PLEASE SHOW FULL SOLVING. PREFERRABLY WITH FINANCIAL CALCULAOR. AND HANDRITTEN. NO EXCEL

PLEASE SHOW FULL SOLVING. PREFERRABLY WITH FINANCIAL CALCULAOR. AND HANDRITTEN. NO EXCEL

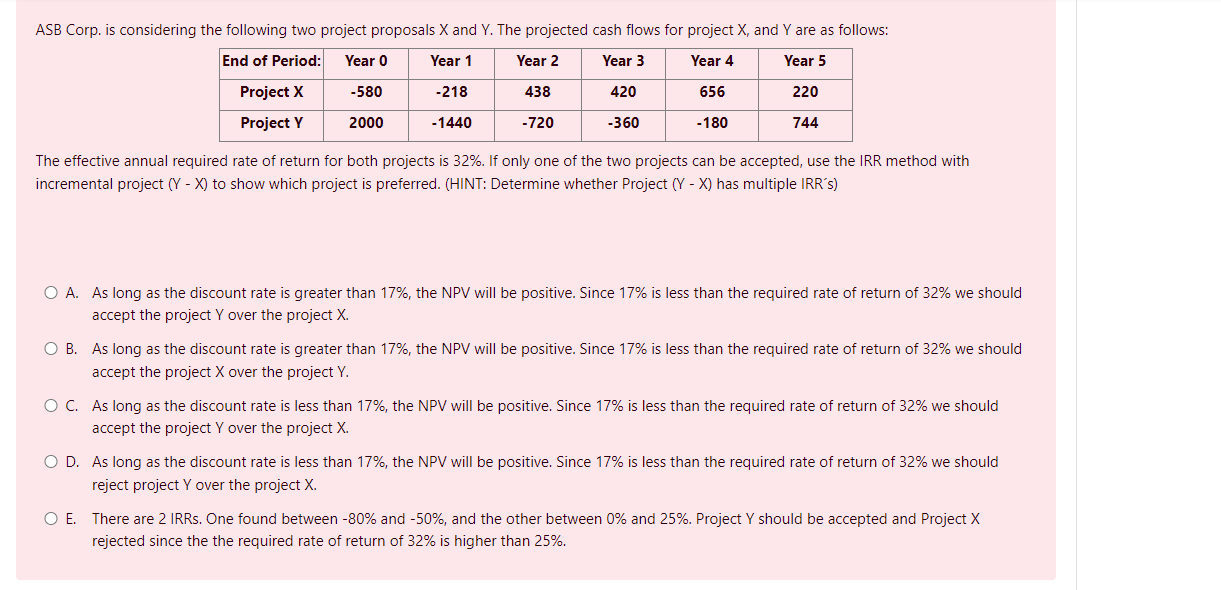

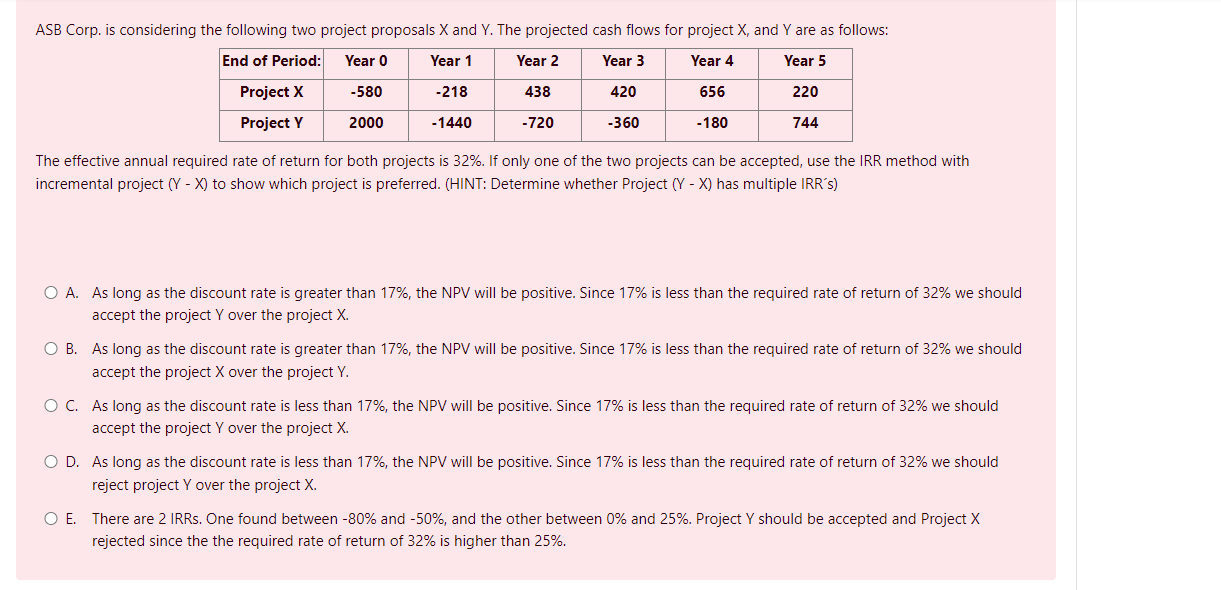

The effective annual required rate of return for both projects is 32%. If only one of the two projects can be accepted, use the IRR method with incremental project (YX) to show which project is preferred. (HINT: Determine whether Project (YX) has multiple IRR's) A. As long as the discount rate is greater than 17%, the NPV will be positive. Since 17% is less than the required rate of return of 32% we should accept the project Y over the project X. B. As long as the discount rate is greater than 17%, the NPV will be positive. Since 17% is less than the required rate of return of 32% we should accept the project X over the project Y. C. As long as the discount rate is less than 17%, the NPV will be positive. Since 17% is less than the required rate of return of 32% we should accept the project Y over the project X. D. As long as the discount rate is less than 17%, the NPV will be positive. Since 17% is less than the required rate of return of 32% we should reject project Y over the project X. E. There are 2 IRRs. One found between 80% and 50%, and the other between 0% and 25%. Project Y should be accepted and Project X rejected since the the required rate of return of 32% is higher than 25%. The effective annual required rate of return for both projects is 32%. If only one of the two projects can be accepted, use the IRR method with incremental project (YX) to show which project is preferred. (HINT: Determine whether Project (YX) has multiple IRR's) A. As long as the discount rate is greater than 17%, the NPV will be positive. Since 17% is less than the required rate of return of 32% we should accept the project Y over the project X. B. As long as the discount rate is greater than 17%, the NPV will be positive. Since 17% is less than the required rate of return of 32% we should accept the project X over the project Y. C. As long as the discount rate is less than 17%, the NPV will be positive. Since 17% is less than the required rate of return of 32% we should accept the project Y over the project X. D. As long as the discount rate is less than 17%, the NPV will be positive. Since 17% is less than the required rate of return of 32% we should reject project Y over the project X. E. There are 2 IRRs. One found between 80% and 50%, and the other between 0% and 25%. Project Y should be accepted and Project X rejected since the the required rate of return of 32% is higher than 25%

PLEASE SHOW FULL SOLVING. PREFERRABLY WITH FINANCIAL CALCULAOR. AND HANDRITTEN. NO EXCEL

PLEASE SHOW FULL SOLVING. PREFERRABLY WITH FINANCIAL CALCULAOR. AND HANDRITTEN. NO EXCEL