Answered step by step

Verified Expert Solution

Question

1 Approved Answer

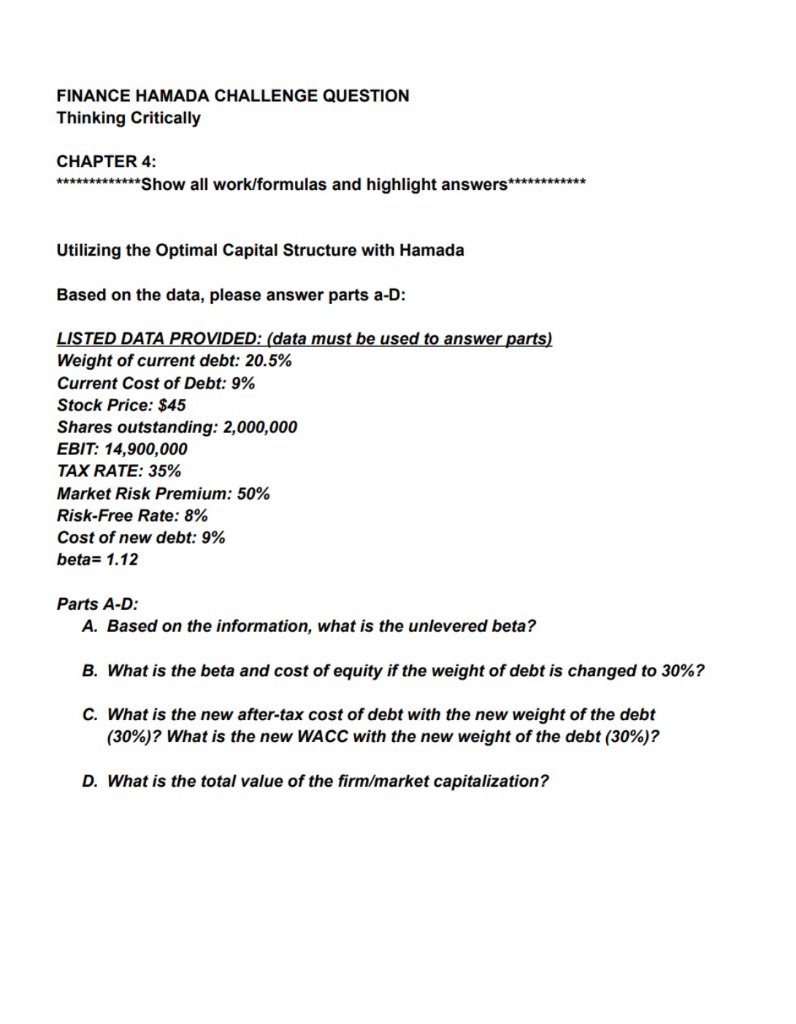

******PLEASE SHOW FORMULAS AND HIGHLIGHT ANSWERS************ FINANCE HAMADA CHALLENGE QUESTION Thinking Critically CHAPTER 4: ************* Show all work/formulas and highlight answers************ Utilizing the optimal Capital

******PLEASE SHOW FORMULAS AND HIGHLIGHT ANSWERS************

FINANCE HAMADA CHALLENGE QUESTION Thinking Critically CHAPTER 4: ************* Show all work/formulas and highlight answers************ Utilizing the optimal Capital Structure with Hamada Based on the data, please answer parts a-D: LISTED DATA PROVIDED: (data must be used to answer parts) Weight of current debt: 20.5% Current Cost of Debt: 9% Stock Price: $45 Shares outstanding: 2,000,000 EBIT: 14,900,000 TAX RATE: 35% Market Risk Premium: 50% Risk-Free Rate: 8% Cost of new debt: 9% beta= 1.12 Parts A-D: A. Based on the information, what is the unlevered beta? B. What is the beta and cost of equity if the weight of debt is changed to 30%? C. What is the new after-tax cost of debt with the new weight of the debt (30%)? What is the new WACC with the new weight of the debt (30%)? D. What is the total value of the firm/market capitalizationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started