Please show in Excel Spreadsheet and show work & the formulas you used.

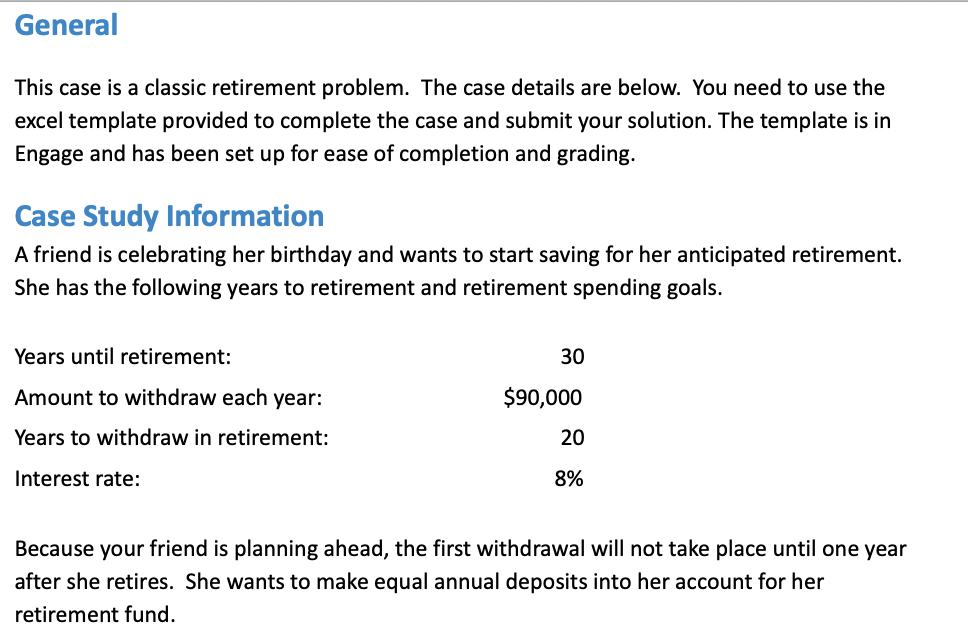

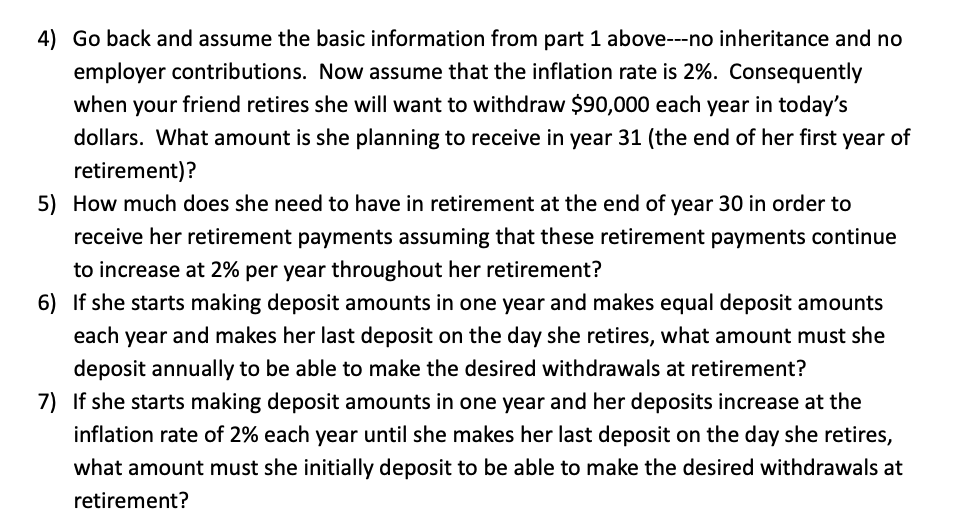

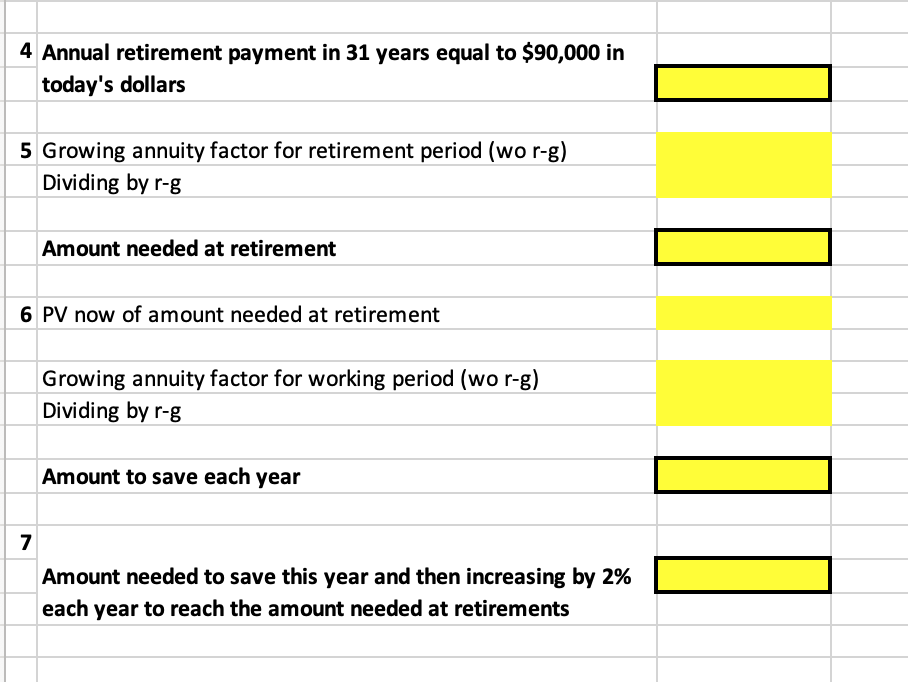

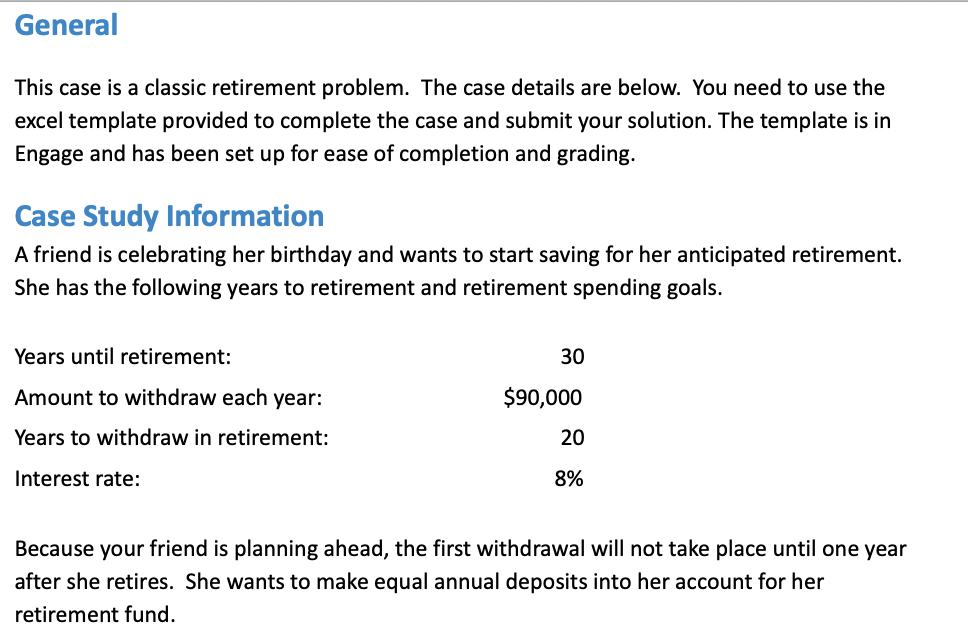

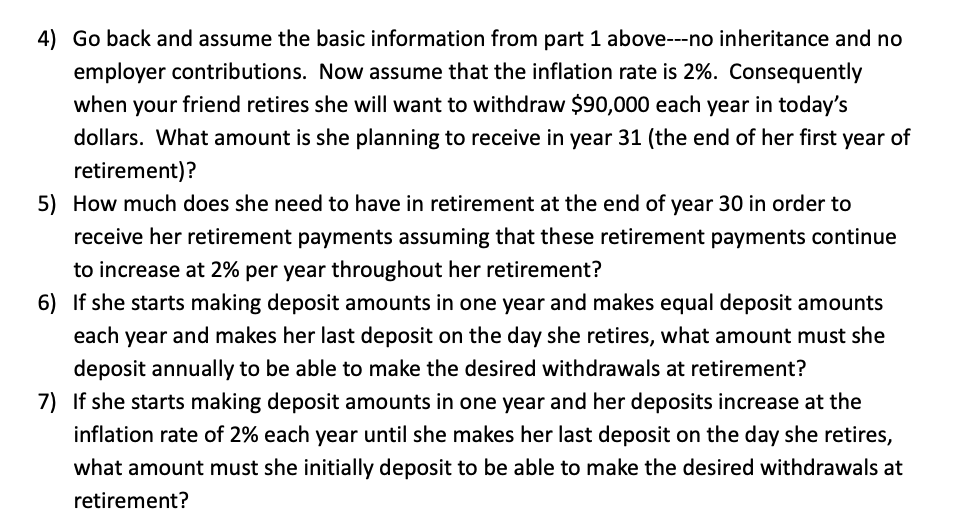

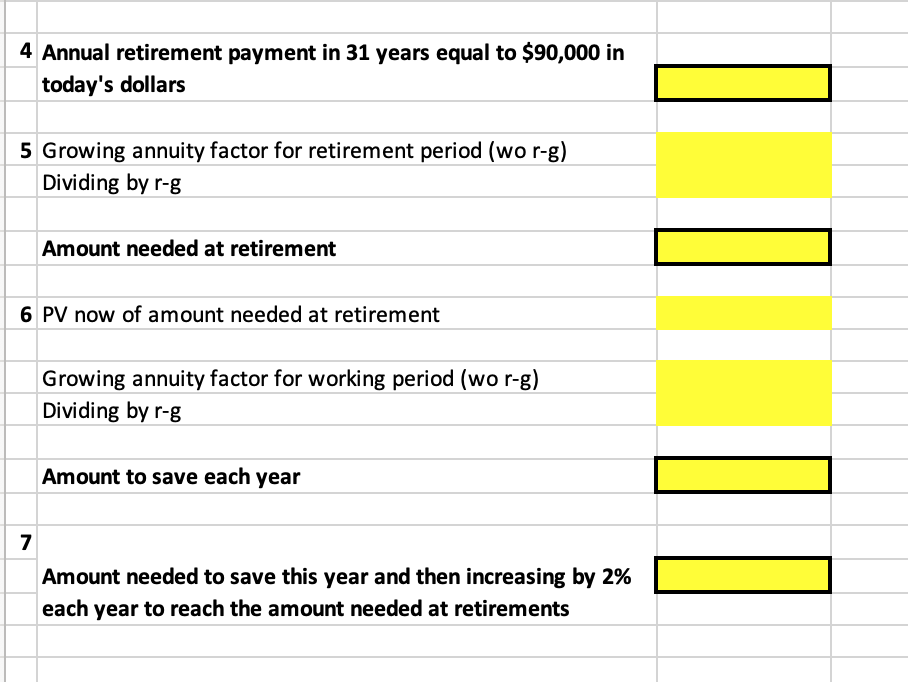

General This case is a classic retirement problem. The case details are below. You need to use the excel template provided to complete the case and submit your solution. The template is in Engage and has been set up for ease of completion and grading. Case Study Information A friend is celebrating her birthday and wants to start saving for her anticipated retirement. She has the following years to retirement and retirement spending goals. Years until retirement: 30 Amount to withdraw each year: $90,000 Years to withdraw in retirement: 20 Interest rate: 8% Because your friend is planning ahead, the first withdrawal will not take place until one year after she retires. She wants to make equal annual deposits into her account for her retirement fund. 4) Go back and assume the basic information from part 1 above---no inheritance and no employer contributions. Now assume that the inflation rate is 2%. Consequently when your friend retires she will want to withdraw $90,000 each year in today's dollars. What amount is she planning to receive in year 31 (the end of her first year of retirement)? 5) How much does she need to have in retirement at the end of year 30 in order to receive her retirement payments assuming that these retirement payments continue to increase at 2% per year throughout her retirement? 