Answered step by step

Verified Expert Solution

Question

1 Approved Answer

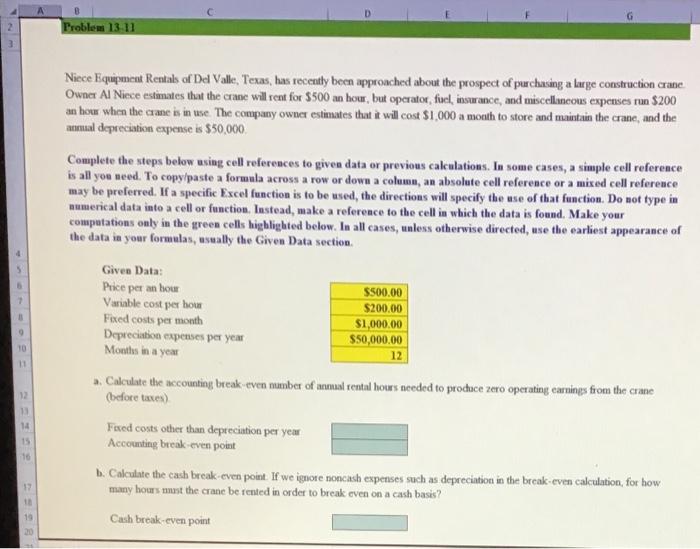

please show formulas. TY Step Instructions Points Possible 0 Complete the steps below using cell references to given data or previous calculations. In some cases,

please show formulas. TY

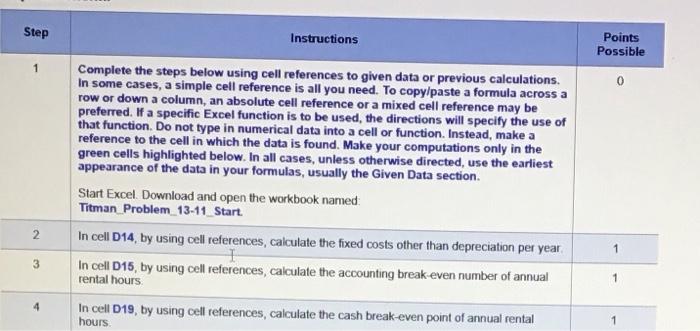

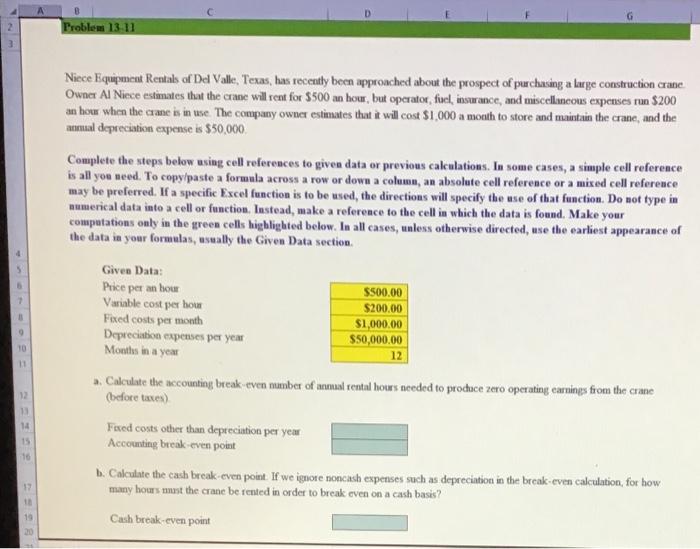

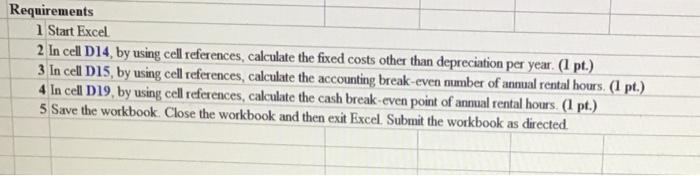

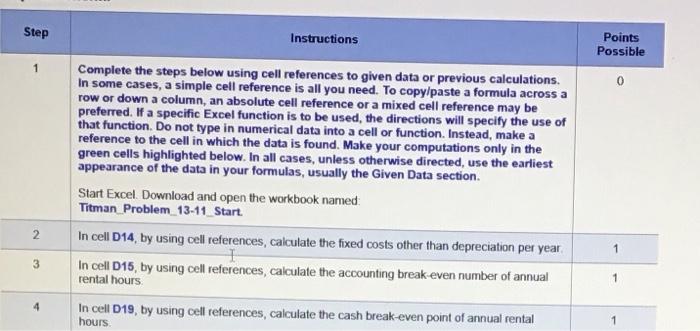

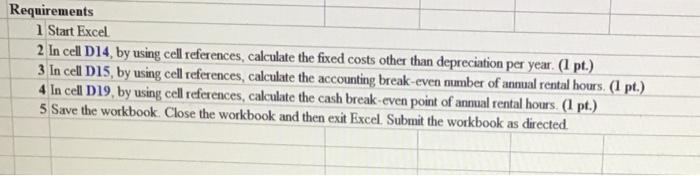

Step Instructions Points Possible 0 Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the green cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. Start Excel. Download and open the workbook named Titman Problem_13-11_Start. In cell D14, by using cell references, calculate the fixed costs other than depreciation per year In cell D15, by using cell references, calculate the accounting break even number of annual rental hours In cell D19, by using cell references, calculate the cash break-even point of annual rental hours 2 1 3 1 4 B Problem 13-11 Niece Equipment Rentals of De Valle, Texas, has recently been approached about the prospect of purchasing a large construction crane Owner Al Nince estimates that the crane will rent for 500 an hour, but operator, foc, insurance, and miscellaneous expenses ran $200 an hour when the crane is in use. The company owner estimates that it will cost $1,000 a month to store and maintain the crane, and the amal depreciation expense is $50,000 Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the green cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section Given Data: Price per an hou $500.00 Variable cost per hour $200.00 Feed costs per month $1,000.00 Depreciation expenses per year $50,000.00 Months in a year 12 Calculate the accounting break even number of unmaal rental hours needed to procace zero operating earnings from the crane (before taxes) Feed costs other than depreciation per year Accounting break-even point 1. Calculate the cash break-even point. If we ignore noncash expenses such as depreciation in the break even calculation, for how many hours must the crane be rented in order to break even on a on a cash basis? 10 11 12 1 14 15 16 19 1 19 Cash break-even point Requirements 1 Start Excel 2 In cell D14, by using cell references, calculate the fixed costs other than depreciation per year. (1 pt.) 3 In cell D15, by using cell references, calculate the accounting break-even number of annual rental hours. (1 pt.) 4 In cell D19, by using cell references, calculate the cash break-even point of annual rental hours (1 pt.) 5 Save the workbook. Close the workbook and then exit Excel Submit the workbook as directed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started