Answered step by step

Verified Expert Solution

Question

1 Approved Answer

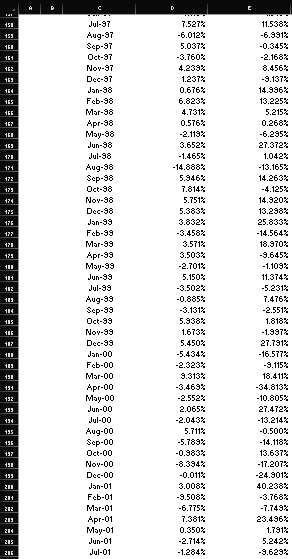

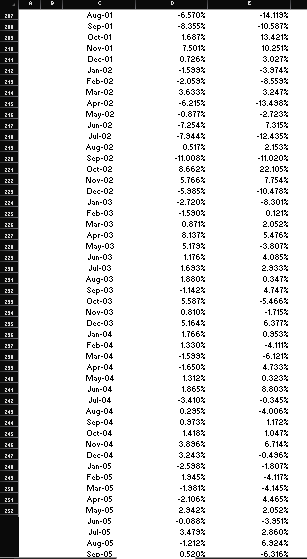

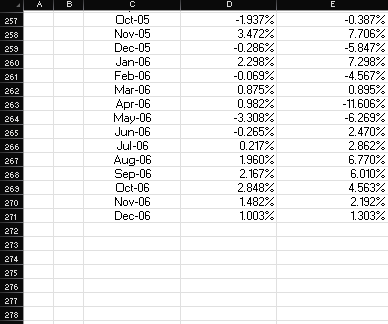

Please show in excel and show excel formulas Thank you, will up vote The spreadsheet below has data on Microsoft and the S&P 500 from

