Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show me how to solve it, thank you You lend $8,167 to a small startup firm that promises to pay a 10% rate for

Please show me how to solve it, thank you

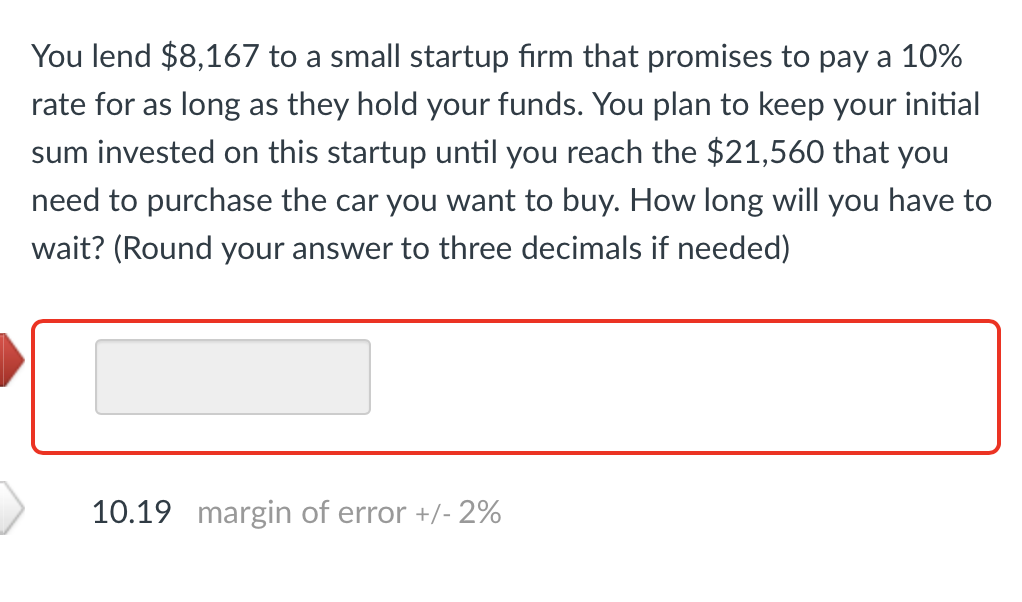

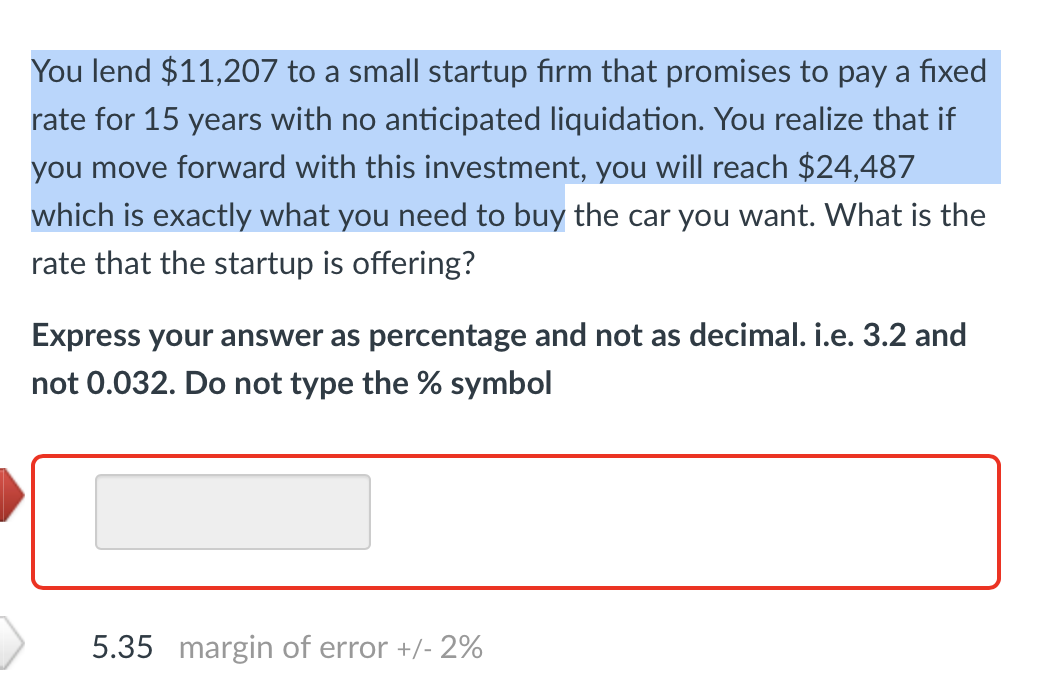

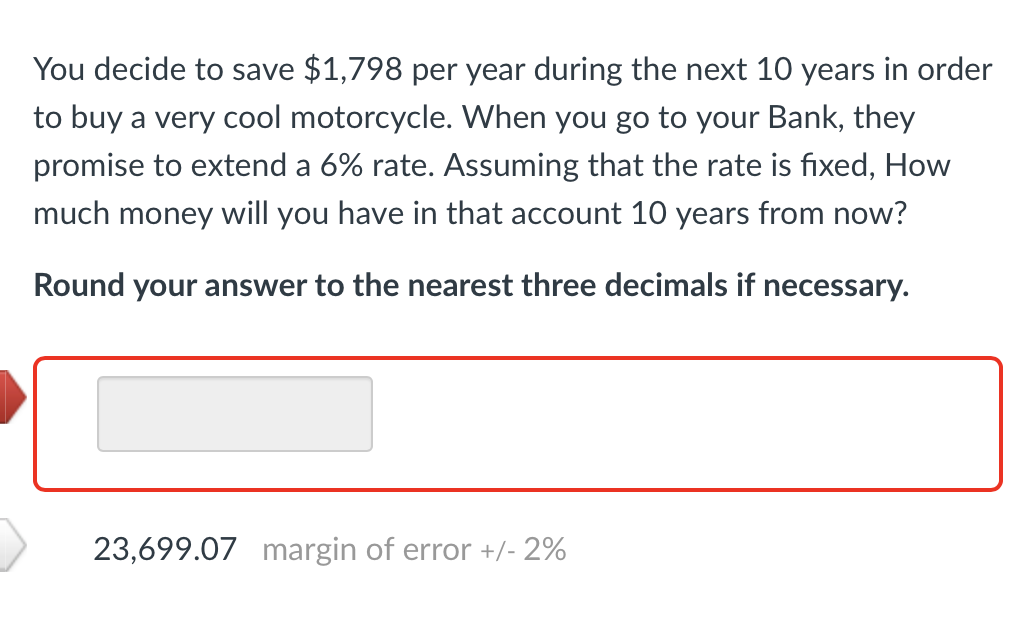

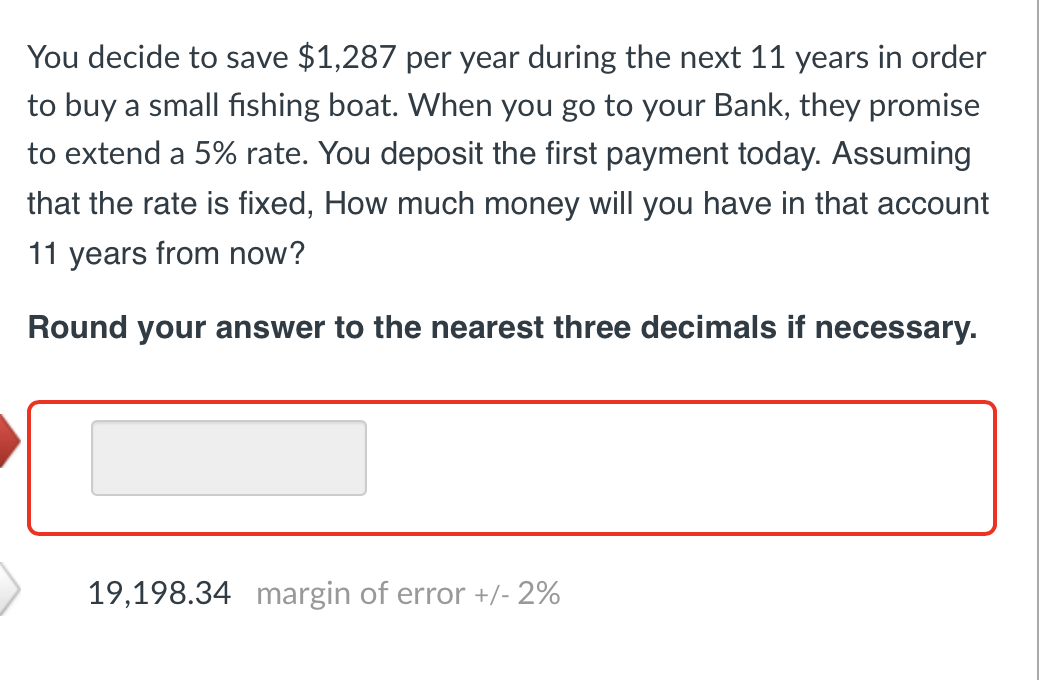

You lend $8,167 to a small startup firm that promises to pay a 10% rate for as long as they hold your funds. You plan to keep your initial sum invested on this startup until you reach the $21,560 that you need to purchase the car you want to buy. How long will you have to wait? (Round your answer to three decimals if needed) 10.19 margin of error +/- 2% You lend $11,207 to a small startup firm that promises to pay a fixed rate for 15 years with no anticipated liquidation. You realize that if you move forward with this investment, you will reach $24,487 which is exactly what you need to buy the car you want. What is the rate that the startup is offering? Express your answer as percentage and not as decimal. i.e. 3.2 and not 0.032. Do not type the % symbol 5.35 margin of error +/- 2% You decide to save $1,798 per year during the next 10 years in order to buy a very cool motorcycle. When you go to your Bank, they promise to extend a 6% rate. Assuming that the rate is fixed, How much money will you have in that account 10 years from now? Round your answer to the nearest three decimals if necessary. 23,699.07 margin of error +/- 2% You decide to save $1,287 per year during the next 11 years in order to buy a small fishing boat. When you go to your Bank, they promise to extend a 5% rate. You deposit the first payment today. Assuming that the rate is fixed, How much money will you have in that account 11 years from now? Round your answer to the nearest three decimals if necessary. 19,198.34 margin of error +/- 2%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started