please show how you reached each answer (e.g formulas etc.)

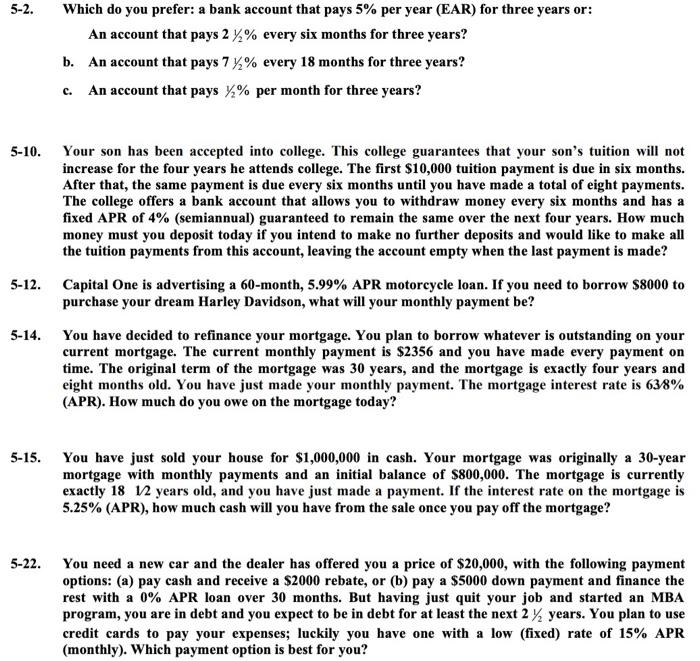

5-2. Which do you prefer: a bank account that pays 5% per year (EAR) for three years or: An account that pays 2 % every six months for three years? b. An account that pays 77% every 18 months for three years? An account that pays y,% per month for three years? c. 5-10. Your son has been accepted into college. This college guarantees that your son's tuition will not increase for the four years he attends college. The first $10,000 tuition payment is due in six months. After that, the same payment is due every six months until you have made a total of eight payments. The college offers a bank account that allows you to withdraw money every six months and has a fixed APR of 4% (semiannual) guaranteed to remain the same over the next four years. How much money must you deposit today if you intend to make no further deposits and would like to make all the tuition payments from this account, leaving the account empty when the last payment is made? 5-12. Capital One is advertising a 60-month, 5.99% APR motorcycle loan. If you need to borrow $8000 to purchase your dream Harley Davidson, what will your monthly payment be? 5-14. You have decided to refinance your mortgage. You plan to borrow whatever is outstanding on your current mortgage. The current monthly payment is $2356 and you have made every payment on time. The original term of the mortgage was 30 years, and the mortgage is exactly four years and eight months old. You have just made your monthly payment. The mortgage interest rate is 638% (APR). How much do you owe on the mortgage today? 5-15. You have just sold your house for $1,000,000 in cash. Your mortgage was originally a 30-year mortgage with monthly payments and an initial balance of $800,000. The mortgage is currently exactly 18 12 years old, and you have just made a payment. If the interest rate on the mortgage is 5.25% (APR), how much cash will you have from the sale once you pay off the mortgage? 5-22. You need a new car and the dealer has offered you a price of $20,000, with the following payment options: (a) pay cash and receive a $2000 rebate, or (b) pay a $5000 down payment and finance the rest with a 0% APR loan over 30 months. But having just quit your job and started an MBA program, you are in debt and you expect to be in debt for at least the next 2 / years. You plan to use credit cards to pay your expenses; luckily you have one with a low (fixed) rate of 15% APR (monthly). Which payment option is best for you