Answered step by step

Verified Expert Solution

Question

1 Approved Answer

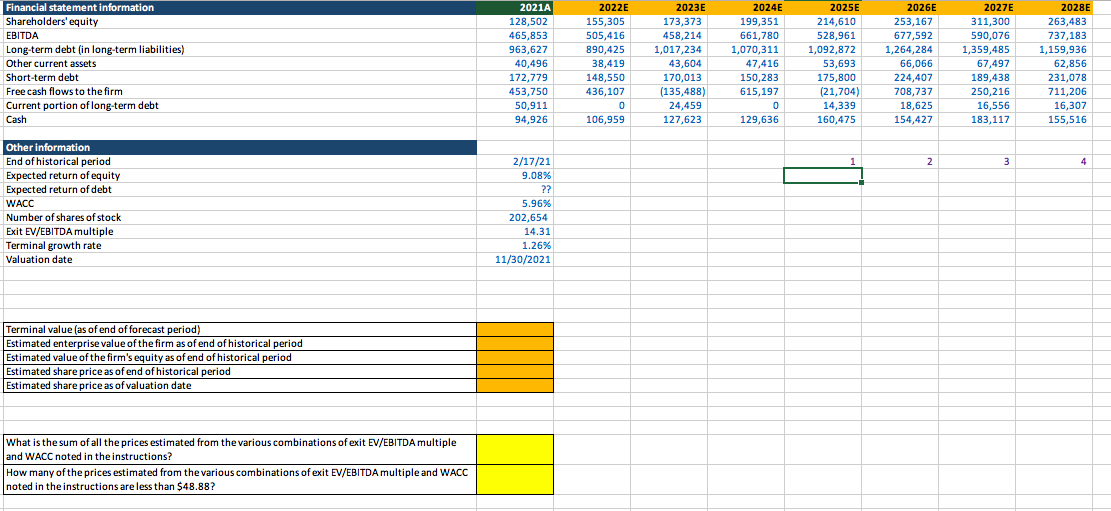

Please show formulas for orange and yellow boxes Financial statement information Shareholders' equity EBITDA Long-term debt (in long-term liabilities) Other current assets Short-term debt Free

Please show formulas for orange and yellow boxes

Financial statement information Shareholders' equity EBITDA Long-term debt (in long-term liabilities) Other current assets Short-term debt Free cash flows to the firm Current portion of long-term debt Cash 2021A 128,502 465,853 963,627 40,496 172,779 453,750 50,911 94,926 2022E 155,305 505,416 890,425 38,419 148,550 436,107 0 106,959 2023E 173,373 458,214 1,017,234 43.604 170,013 (135,488) 24,459 127,623 2024E 199,351 661,780 1,070,311 47,416 150,283 615,197 0 129,636 2025E 214,610 528,961 1,092,872 53,693 175,800 (21,704) 14,339 160,475 2026E 253,167 677,592 1,264,284 66,066 224,407 708,737 18,625 154,427 2027E 311,300 590,076 1,359,485 67,497 189,438 250,216 16,556 183,117 2028E 263,483 737,183 1,159,936 62,856 231,078 711,206 16,307 155,516 1 2 2 3 4 Other information End of historical period Expected return of equity Expected return of debt WACC Number of shares of stock Exit EV/EBITDA multiple Terminal growth rate Valuation date 2/17/21 9.08% ?? 5.96% 202,654 14.31 1.26% 11/30/2021 Terminal value (as of end of forecast period) Estimated enterprise value of the firm as of end of historical period Estimated value of the firm's equity as of end of historical period Estimated share price as of end of historical period Estimated share price as of valuation date What is the sum of all the prices estimated from the various combinations of exit EV/EBITDA multiple and WACC noted in the instructions? How many of the prices estimated from the various combinations of exit EV/EBITDA multiple and WACC noted in the instructions are less than $48.88? Financial statement information Shareholders' equity EBITDA Long-term debt (in long-term liabilities) Other current assets Short-term debt Free cash flows to the firm Current portion of long-term debt Cash 2021A 128,502 465,853 963,627 40,496 172,779 453,750 50,911 94,926 2022E 155,305 505,416 890,425 38,419 148,550 436,107 0 106,959 2023E 173,373 458,214 1,017,234 43.604 170,013 (135,488) 24,459 127,623 2024E 199,351 661,780 1,070,311 47,416 150,283 615,197 0 129,636 2025E 214,610 528,961 1,092,872 53,693 175,800 (21,704) 14,339 160,475 2026E 253,167 677,592 1,264,284 66,066 224,407 708,737 18,625 154,427 2027E 311,300 590,076 1,359,485 67,497 189,438 250,216 16,556 183,117 2028E 263,483 737,183 1,159,936 62,856 231,078 711,206 16,307 155,516 1 2 2 3 4 Other information End of historical period Expected return of equity Expected return of debt WACC Number of shares of stock Exit EV/EBITDA multiple Terminal growth rate Valuation date 2/17/21 9.08% ?? 5.96% 202,654 14.31 1.26% 11/30/2021 Terminal value (as of end of forecast period) Estimated enterprise value of the firm as of end of historical period Estimated value of the firm's equity as of end of historical period Estimated share price as of end of historical period Estimated share price as of valuation date What is the sum of all the prices estimated from the various combinations of exit EV/EBITDA multiple and WACC noted in the instructions? How many of the prices estimated from the various combinations of exit EV/EBITDA multiple and WACC noted in the instructions are less than $48.88Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started