Please show in excel and show excel formulas

Thank you, will up vote

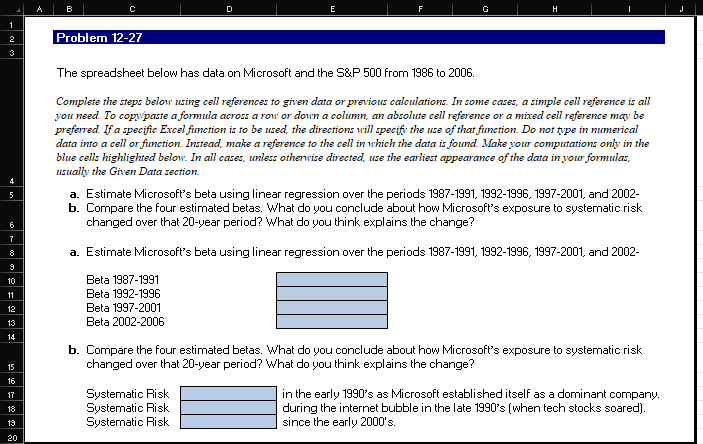

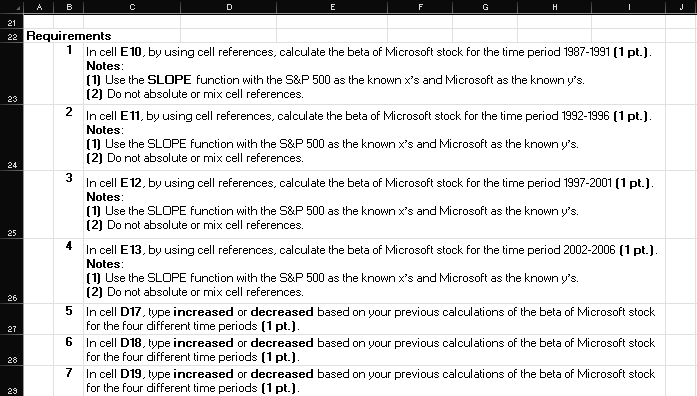

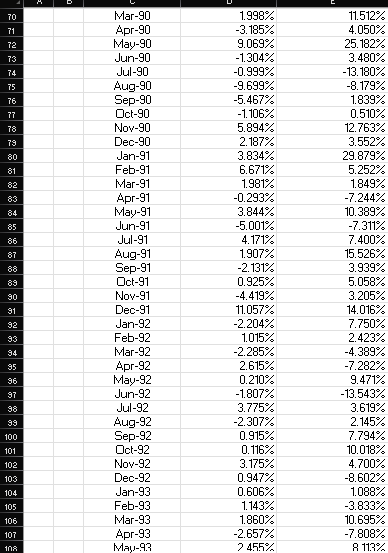

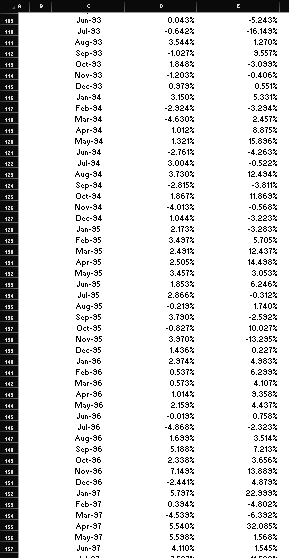

The spreadsheet below has data on Microsoft and the S\&P 500 from 1986 to 2006. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found Make your computations only in the blue cells highlighted below. In all cases, unless othenvise directed, use the earliest appearance of the data in your formulas, usually the Grien Data section. a. Estimate Microsoft's beta using linear regression over the periods 1987-1991, 1992-1996, 1997-2001, and 2002- b. Compare the four estimated betas. What do you conclude about how lyicrosoft's exposure to systematic risk changed over that 20-year period? What do you think explains the change? a. Estimate Microsoft's beta using linear regression over the periods 1987-1991, 1992-1996, 1997-2001, and 2002- Beta 1987-1991 Beta 1992-1996 Beta 1997-2001 Beta 20022006 b. Compare the four estimated betas. What do you conclude aboul how Microsoft's exposure to sustematic risk changed over that 20 -year period? What do you think explains the change? Sustematic Risk in the early 1990's as Microsoft established itself as a dominant company. Systematic Risk during the internet bubble in the late 1990's (when tech stocks soared). Systematic Risk. since the early 2000 's. quirements 1 In cell E10, by using cell references, calculate the beta of Microsoft stock for the time period 19871991 [1 pt.]. Motes: [1) Use the SLDPE function with the S\&P 500 as the known x 's and Microsoft as the known y 's. [2] Do not absolute or mix cell references. 2 In cell E11, by using cell references, calculate the beta of Microsoft stock for the time period 19921996 [1 pt.]. Motes: (1) Use the SLDPE function with the S\&P 500 as the known x 's and Microsoft as the known y 's. [2] Do not absolute or mix cell references. 3 In cell E 12, by using cell references, calculate the beta of licrosoft stock for the time period 19972001 [1 pt.]. Motes: (1) Use the SLDPE function with the S\&P 500 as the known x 's and Microsoft as the known y 's. [2] Do not absolute or mix cell references. 4 In cell E13, by using cell references, calculate the beta of Microsoft stock for the time period 20022006 (1 pt.]. Motes: [1] Use the SLDPE function with the S\&P 500 as the known x 's and Microsoft as the known y 's. [2] Do not absolute or mix cell references. 5 In cell D17, type increased or decreased based on your previous calculations of the beta of Microsoft stock for the four different time periods [1 pt.]. 6 In cell D18, type increased or decreased based on your previous calculations of the beta of Microsoft stock for the four different time periods [1 pt.]. 7 In cell D19, type increased or decreased based on your previous calculations of the beta of lyicrosoft stock for the four different time periods [1 pt.]. The spreadsheet below has data on Microsoft and the S\&P 500 from 1986 to 2006. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found Make your computations only in the blue cells highlighted below. In all cases, unless othenvise directed, use the earliest appearance of the data in your formulas, usually the Grien Data section. a. Estimate Microsoft's beta using linear regression over the periods 1987-1991, 1992-1996, 1997-2001, and 2002- b. Compare the four estimated betas. What do you conclude about how lyicrosoft's exposure to systematic risk changed over that 20-year period? What do you think explains the change? a. Estimate Microsoft's beta using linear regression over the periods 1987-1991, 1992-1996, 1997-2001, and 2002- Beta 1987-1991 Beta 1992-1996 Beta 1997-2001 Beta 20022006 b. Compare the four estimated betas. What do you conclude aboul how Microsoft's exposure to sustematic risk changed over that 20 -year period? What do you think explains the change? Sustematic Risk in the early 1990's as Microsoft established itself as a dominant company. Systematic Risk during the internet bubble in the late 1990's (when tech stocks soared). Systematic Risk. since the early 2000 's. quirements 1 In cell E10, by using cell references, calculate the beta of Microsoft stock for the time period 19871991 [1 pt.]. Motes: [1) Use the SLDPE function with the S\&P 500 as the known x 's and Microsoft as the known y 's. [2] Do not absolute or mix cell references. 2 In cell E11, by using cell references, calculate the beta of Microsoft stock for the time period 19921996 [1 pt.]. Motes: (1) Use the SLDPE function with the S\&P 500 as the known x 's and Microsoft as the known y 's. [2] Do not absolute or mix cell references. 3 In cell E 12, by using cell references, calculate the beta of licrosoft stock for the time period 19972001 [1 pt.]. Motes: (1) Use the SLDPE function with the S\&P 500 as the known x 's and Microsoft as the known y 's. [2] Do not absolute or mix cell references. 4 In cell E13, by using cell references, calculate the beta of Microsoft stock for the time period 20022006 (1 pt.]. Motes: [1] Use the SLDPE function with the S\&P 500 as the known x 's and Microsoft as the known y 's. [2] Do not absolute or mix cell references. 5 In cell D17, type increased or decreased based on your previous calculations of the beta of Microsoft stock for the four different time periods [1 pt.]. 6 In cell D18, type increased or decreased based on your previous calculations of the beta of Microsoft stock for the four different time periods [1 pt.]. 7 In cell D19, type increased or decreased based on your previous calculations of the beta of lyicrosoft stock for the four different time periods [1 pt.]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started