31000 14 12/1/26 1.960 0.28000 15 1/1/27 -1.930 0.25000 16 2/1/27 5.370 0.26000 17 3/1/27 0.870 0.30000 18 4/1/27 2.010 0.25000 19 5/1/27 6.070 0.30000 20 6/1/27 -0.670 0.26000 21 7/1/27 6.700 0.30000 22 8/1/27 5.150 0.28000 23 9/1/27 4.500 0.21000 24 10/1/27 -5.020 0.25000 25 11/1/27 7.210 0.21000 26 12/1/27 2.790 0.22000 27 1/1/28 -0.400 0.25000 28 2/1/28 -1.250 0.33000 29 3/1/28 11.010 0.29000 30 4/1/28 3.450 0.22000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started