Please show how you got the answers please. Thanks!

Please show how you got the answers please. Thanks!

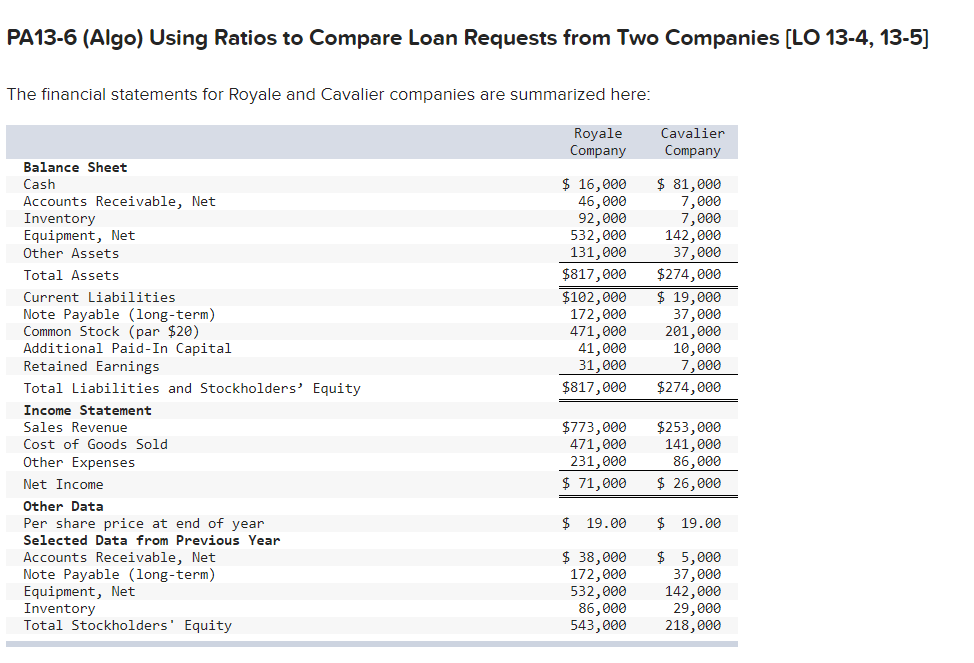

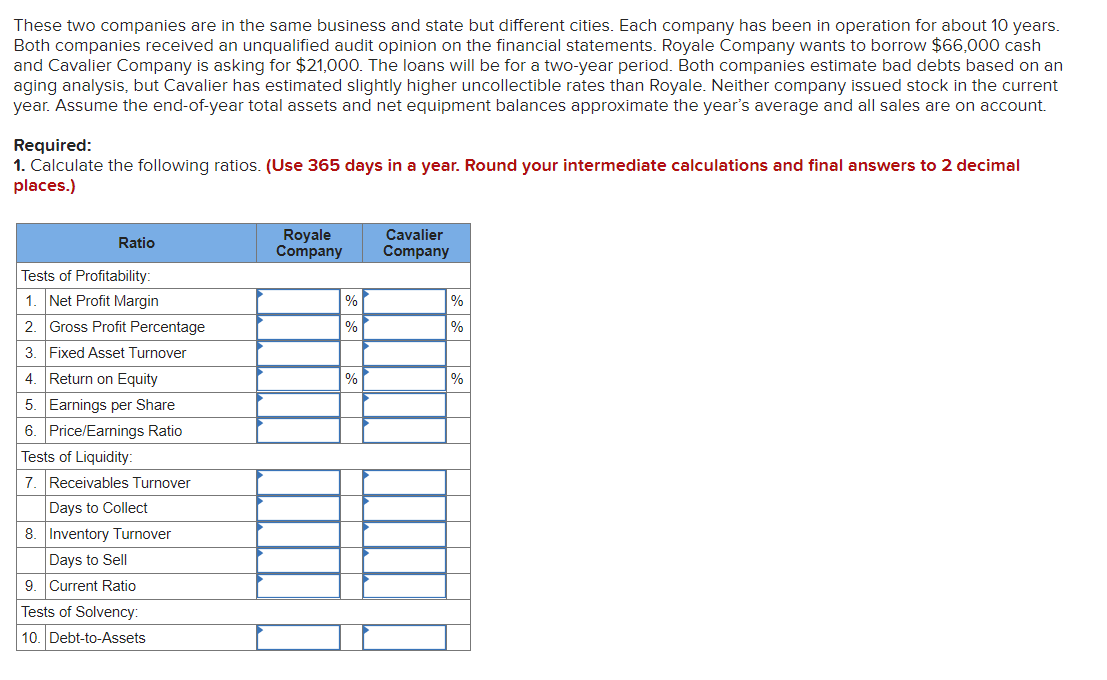

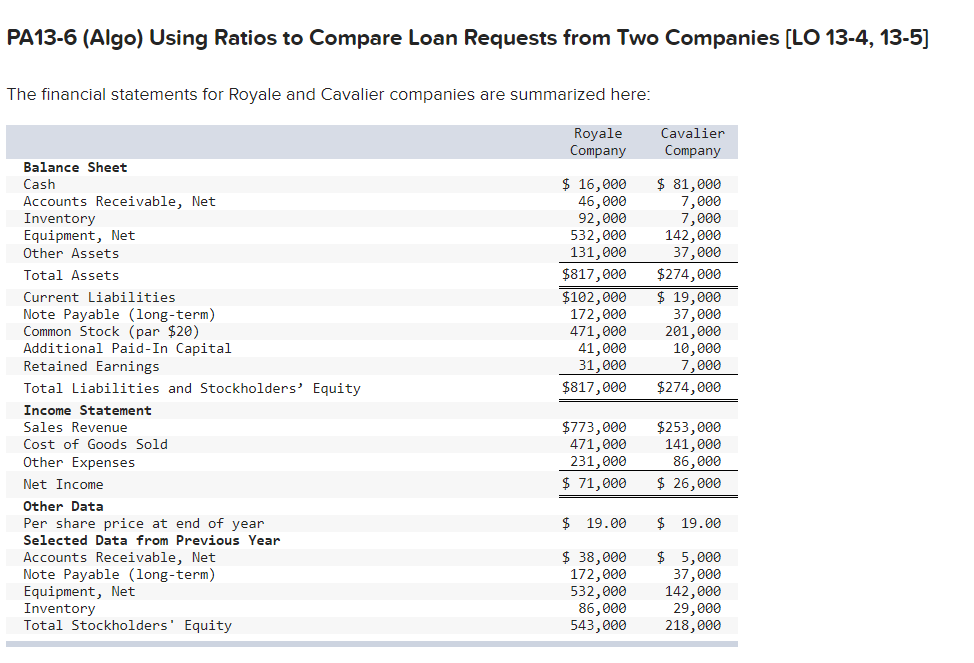

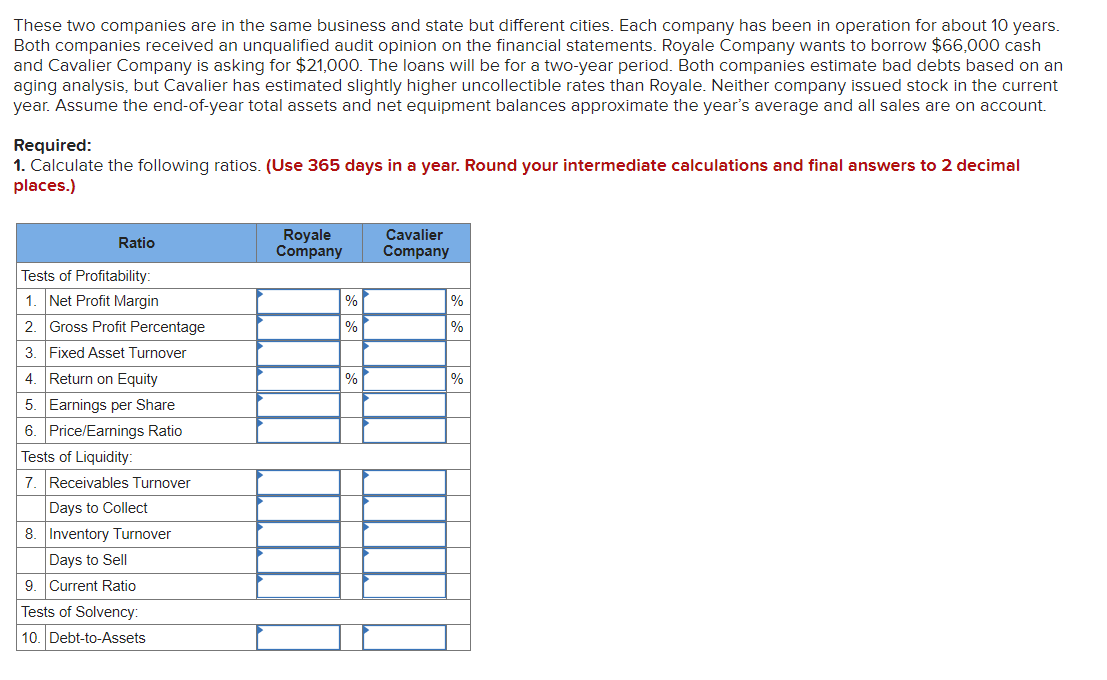

PA13-6 (Algo) Using Ratios to Compare Loan Requests from Two Companies (LO 13-4, 13-5) The financial statements for Royale and Cavalier companies are summarized here: Royale Company Cavalier Company $ 16,000 46,000 92,000 532,000 131,000 $817,000 $102,000 172,000 471,000 41,000 31,000 $817,000 $ 81,000 7,000 7,000 142,000 37,000 $274,000 $ 19,000 37,000 201,000 10,000 7,000 $274,000 Balance Sheet Cash Accounts Receivable, Net Inventory Equipment, Net Other Assets Total Assets Current Liabilities Note Payable (long-term) Common Stock (par $20) Additional Paid-In Capital Retained Earnings