Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show formula's as well. Assumptions: - You have found a 2-acre piece of land with an existing 10,000 sq ft bank in an older

Please show formula's as well.

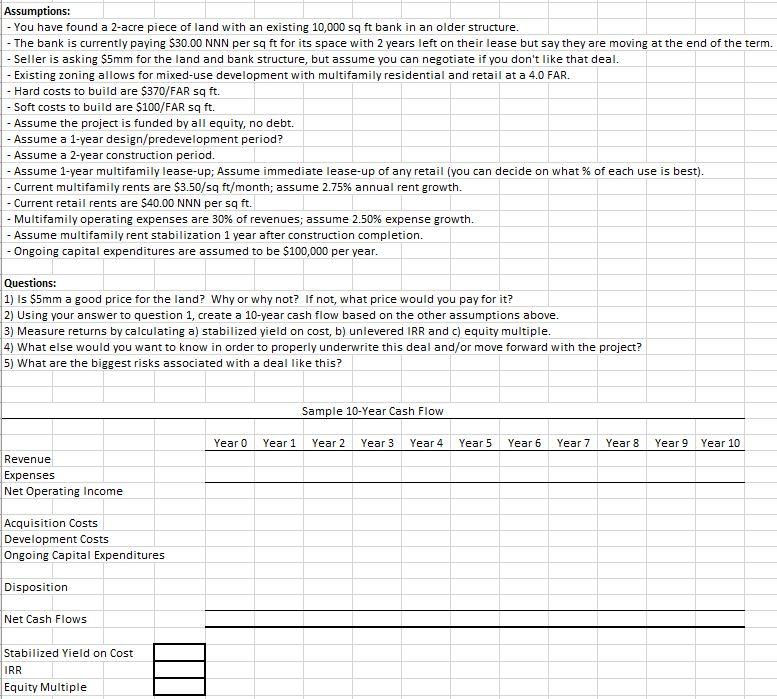

Assumptions: - You have found a 2-acre piece of land with an existing 10,000 sq ft bank in an older structure. - The bank is currently paying $30.00 NNN per sq ft for its space with 2 years left on their lease but say they are moving at the end of the term. - Seller is asking $5mm for the land and bank structure, but assume you can negotiate if you don't like that deal. - Existing zoning allows for mixed-use development with multifamily residential and retail at a 4.0 FAR. - Hard costs to build are $370/FAR sq ft. - Soft costs to build are $100/FAR sq ft. - Assume the project is funded by all equity, no debt. - Assume a 1-year design/predevelopment period? - Assume a 2-year construction period. - Assume 1-year multifamily lease-up; Assume immediate lease-up of any retail (you can decide on what % of each use is best). - Current multifamily rents are $3.50/sq ft/month; assume 2.75% annual rent growth. - Current retail rents are $40.00 NNN per sq ft. - Multifamily operating expenses are 30% of revenues; assume 2.50% expense growth. - Assume multifamily rent stabilization 1 year after construction completion. - Ongoing capital expenditures are assumed to be $100,000 per year. Questions: 1) Is $5mm a good price for the land? Why or why not? If not, what price would you pay for it? 2) Using your answer to question 1, create a 10-year cash flow based on the other assumptions above. 3) Measure returns by calculating a) stabilized yield on cost, b) unlevered IRR and c) equity multiple. 4) What else would you want to know in order to properly underwrite this deal and/or move forward with the project? 5) What are the biggest risks associated with a deal like this? Revenue Expenses Net Operating Income Acquisition Costs Development Costs Ongoing Capital Expenditures Disposition Net Cash Flows Stabilized Yield on Cost IRR Equity Multiple Year 0 Year 1 Sample 10-Year Cash Flow Year 2 Year 3 Year 4 Year 5. Year 6 Year 7 Year 8 Year 9 Year 10 Assumptions: - You have found a 2-acre piece of land with an existing 10,000 sq ft bank in an older structure. - The bank is currently paying $30.00 NNN per sq ft for its space with 2 years left on their lease but say they are moving at the end of the term. - Seller is asking $5mm for the land and bank structure, but assume you can negotiate if you don't like that deal. - Existing zoning allows for mixed-use development with multifamily residential and retail at a 4.0 FAR. - Hard costs to build are $370/FAR sq ft. - Soft costs to build are $100/FAR sq ft. - Assume the project is funded by all equity, no debt. - Assume a 1-year design/predevelopment period? - Assume a 2-year construction period. - Assume 1-year multifamily lease-up; Assume immediate lease-up of any retail (you can decide on what % of each use is best). - Current multifamily rents are $3.50/sq ft/month; assume 2.75% annual rent growth. - Current retail rents are $40.00 NNN per sq ft. - Multifamily operating expenses are 30% of revenues; assume 2.50% expense growth. - Assume multifamily rent stabilization 1 year after construction completion. - Ongoing capital expenditures are assumed to be $100,000 per year. Questions: 1) Is $5mm a good price for the land? Why or why not? If not, what price would you pay for it? 2) Using your answer to question 1, create a 10-year cash flow based on the other assumptions above. 3) Measure returns by calculating a) stabilized yield on cost, b) unlevered IRR and c) equity multiple. 4) What else would you want to know in order to properly underwrite this deal and/or move forward with the project? 5) What are the biggest risks associated with a deal like this? Revenue Expenses Net Operating Income Acquisition Costs Development Costs Ongoing Capital Expenditures Disposition Net Cash Flows Stabilized Yield on Cost IRR Equity Multiple Year 0 Year 1 Sample 10-Year Cash Flow Year 2 Year 3 Year 4 Year 5. Year 6 Year 7 Year 8 Year 9 Year 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started