6) If she starts making deposit amounts in one year and makes equal deposit amounts each year and makes her last deposit on the day she retires, what amount must she deposit annually to be able to make the desired withdrawals at retirement? 7) If she starts making deposit amounts in one year and her deposits increase at the inflation rate of 2% each year until she makes her last deposit on the day she retires, what amount must she initially deposit to be able to make the desired withdrawals at retirement? 4 Annual retirement payment in 31 years equal to $90,000 in today's dollars 5 Growing annuity factor for retirement period (wo r-g) Dividing by r-g Amount needed at retirement 6 PV now of amount needed at retirement Growing annuity factor for working period (wor-g) Dividing by r-g Amount to save each year 7 Amount needed to save this year and then increasing by 2% each year to reach the amount needed at retirements General This case is a classic retirement problem. The case details are below. You need to use the excel template provided to complete the case and submit your solution. The template is in Engage and has been set up for ease of completion and grading. Case Study Information A friend is celebrating her birthday and wants to start saving for her anticipated retirement. She has the following years to retirement and retirement spending goals. Years until retirement: 30 Amount to withdraw each year: $90,000 Years to withdraw in retirement: 20 Interest rate: 8% Because your friend is planning ahead, the first withdrawal will not take place until one year after she retires. She wants to make equal annual deposits into her account for her retirement fund. 4) Go back and assume the basic information from part 1 above---no inheritance and no employer contributions. Now assume that the inflation rate is 2%. Consequently when your friend retires she will want to withdraw $90,000 each year in today's dollars. What amount is she planning to receive in year 31 (the end of her first year of retirement)? 5) How much does she need to have in retirement at the end of year 30 in order to receive her retirement payments assuming that these retirement payments continue to increase at 2% per year throughout her retirement? 6) If she starts making deposit amounts in one year and makes equal deposit amounts each year and makes her last deposit on the day she retires, what amount must she deposit annually to be able to make the desired withdrawals at retirement? 7) If she starts making deposit amounts in one year and her deposits increase at the inflation rate of 2% each year until she makes her last deposit on the day she retires, what amount must she initially deposit to be able to make the desired withdrawals at retirement? 4 Annual retirement payment in 31 years equal to $90,000 in today's dollars 5 Growing annuity factor for retirement period (wo r-g) Dividing by r-g Amount needed at retirement 6 PV now of amount needed at retirement Growing annuity factor for working period (wor-g) Dividing by r-g Amount to save each year 7 Amount needed to save this year and then increasing by 2% each year to reach the amount needed at retirements