Answered step by step

Verified Expert Solution

Question

1 Approved Answer

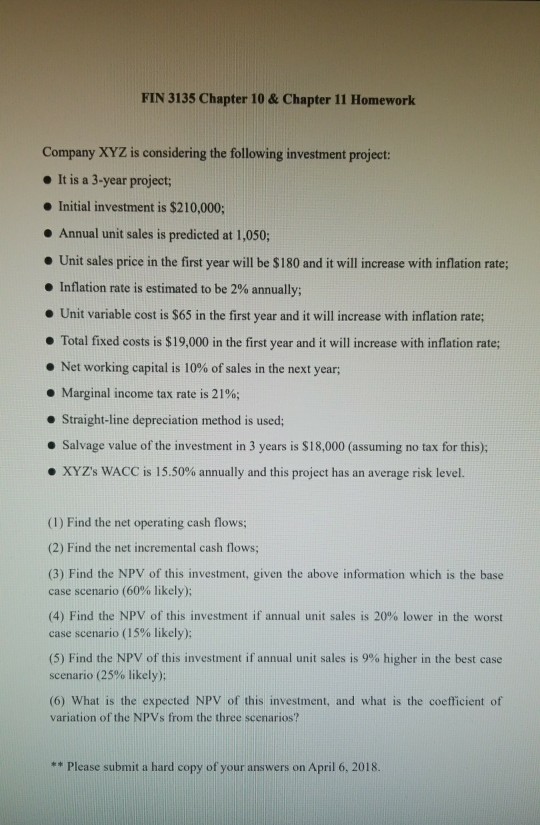

Please show how you got the answer! Thanks a lot! FIN 3135 Chapter 10 & Chapter 11 Homework Company XYZ is considering the following investment

Please show how you got the answer! Thanks a lot!

FIN 3135 Chapter 10 & Chapter 11 Homework Company XYZ is considering the following investment project: . It is a 3-year project; Initial investment is $210,000; Annual unit sales is predicted at 1,050; e Unit sales price in the first year will be $180 and it will increase with inflation rate; Inflation rate is estimated to be 2% annually; e Unit variable cost is $65 in the first year and it will increase with inflation rate; - Total fixed costs is $19,000 in the first year and it will increase with inflation rate; . Net working capital is 10% of sales in the next year; Marginal income tax rate is 21%; e Straight-line depreciation method is used; Salvage value of the investment in 3 years is $18,000 (assuming no tax for this); . XYZ's WACC is 15.50% annually and this project has an average risk level. (1) Find the net operating cash flows: (2) Find the net incremental cash flows (3) Find the NPV of this investment, given the above information which is the base case scenario (60% likely); (4) Find the NPV of this investment if annual unit sales is 20% lower in the worst case scenario ( 15% likely); (5) Find the NPV of this investment if annual unit sales is 9% higher in the best case scenario (25% likely); (6) What is the expected NPV of this investment, and what is the coefficient of variation of the NPVs from the three scenarios? ** Please submit a hard copy of your answers on April 6, 2018Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started