Answered step by step

Verified Expert Solution

Question

1 Approved Answer

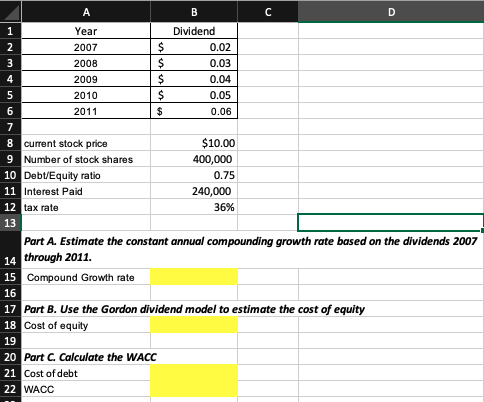

Please show formulas Dividend 0.02 0.03 Year 2007 2008 2009 2010 2011 0.04 0.05 0.06 8 current stock price 9 Number of stock shares 10

Please show formulas

Dividend 0.02 0.03 Year 2007 2008 2009 2010 2011 0.04 0.05 0.06 8 current stock price 9 Number of stock shares 10 Debt/Equity ratio 11 Interest Paid 12 tax rate $10.00 400,000 0.75 240,000 36% 13 Part A. Estimate the constant annual compounding growth rate based on the dividends 2007 14 through 2011 15 Compound Growth rate 17 Part B. Use the Gordon dividend model to estimate the cost of equity 18 Cost of equity 20 Part C. Calculate the WACC 21 Cost of debt 22 WACCStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started