Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show how to do it, all the steps thanks! 33. You want to retire at age 65, you begin your investment program at 25

please show how to do it, all the steps thanks!

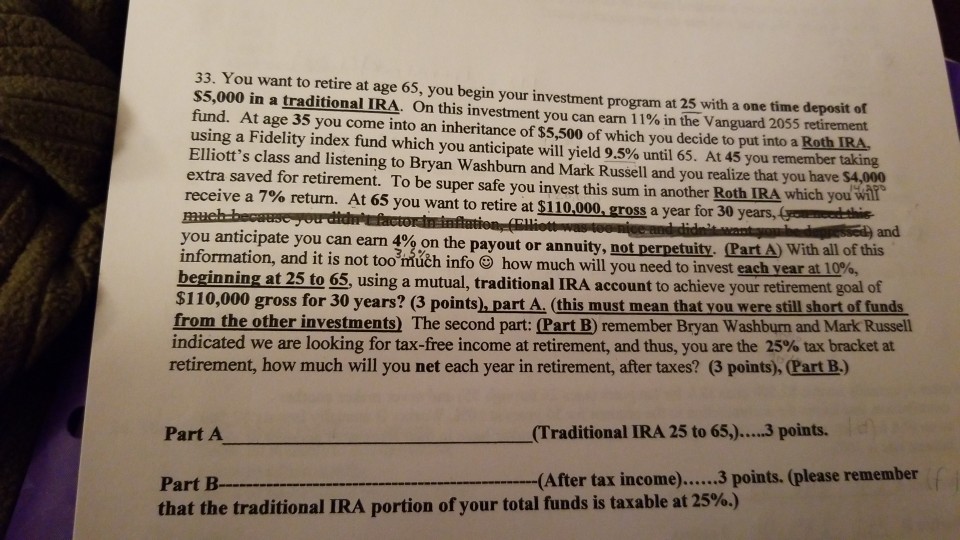

33. You want to retire at age 65, you begin your investment program at 25 with a one time deposit of $5,000 in a traditional IRA. On this investment you can earn 11% in the Vanguard 2055 retirement fund. At age 35 you come into an inheritance of $5,500 of which you decide to put into a Roth IRA using a Fidelity index fund which you anticipate will yield 9.5% until 65 . At 45 you remember taking Elliott's class and listening to Bryan Washburn and Mark Russell and you realize that you have $4,000 extra saved for retirement. To be super safe you invest this sum in another Roth IRA which you receive a 7% return. At 65 you want to retire at $110,000 gross a year for 30 years, gene i and you anticipate you can earn 4% on the payout o information, and it is not too much info C. how much will you need to invest each year at 10% beginning at 25 to 65, using a mutual, traditional IRA account to achieve your retirement goal of $110,000 gross for 30 years? (3 points), part A. (this must mean that you were still short of funds r annuity, not perpetuity. (Part A) with all of this from the other investments) The second part: (Part B) remember Bryan Washburn and Mark Russell indicated we are looking for tax-free income at retirement, and thus, you are the 25% tax bracket at retirement, how much will you net each year in retirement, after taxes? (3 points), Part B) Part A (Traditional IRA 25 to 65,)...3 points. (After tax income)....s points. (please remembser Part B that the traditional IRA portion of your total funds is taxable at 25%.) 33. You want to retire at age 65, you begin your investment program at 25 with a one time deposit of $5,000 in a traditional IRA. On this investment you can earn 11% in the Vanguard 2055 retirement fund. At age 35 you come into an inheritance of $5,500 of which you decide to put into a Roth IRA using a Fidelity index fund which you anticipate will yield 9.5% until 65 . At 45 you remember taking Elliott's class and listening to Bryan Washburn and Mark Russell and you realize that you have $4,000 extra saved for retirement. To be super safe you invest this sum in another Roth IRA which you receive a 7% return. At 65 you want to retire at $110,000 gross a year for 30 years, gene i and you anticipate you can earn 4% on the payout o information, and it is not too much info C. how much will you need to invest each year at 10% beginning at 25 to 65, using a mutual, traditional IRA account to achieve your retirement goal of $110,000 gross for 30 years? (3 points), part A. (this must mean that you were still short of funds r annuity, not perpetuity. (Part A) with all of this from the other investments) The second part: (Part B) remember Bryan Washburn and Mark Russell indicated we are looking for tax-free income at retirement, and thus, you are the 25% tax bracket at retirement, how much will you net each year in retirement, after taxes? (3 points), Part B) Part A (Traditional IRA 25 to 65,)...3 points. (After tax income)....s points. (please remembser Part B that the traditional IRA portion of your total funds is taxable at 25%.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started