Answered step by step

Verified Expert Solution

Question

1 Approved Answer

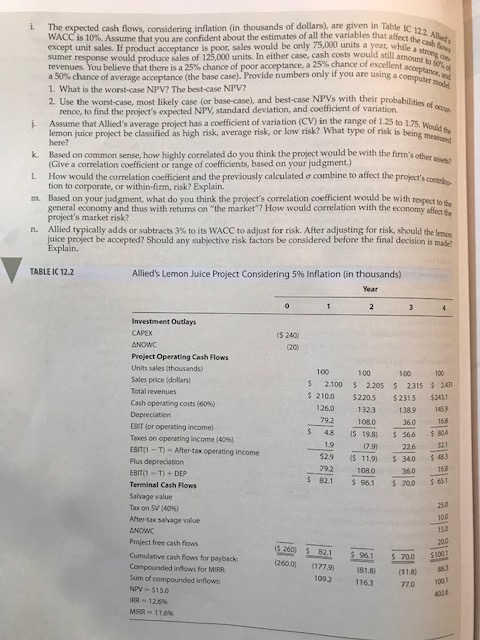

Please show in detail how to solve in spreadsheet. The expected cash flows, considering inflation (in thousands of dollars) are given in Table WACC is

Please show in detail how to solve in spreadsheet.

The expected cash flows, considering inflation (in thousands of dollars) are given in Table WACC is 10%. Assume that you are confident about the estimates of all the variables that affectthe except unit sales. If product acceptance is poor, sales would be only 75,000 units a year, whie ash i. would produce sales of 125,000 units. In either case, cash costs would still amouong revenues. You believe that there is a 25% chance of poor acceptance, a 25% chance of excellent a 50% chance of average acceptance (the base case). Pov ide numbers only if you are using a 1. What is the worst-case NPV? The best-case NPV 2. Use the worst-case, most likely case (or base-case), and best-case NPVs with their probabilities rence, to find the project's expected NPV, standard deviation, and coefficient of variation. Assume that Allied s average pro ect has a coefficient of variation (CV) in the range of 1.25 to 1.75. emon juice project be classified as high risk, average risk, or low risk? What type of risk is being hould te ) Based on common sense, how highly correlated do you think the project would be with the firm's other Give a correlation coefficient or range of coefficients, based on your judgment.) k. L How would the correlation coffent and the previously calculated combine to affect the project sco , m. Based on your judgment, what do you think the project's correlation coefficient would be with respect to he n. Allied typically adds or subtracts 3% to its WACC to adjust for risk. After adjusting for risk, should the l , tion to corporate, or within-firm, risk? Explain. general economy and thus with returns on "the market"? How would correlation with the economy affe t project's market risk? y affect the uice project be accepted? Should any subjective risk factors be considered before the final decision is made TABLE IC 12.2 Allied's Lemon Juice Project Considering 5% Inflation (in thousands) Year Investment Outlays Project Operating Cash Flows Units sales (thousands) Sales price (dollars) Total revenues Cash operating costs (60%) 100 100 100 2.100 2205 2315 231 5 210.0 $2205 $2315 $231 126.0 1323 1389 1459 19.8 566 $ 804 11.9) 340 $ 483 96.1 70.0 61 ESIT (or operacing income) Taxes on operating income (40%) EBTI T-After-tax operating income Plus depreciation EBITC T) +DEP Terminal Cash Flows Salvage value Tax on SV (40%) After-tax salvage value NOWC Project free cash flows Cumulative cash fows for payback Compounded inflows for MIRR Sum of compounded inflows NPV $15.0 SRA+ 126% MIRR 1 1.6% 548 29 s 821 1370033 260.0) (1779) (88) (1181 1163 770 100 The expected cash flows, considering inflation (in thousands of dollars) are given in Table WACC is 10%. Assume that you are confident about the estimates of all the variables that affectthe except unit sales. If product acceptance is poor, sales would be only 75,000 units a year, whie ash i. would produce sales of 125,000 units. In either case, cash costs would still amouong revenues. You believe that there is a 25% chance of poor acceptance, a 25% chance of excellent a 50% chance of average acceptance (the base case). Pov ide numbers only if you are using a 1. What is the worst-case NPV? The best-case NPV 2. Use the worst-case, most likely case (or base-case), and best-case NPVs with their probabilities rence, to find the project's expected NPV, standard deviation, and coefficient of variation. Assume that Allied s average pro ect has a coefficient of variation (CV) in the range of 1.25 to 1.75. emon juice project be classified as high risk, average risk, or low risk? What type of risk is being hould te ) Based on common sense, how highly correlated do you think the project would be with the firm's other Give a correlation coefficient or range of coefficients, based on your judgment.) k. L How would the correlation coffent and the previously calculated combine to affect the project sco , m. Based on your judgment, what do you think the project's correlation coefficient would be with respect to he n. Allied typically adds or subtracts 3% to its WACC to adjust for risk. After adjusting for risk, should the l , tion to corporate, or within-firm, risk? Explain. general economy and thus with returns on "the market"? How would correlation with the economy affe t project's market risk? y affect the uice project be accepted? Should any subjective risk factors be considered before the final decision is made TABLE IC 12.2 Allied's Lemon Juice Project Considering 5% Inflation (in thousands) Year Investment Outlays Project Operating Cash Flows Units sales (thousands) Sales price (dollars) Total revenues Cash operating costs (60%) 100 100 100 2.100 2205 2315 231 5 210.0 $2205 $2315 $231 126.0 1323 1389 1459 19.8 566 $ 804 11.9) 340 $ 483 96.1 70.0 61 ESIT (or operacing income) Taxes on operating income (40%) EBTI T-After-tax operating income Plus depreciation EBITC T) +DEP Terminal Cash Flows Salvage value Tax on SV (40%) After-tax salvage value NOWC Project free cash flows Cumulative cash fows for payback Compounded inflows for MIRR Sum of compounded inflows NPV $15.0 SRA+ 126% MIRR 1 1.6% 548 29 s 821 1370033 260.0) (1779) (88) (1181 1163 770 100Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started