please show how this info would go into the corp forms listed

please show how this info would go into the corp forms listed

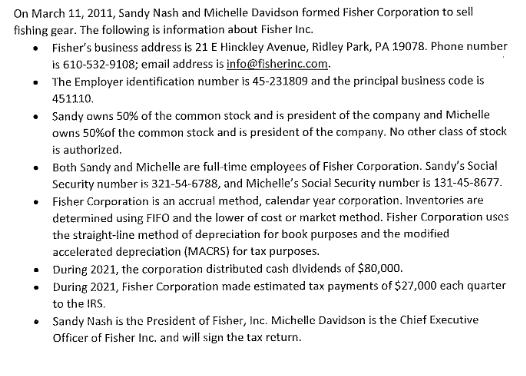

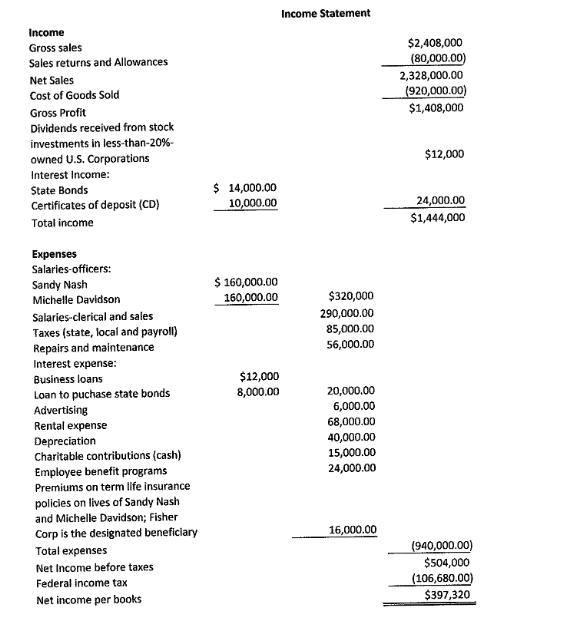

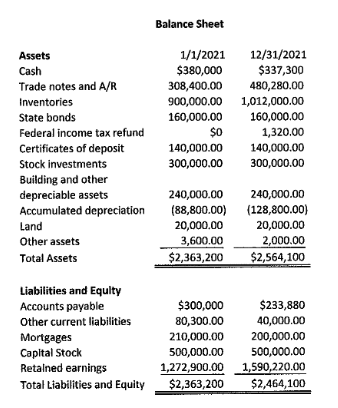

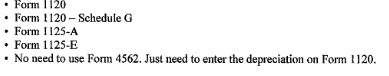

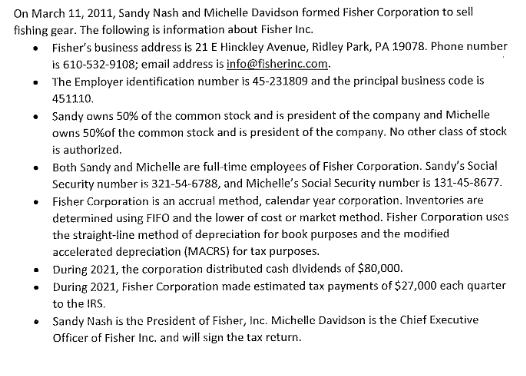

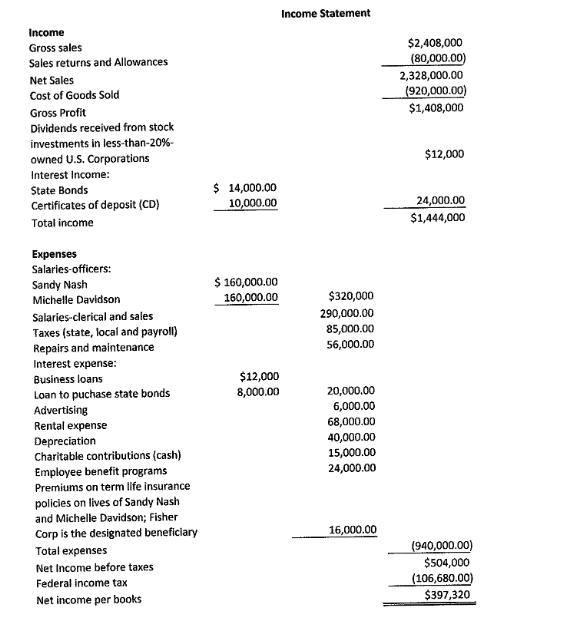

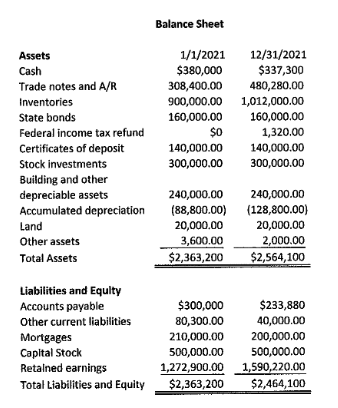

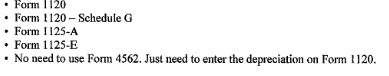

On March 11, 2011, Sandy Nash and Michelle Davidson formed Fisher Corporation to sell fishing gear. The following is information about Fisher Inc. - Fisher's business address is 21E Hinckley Avenue, Ridley Park, PA 19078. Phone number is 610-532-9108; email address is info@fisherinc.com. - The Employer identification number is 45-231809 and the principal business code is 451110 - Sandy owns 50% of the common stock and is president of the company and Michelle owns 50% of the common stock and is president of the company. No other class of stock is authorized. - Both Sandy and Michelle are full-time employees of Fisher Corporation. Sandy's Social Security number is 321-54-6788, and Michelle's Social Security number is 131-45-8677. - Fisher Corporation is an accrual method, calendar year corporation. Inventories are determined using FIFO and the lower of cost or market method. Fisher Corporation uses the straight-line method of depreciation for book purposes and the modified accelerated depreciation (MACRS) for tax purposes. - During 2021, the corporation distributed cash dividends of $80,000. - During 2021, Fisher Corporation made estimated tax payments of $27,000 each quarter to the IRS. - Sandy Nash is the President of Fisher, Inc. Michelle Davidson is the Chief Executive Officer of Fisher Inc. and will sign the tax return. Income Statement \begin{tabular}{lrr} & Balance Sheet & \\ Assets & & \\ Cash & 1/1/2021 & 12/31/2021 \\ Trade notes and A/R & $380,000 & $337,300 \\ Inventories & 308,400.00 & 480,280.00 \\ State bonds & 900,000.00 & 1,012,000.00 \\ Federal income tax refund & 160,000.00 & 160,000.00 \\ Certificates of deposit & 140,000.00 & 140,000.00 \\ Stock investments & 300,000.00 & 300,000.00 \\ Building and other & & \\ depreciable assets & 240,000.00 & 240,000.00 \\ Accumulated depreciation & (88,800.00) & {128,800.00} \\ Land & 20,000.00 & 20,000.00 \\ Other assets & 3,600.00 & 2,000.00 \\ \cline { 2 - 3 } Total Assets & $2,363,200 & $2,564,100 \\ \hline & & \\ Liabilities and Equlty & & \\ Accounts payable & $300,000 & $233,880 \\ Other current liabilities & 80,300.00 & 40,000.00 \\ Mortgages & 210,000.00 & 200,000.00 \\ Capltal Stock & 500,000.00 & 500,000.00 \\ Retalned earnings & 1,272,900.00 & 1,590,220.00 \\ \cline { 2 - 3 } Total Liabilities and Equity & $2,363,200 & $2,464,100 \\ & & \end{tabular} - Form 1120 - Form 1120 - Schedule G - Form I125-A - Form 1125-E - No need to use Form 4562. Just need to enter the depreciation on Form 1120. On March 11, 2011, Sandy Nash and Michelle Davidson formed Fisher Corporation to sell fishing gear. The following is information about Fisher Inc. - Fisher's business address is 21E Hinckley Avenue, Ridley Park, PA 19078. Phone number is 610-532-9108; email address is info@fisherinc.com. - The Employer identification number is 45-231809 and the principal business code is 451110 - Sandy owns 50% of the common stock and is president of the company and Michelle owns 50% of the common stock and is president of the company. No other class of stock is authorized. - Both Sandy and Michelle are full-time employees of Fisher Corporation. Sandy's Social Security number is 321-54-6788, and Michelle's Social Security number is 131-45-8677. - Fisher Corporation is an accrual method, calendar year corporation. Inventories are determined using FIFO and the lower of cost or market method. Fisher Corporation uses the straight-line method of depreciation for book purposes and the modified accelerated depreciation (MACRS) for tax purposes. - During 2021, the corporation distributed cash dividends of $80,000. - During 2021, Fisher Corporation made estimated tax payments of $27,000 each quarter to the IRS. - Sandy Nash is the President of Fisher, Inc. Michelle Davidson is the Chief Executive Officer of Fisher Inc. and will sign the tax return. Income Statement \begin{tabular}{lrr} & Balance Sheet & \\ Assets & & \\ Cash & 1/1/2021 & 12/31/2021 \\ Trade notes and A/R & $380,000 & $337,300 \\ Inventories & 308,400.00 & 480,280.00 \\ State bonds & 900,000.00 & 1,012,000.00 \\ Federal income tax refund & 160,000.00 & 160,000.00 \\ Certificates of deposit & 140,000.00 & 140,000.00 \\ Stock investments & 300,000.00 & 300,000.00 \\ Building and other & & \\ depreciable assets & 240,000.00 & 240,000.00 \\ Accumulated depreciation & (88,800.00) & {128,800.00} \\ Land & 20,000.00 & 20,000.00 \\ Other assets & 3,600.00 & 2,000.00 \\ \cline { 2 - 3 } Total Assets & $2,363,200 & $2,564,100 \\ \hline & & \\ Liabilities and Equlty & & \\ Accounts payable & $300,000 & $233,880 \\ Other current liabilities & 80,300.00 & 40,000.00 \\ Mortgages & 210,000.00 & 200,000.00 \\ Capltal Stock & 500,000.00 & 500,000.00 \\ Retalned earnings & 1,272,900.00 & 1,590,220.00 \\ \cline { 2 - 3 } Total Liabilities and Equity & $2,363,200 & $2,464,100 \\ & & \end{tabular} - Form 1120 - Form 1120 - Schedule G - Form I125-A - Form 1125-E - No need to use Form 4562. Just need to enter the depreciation on Form 1120

please show how this info would go into the corp forms listed

please show how this info would go into the corp forms listed