Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show full working. Thank you very much!! Problem 1 (24 marks) You are a new intern at Wingate Weather Corp (WWC), a Canadian manufacturer

Please show full working. Thank you very much!!

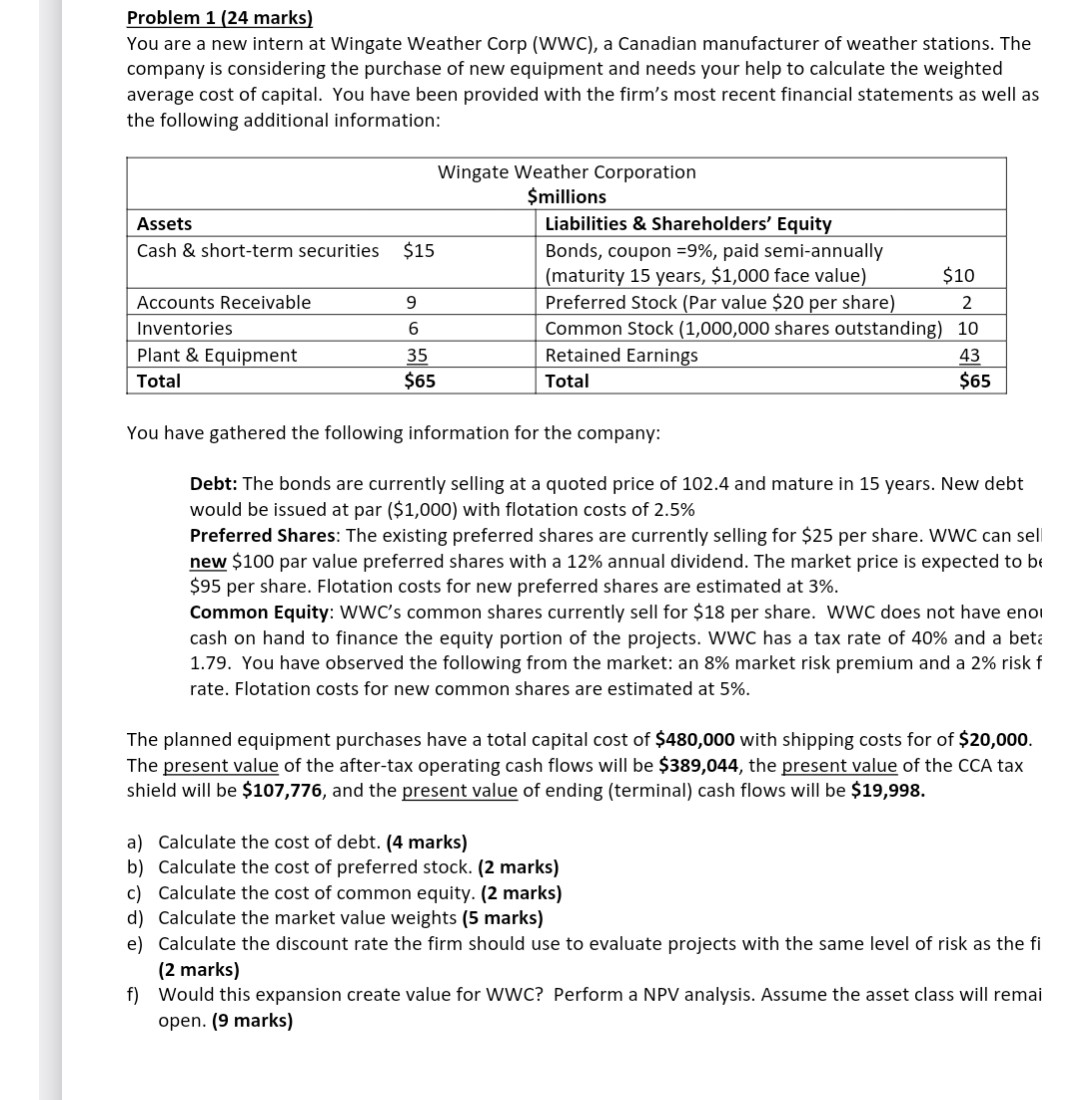

Problem 1 (24 marks) You are a new intern at Wingate Weather Corp (WWC), a Canadian manufacturer of weather stations. The company is considering the purchase of new equipment and needs your help to calculate the weighted average cost of capital. You have been provided with the firm's most recent financial statements as well as the following additional information: You have gathered the following information for the company: Debt: The bonds are currently selling at a quoted price of 102.4 and mature in 15 years. New debt would be issued at par ($1,000) with flotation costs of 2.5% Preferred Shares: The existing preferred shares are currently selling for $25 per share. WWC can sel new $100 par value preferred shares with a 12% annual dividend. The market price is expected to bs $95 per share. Flotation costs for new preferred shares are estimated at 3%. Common Equity: WWC's common shares currently sell for $18 per share. WWC does not have enol cash on hand to finance the equity portion of the projects. WWC has a tax rate of 40% and a beti 1.79. You have observed the following from the market: an 8% market risk premium and a 2% risk f rate. Flotation costs for new common shares are estimated at 5%. The planned equipment purchases have a total capital cost of $480,000 with shipping costs for of $20,000. The present value of the after-tax operating cash flows will be $389,044, the present value of the CCA tax shield will be $107,776, and the present value of ending (terminal) cash flows will be $19,998. a) Calculate the cost of debt. ( 4 marks) b) Calculate the cost of preferred stock. (2 marks) c) Calculate the cost of common equity. (2 marks) d) Calculate the market value weights ( 5 marks) e) Calculate the discount rate the firm should use to evaluate projects with the same level of risk as the fi (2 marks) f) Would this expansion create value for WWC? Perform a NPV analysis. Assume the asset class will remai open. (9 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started