please show formulas if possible

please show formulas if possible

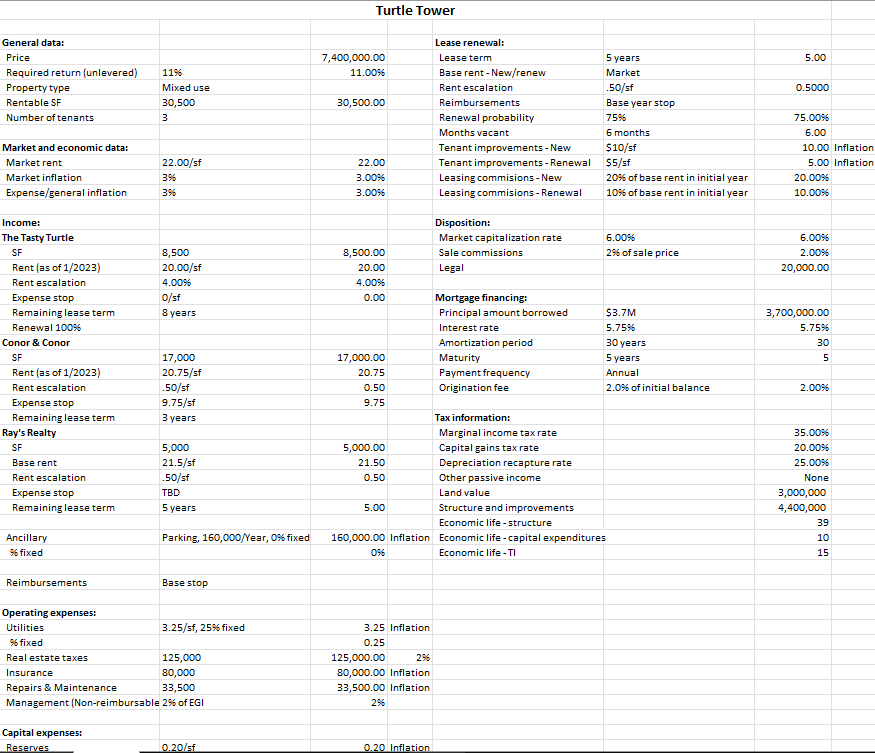

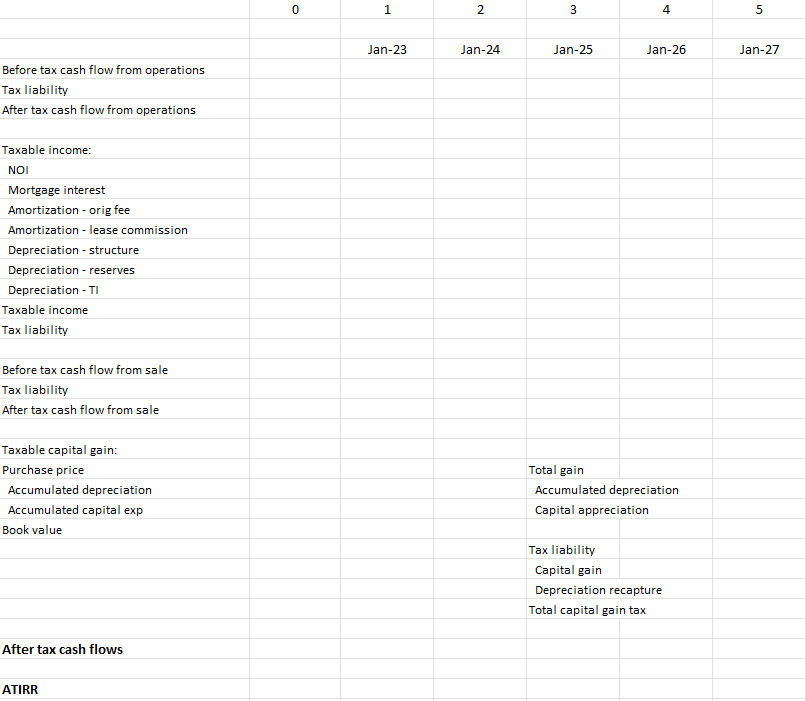

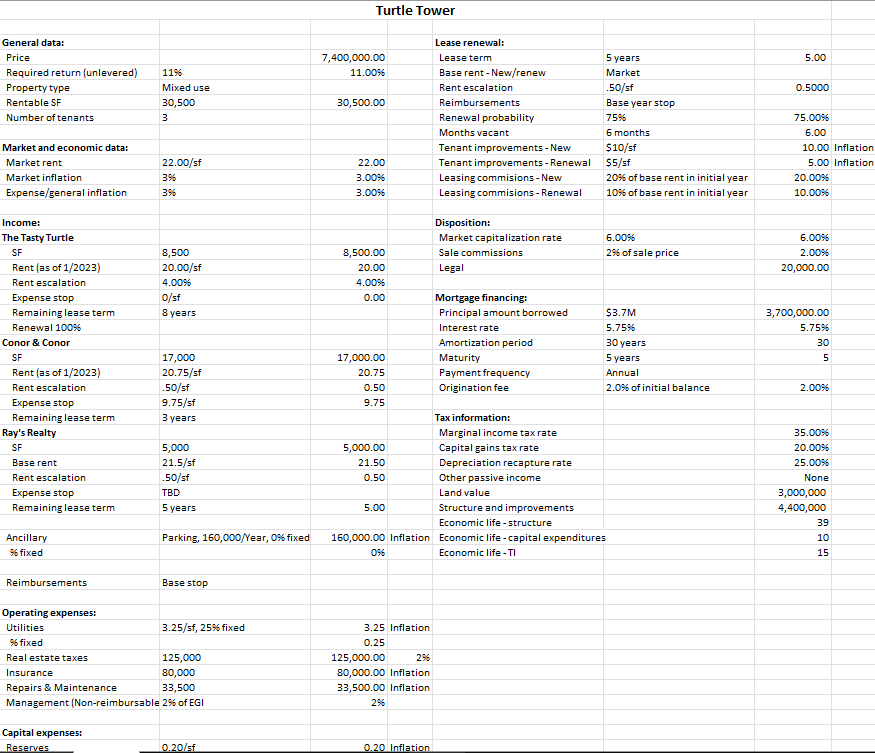

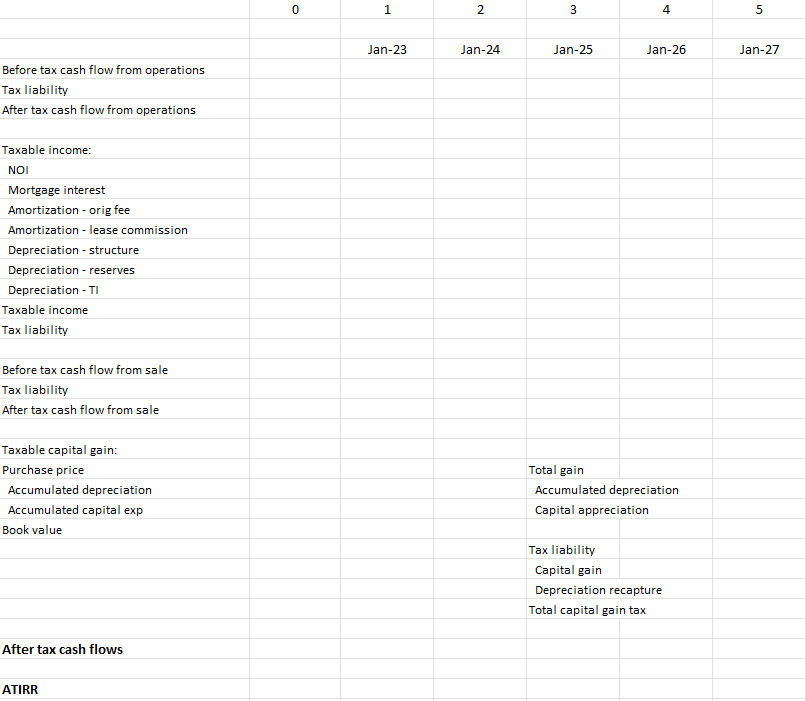

Turtle Tower General data: Income: Disposition: The Tasty Turtle SF Rent (as of 1/2023) Rent escalation Expense stop Remaining lease term Renewal 100% Conor \& Conor SF \begin{tabular}{|l|l} \hline Reimbursements & Base stop \\ \hline \end{tabular} Operating expenses: \begin{tabular}{|l|l|r|r|} \hline Utilities & 3.25/sf,25% fixed & 3.25 & Inflation \\ \hline \%6 fixed & & 0.25 & \\ \hline Real estate taxes & 125,000 & 125,000.00 & 2% \\ \hline Insurance & 80,000 & 80,000.00 & Inflation \\ \hline Repairs \& Maintenance & 33,500 & 33,500.00 & Inflation \\ \hline Management (Non-reimbursable 2%6 of EGI & 2%6 & \end{tabular} Capital expenses: Reserves 0.20/ sf 0.20 Inflation Before tax cash flow from operations Tax liability After tax cash flow from operations Taxable income: NOI Mortgage interest Amortization - orig fee Amortization - lease commission Depreciation - structure Depreciation - reserves Depreciation - TI Taxable income Tax liability Before tax cash flow from sale Tax liability After tax cash flow from sale Taxable capital gain: Purchase price Total gain Accumulated depreciation Accumulated depreciation Accumulated capital exp Capital appreciation Book value Tax liability