Answered step by step

Verified Expert Solution

Question

1 Approved Answer

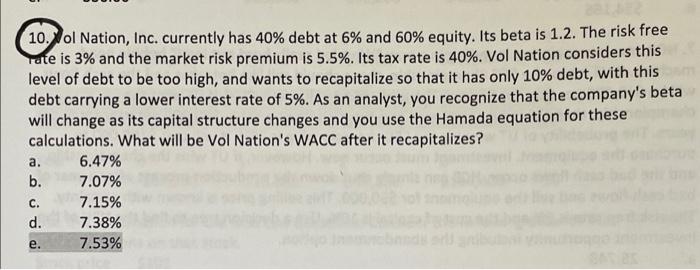

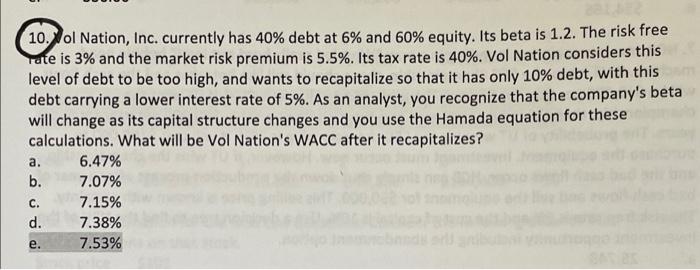

Please show how to get the answers E 10. ol Nation, Inc. currently has 40% debt at 6% and 60% equity. Its beta is 1.2.

Please show how to get the answers E

10. ol Nation, Inc. currently has 40% debt at 6% and 60% equity. Its beta is 1.2. The risk free Tate is 3% and the market risk premium is 5.5%. Its tax rate is 40%. Vol Nation considers this level of debt to be too high, and wants to recapitalize so that it has only 10% debt, with this debt carrying a lower interest rate of 5%. As an analyst, you recognize that the company's beta will change as its capital structure changes and you use the Hamada equation for these calculations. What will be Vol Nation's WACC after it recapitalizes? a. 6.47% b. 7.07% C. 7.15% d. 7.38% e. 7.53%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started