Total Liabilities and Stockholders' Equity Income Statement Sales Revenue Cost of Goods Sold Other Expenses Net Income Other Data Per share price at end of year Selected Data from Previous Year Accounts Receivable, Net Note Payable (long-term) Equipment, Net Inventory Total Stockholders' Equity $773,000 471,000 231,000 $ 71,000 $253,000 141,000 86,000 $ 26,000 $ 19.00 $ 19.00 $ 38,000 172,000 532,000 86,000 543,000 $ 5,000 37,000 142,000 29,000 218,000 These two companies are in the same business and state but different cities. Each company has been in operation for about 10 years. Both companies received an unqualified audit opinion on the financial statements. Royale Company wants to borrow $66,000 cash and Cavalier Company is asking for $21,000. The loans will be for a two-year period. Both companies estimate bad debts based on an aging analysis, but Cavalier has estimated slightly higher uncollectible rates than Royale. Neither company issued stock in the current year. Assume the end-of-year total assets and net equipment balances approximate the year's average and all sales are on account. Required: 1. Calculate the following ratios. (Use 365 days in a year. Round your intermediate calculations and final answers to 2 decimal places.) Ratio Royale Company Cavalier Company % % % % % % Tests of Profitability: 1. Net Profit Margin 2. Gross Profit Percentage 3. Fixed Asset Turnover 4. Return on Equity 5. Earnings per Share 6. Price/Earnings Ratio Tests of Liquidity: 7. Receivables Turnover Days to Collect 8. Inventory Turnover Days to Sell 9. Current Ratio Tests of Solvency: 10. Debt-to-Assets

Please show how you got the answers please. Thanks!

Please show how you got the answers please. Thanks!