Capital gain Depreciation recapture Total capital gain tax After tax cash flows ATIRR Turtle Tower General data: Income: Disposition: The Tasty Turtle SF Rent (as of 1/2023) Rent escalation Expense stop Remaining lease term Renewal 100% Conor \& Conor SF \begin{tabular}{|l|l} \hline Reimbursements & Base stop \\ \hline \end{tabular} Operating expenses: \begin{tabular}{|l|l|r|r|} \hline Utilities & 3.25/sf,25% fixed & 3.25 & Inflation \\ \hline \%6 fixed & & 0.25 & \\ \hline Real estate taxes & 125,000 & 125,000.00 & 2% \\ \hline Insurance & 80,000 & 80,000.00 & Inflation \\ \hline Repairs \& Maintenance & 33,500 & 33,500.00 & Inflation \\ \hline Management (Non-reimbursable 2%6 of EGI & 2%6 & \end{tabular} Capital expenses: Reserves 0.20/ sf 0.20 Inflation Before tax cash flow from operations Tax liability After tax cash flow from operations Taxable income: NOI Mortgage interest Amortization - orig fee Amortization - lease commission Depreciation - structure Depreciation - reserves Depreciation - TI Taxable income Tax liability Before tax cash flow from sale Tax liability After tax cash flow from sale Taxable capital gain: Purchase price Total gain Accumulated depreciation Accumulated depreciation Accumulated capital exp Capital appreciation Book value Tax liability Capital gain Depreciation recapture Total capital gain tax After tax cash flows ATIRR

please show formulas if possible

please show formulas if possible