Answered step by step

Verified Expert Solution

Question

1 Approved Answer

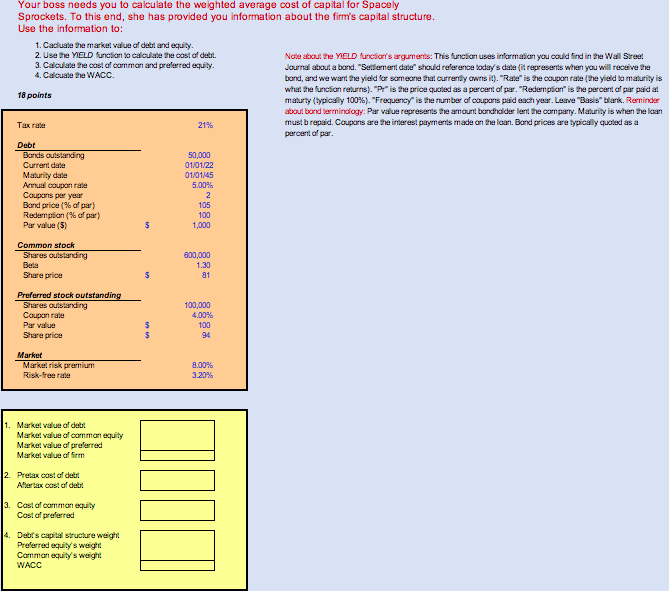

Please show formulas Your boss needs you to calculate the weighted average cost of capital for Spacely Sprockets. To this end, she has provided you

Please show formulas

Your boss needs you to calculate the weighted average cost of capital for Spacely Sprockets. To this end, she has provided you information about the firm's capital structure. Use the information to: 1. Cacluate the market value of debt and equity. 2. Use the YIELD function to calculate the cost of debt. 3. Calculate the cost of common and preferred equity. 4. Calcuate the WACC. 18 points Tax rate 21% Debt 50,000 Bands outstanding Current date Maturity date 01/01/22 01/01/45 Annual coupon rate 5.00% 2 105 Coupons per year Band price (% of par) Redemption (% of par) Par value (5) 100 1,000 Common stock Shares outstanding Beta 600,000 1.30 81 Share price Preferred stock outstanding Shares outstanding 100,000 Coupon rate 4.00% Par value 100 Share price 94 Market Market risk premium Risk-free rate 8.00% 3.20% 1. Market value of debt Market value of comman equity Market value of preferred Market value of firm 2. Pretax cast of debt Aftertax cost of debt 3. Cast of comman equity Cast of preferred 4. Debt's capital structure weight Preferred equity's weight Comman equity's weight WACC $ $ 7007 Note about the YIELD function's arguments: This function uses information you could find in the Wall Street Journal about a bond. "Settlement date" should reference today's date (it represents when you will receive the band, and we want the yield for someone that currently owns it). "Rate" is the coupon rate (the yield to maturity is what the function returns). "Pr" is the price quoted as a percent of par. "Redemption" is the percent of par paid at maturty (typically 100%). "Frequency" is the number of coupons paid each year. Leave "Basis" blank. Reminder about bond terminology: Par value represents the amount bondholder lent the company. Maturity is when the loan must brepaid. Coupons are the interest payments made on the loan. Band prices are typically quoted as a percent of par. Your boss needs you to calculate the weighted average cost of capital for Spacely Sprockets. To this end, she has provided you information about the firm's capital structure. Use the information to: 1. Cacluate the market value of debt and equity. 2. Use the YIELD function to calculate the cost of debt. 3. Calculate the cost of common and preferred equity. 4. Calcuate the WACC. 18 points Tax rate 21% Debt 50,000 Bands outstanding Current date Maturity date 01/01/22 01/01/45 Annual coupon rate 5.00% 2 105 Coupons per year Band price (% of par) Redemption (% of par) Par value (5) 100 1,000 Common stock Shares outstanding Beta 600,000 1.30 81 Share price Preferred stock outstanding Shares outstanding 100,000 Coupon rate 4.00% Par value 100 Share price 94 Market Market risk premium Risk-free rate 8.00% 3.20% 1. Market value of debt Market value of comman equity Market value of preferred Market value of firm 2. Pretax cast of debt Aftertax cost of debt 3. Cast of comman equity Cast of preferred 4. Debt's capital structure weight Preferred equity's weight Comman equity's weight WACC $ $ 7007 Note about the YIELD function's arguments: This function uses information you could find in the Wall Street Journal about a bond. "Settlement date" should reference today's date (it represents when you will receive the band, and we want the yield for someone that currently owns it). "Rate" is the coupon rate (the yield to maturity is what the function returns). "Pr" is the price quoted as a percent of par. "Redemption" is the percent of par paid at maturty (typically 100%). "Frequency" is the number of coupons paid each year. Leave "Basis" blank. Reminder about bond terminology: Par value represents the amount bondholder lent the company. Maturity is when the loan must brepaid. Coupons are the interest payments made on the loan. Band prices are typically quoted as a percent of parStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started