Answered step by step

Verified Expert Solution

Question

1 Approved Answer

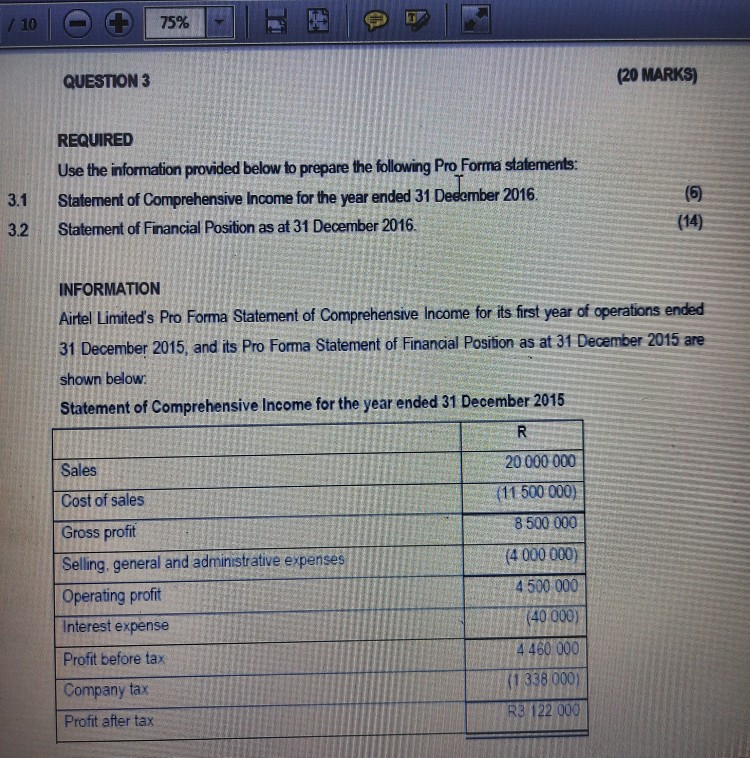

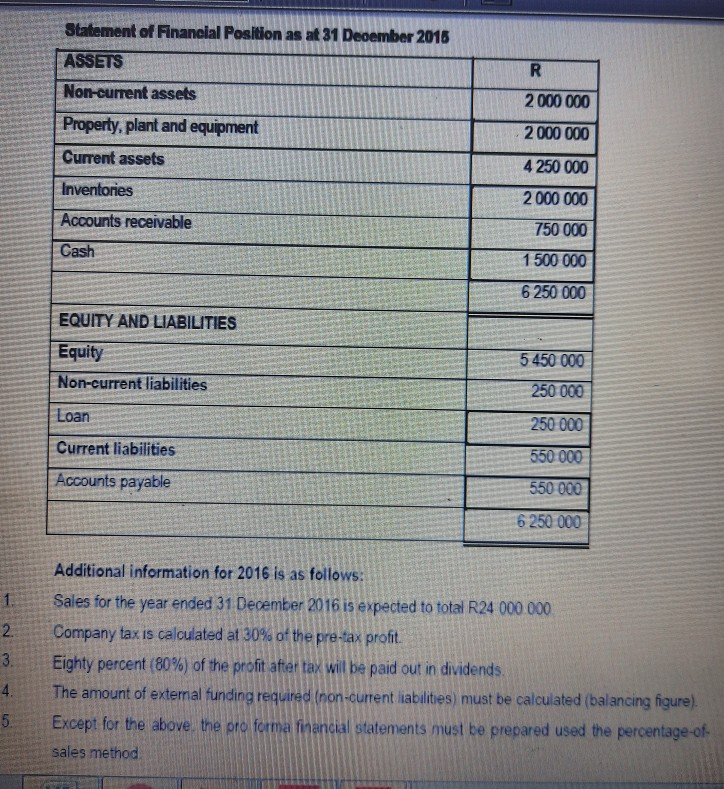

please show how you worked it out ( calculations) / 10 75% QUESTION 3 (20 MARKS) REQUIRED Use the information provided below to prepare the

please show how you worked it out ( calculations)

/ 10 75% QUESTION 3 (20 MARKS) REQUIRED Use the information provided below to prepare the following Pro Forma statements: Statement of Comprehensive Income for the year ended 31 December 2016. Statement of Financial Position as at 31 December 2016 3.1 3.2 (6) (14) INFORMATION Airtel Limited's Pro Forma Statement of Comprehensive Income for its first year of operations ended 31 December 2015, and its Pro Forma Statement of Financial Position as at 31 December 2015 are shown below: Statement of Comprehensive Income for the year ended 31 December 2015 R Sales 20 000 000 (11 500 000) Cost of sales 8500 000 (4 000 000) 4500 000 Gross profit Selling, general and administrative expenses Operating profit Interest expense Profit before tax (40 000) 4460 000 (1338 000) Company tax R3 122 000 Profit after tax Statement of Financial Position as at 31 December 2016 ASSETS R Non-current assets 2 000 000 Property, plant and equipment Current assets 2 000 000 4250 000 Inventories 2 000 000 Accounts receivable Cash 750 000 1 500 000 6 250 000 EQUITY AND LIABILITIES Equity Non-current liabilities 5450 000 250 000 Loan 250 000 Current liabilities 550 000 Accounts payable 550 000 6 250 000 1 2. 3. Additional information for 2016 is as follows: Sales for the year ended 31 December 2016 is expected to total R24 000.000 Company tax is calculated at 30% of the pre-tax profit. Eighty percent (80%) of the profit after tax will be paid out in dividends. The amount of external funding required (non-current liabilities) must be calculated (balancing figure) Except for the above the pro forma financial statements must be prepared used the percentage-of- sales method 4. 5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started