Answered step by step

Verified Expert Solution

Question

1 Approved Answer

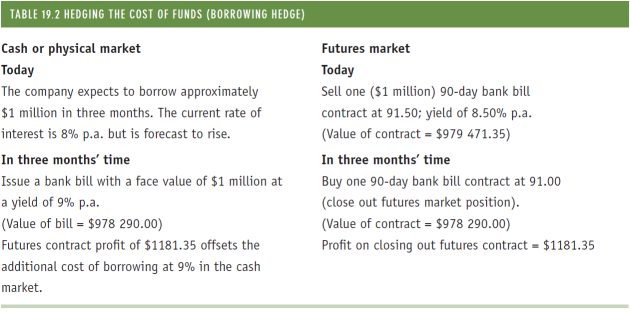

Please show me how to get futures contract profits=1181.35 on both side.Thank you! TABLE 19.2 HEDGING THE COST OF FUNDS (BORROWING HEDGE) Cash or physical

Please show me how to get futures contract profits=1181.35 on both side.Thank you!

TABLE 19.2 HEDGING THE COST OF FUNDS (BORROWING HEDGE) Cash or physical market Today The company expects to borrow approximately $1 million in three months. The current rate of interest is 8% pa. but is forecast to rise. In three months' time Issue a bank bill with a face value of $1 million at a yield of 9% pa. (Value of bill = $978 290.00) Futures contract profit of $1181.35 offsets the additional cost of borrowing at 9% in the cash market Futures market Today Sell one ($1 million) 90-day bank bill contract at 91.50; yield of 8.50% pa. (Value of contract = $979 471.35) In three months' time y one 90-day bank bill contract at 91.00 (close out futures market position) (Value of contract = $978 290.00) Profit on closing out futures contract $1181.35

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started