Answered step by step

Verified Expert Solution

Question

1 Approved Answer

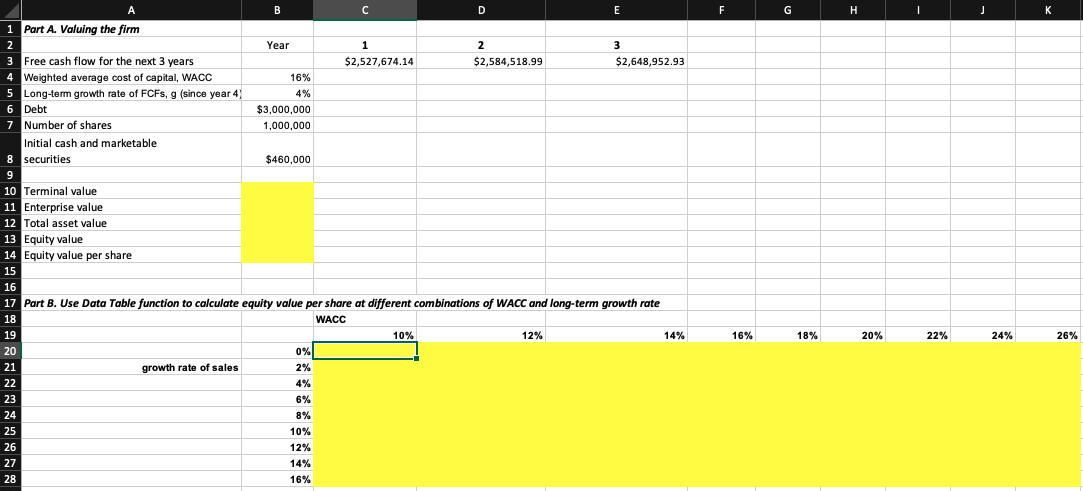

Please show formulas 1 Part A. Voluing the firm Year $2,527,674.14 $2,584,518.99 $2,648,952.93 16% 3 Free cash flow for the next 3 years 4 Weighted

Please show formulas

1 Part A. Voluing the firm Year $2,527,674.14 $2,584,518.99 $2,648,952.93 16% 3 Free cash flow for the next 3 years 4 Weighted average cost of capital, WACC 5 Long-term growth rate of FCFs, g (since year 4 6 Debt 7 Number of shares Initial cash and marketable 8 securities $3,000,000 1,000,000 $460,000 10 Terminal value 11 Enterprise value 12 Total asset value 13 Equity value 14 Equity value per share 16 17 Part B. Use Data Table function to calculate equity value per share at different combinations of WACC and long-term growth rate WACC 10% 12% 14% 0% growth rate of sales 4 % 16% 18% 20% 22% 24% 26% 6% 8% 10% 12% 14% 16%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started