Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show in excel with formula, thank you. This week's assignment concerns itself with bonds. Part of it involves problem solving, part of it some

Please show in excel with formula, thank you.

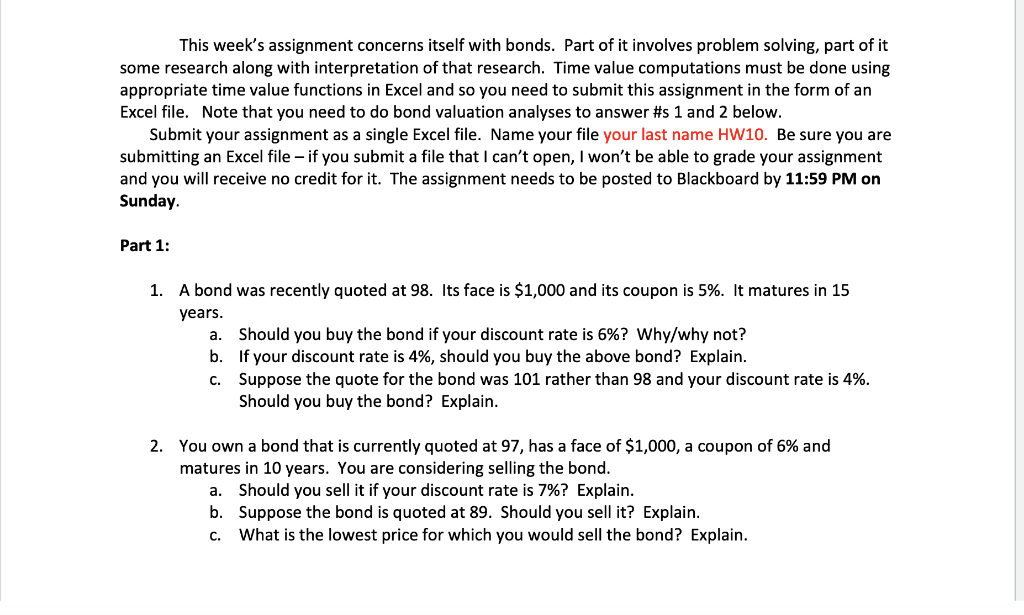

This week's assignment concerns itself with bonds. Part of it involves problem solving, part of it some research along with interpretation of that research. Time value computations must be done using appropriate time value functions in Excel and so you need to submit this assignment in the form of an Excel file. Note that you need to do bond valuation analyses to answer #s 1 and 2 below. Submit your assignment as a single Excel file. Name your file your last name HW10. Be sure you are submitting an Excel file - if you submit a file that I can't open, I won't be able to grade your assignment and you will receive no credit for it. The assignment needs to be posted to Blackboard by 11:59 PM on Sunday Part 1: a. 1. A bond was recently quoted at 98. Its face is $1,000 and its coupon is 5%. It matures in 15 years. Should you buy the bond if your discount rate is 6%? Why/why not? b. If your discount rate is 4%, should you buy the above bond? Explain. C. Suppose the quote for the bond was 101 rather than 98 and your discount rate is 4%. Should you buy the bond? Explain. 2. You own a bond that is currently quoted at 97, has a face of $1,000, a coupon of 6% and matures in 10 years. You are considering selling the bond. a. Should you sell it if your discount rate is 7%? Explain. b. Suppose the bond is quoted at 89. Should you sell it? Explain. What is the lowest price for which you would sell the bond? Explain. CStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started