Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show me how you do it. Thank you. 2. Using Risk Management tools a. You own a building that produces a triple net rent

please show me how you do it. Thank you.

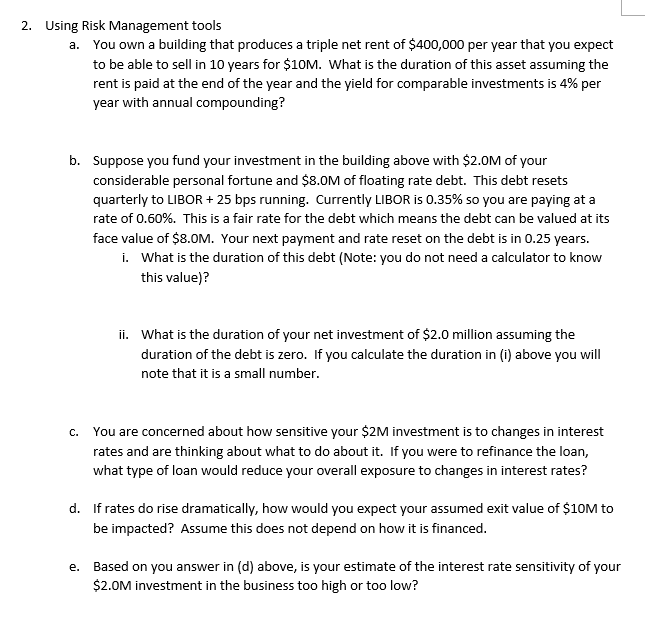

2. Using Risk Management tools a. You own a building that produces a triple net rent of $400,000 per year that you expect to be able to sell in 10 years for $10M. What is the duration of this asset assuming the rent is paid at the end of the year and the yield for comparable investments is 4% per year with annual compounding? b. Suppose you fund your investment in the building above with $2.0M of your considerable personal fortune and $8.0M of floating rate debt. This debt resets quarterly to LIBOR + 25 bps running. Currently LIBOR is 0.35% so you are paying at a rate of 0.60%. This is a fair rate for the debt which means the debt can be valued at its face value of $8.0M. Your next payment and rate reset on the debt is in 0.25 years. i. What is the duration of this debt (Note: you do not need a calculator to know this value)? ii. What is the duration of your net investment of $2.0 million assuming the duration of the debt is zero. If you calculate the duration in (i) above you will note that it is a small number. C. You are concerned about how sensitive your $2M investment is to changes in interest rates and are thinking about what to do about it. If you were to refinance the loan, what type of loan would reduce your overall exposure to changes in interest rates? d. If rates do rise dramatically, how would you expect your assumed exit value of $10M to be impacted? Assume this does not depend on how it is financed. e. Based on you answer in (d) above, is your estimate of the interest rate sensitivity of your $2.0M investment in the business too high or too low? 2. Using Risk Management tools a. You own a building that produces a triple net rent of $400,000 per year that you expect to be able to sell in 10 years for $10M. What is the duration of this asset assuming the rent is paid at the end of the year and the yield for comparable investments is 4% per year with annual compounding? b. Suppose you fund your investment in the building above with $2.0M of your considerable personal fortune and $8.0M of floating rate debt. This debt resets quarterly to LIBOR + 25 bps running. Currently LIBOR is 0.35% so you are paying at a rate of 0.60%. This is a fair rate for the debt which means the debt can be valued at its face value of $8.0M. Your next payment and rate reset on the debt is in 0.25 years. i. What is the duration of this debt (Note: you do not need a calculator to know this value)? ii. What is the duration of your net investment of $2.0 million assuming the duration of the debt is zero. If you calculate the duration in (i) above you will note that it is a small number. C. You are concerned about how sensitive your $2M investment is to changes in interest rates and are thinking about what to do about it. If you were to refinance the loan, what type of loan would reduce your overall exposure to changes in interest rates? d. If rates do rise dramatically, how would you expect your assumed exit value of $10M to be impacted? Assume this does not depend on how it is financed. e. Based on you answer in (d) above, is your estimate of the interest rate sensitivity of your $2.0M investment in the business too high or too lowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started