Please show full solution. Thanks

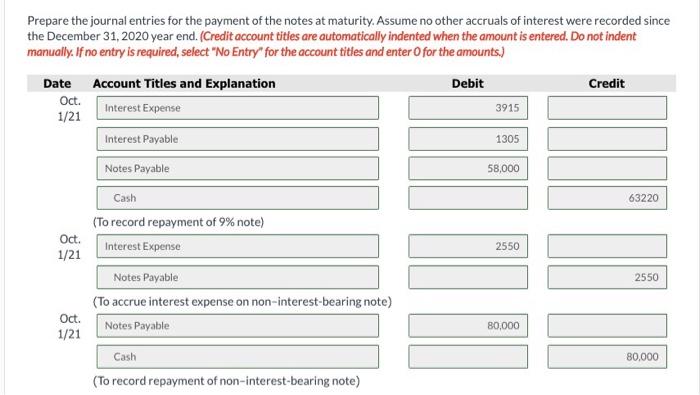

Can't figure out the Interest Expense and Notes Payable in the third image it's marked in red. Please show full solution. Thank you very much have a nice day!

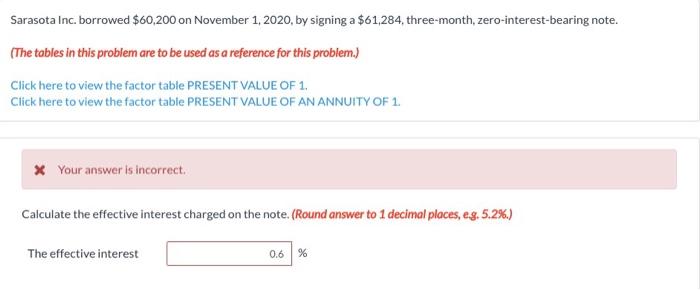

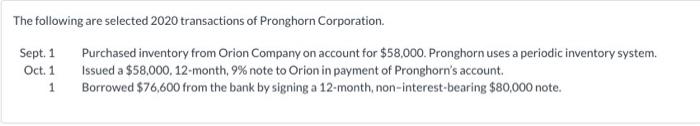

Sarasota Inc. borrowed $60,200 on November 1, 2020, by signing a $61,284, three-month, zero-interest-bearing note. (The tables in this problem are to be used as a reference for this problem.) Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. * Your answer is incorrect. Calculate the effective interest charged on the note. (Round answer to 1 decimal places, eg. 5.2%.) The effective interest 0.6 % The following are selected 2020 transactions of Pronghorn Corporation. Sept. 1 Purchased inventory from Orion Company on account for $58,000. Pronghorn uses a periodic inventory system. Oct. 1 Issued a $58,000. 12-month, 9% note to Orion in payment of Pronghorn's account Borrowed $76,600 from the bank by signing a 12-month, non-interest-bearing $80,000 note. 1 3915 1305 Prepare the journal entries for the payment of the notes at maturity. Assume no other accruals of interest were recorded since the December 31, 2020 year end. (Credit account tities are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Oct. Interest Expense 1/21 Interest Payable Notes Payable 58,000 Cash 63220 (To record repayment of 9% note) Oct Interest Expense 2550 1/21 Notes Payable (To accrue interest expense on non-interest-bearing note) Oct. Notes Payable 1/21 2550 80,000 Cash 80,000 (To record repayment of non-interest-bearing note) Prepare the journal entries for the payment of the notes at maturity, assuming the company uses reversing entries. (Show the reversing entries at January 1, 2021.) (Credit account tities are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Orion Note Jan. 1 Interest Payable Interest Expense Interest Expense 5220 Notes Payable 58,000 1305 1305 Oct. 1 63220 Jan. 1 Cash Bank Note Notes Payable Interest Expense 850 850 Oct. 1 Interest Expense Notes Payable (To accrue interest expense on non-interest-bearing note) Notes Payable Oct. 1 80,000 Cash 80,000 (To record repayment of non-interest-bearing note)