Answered step by step

Verified Expert Solution

Question

1 Approved Answer

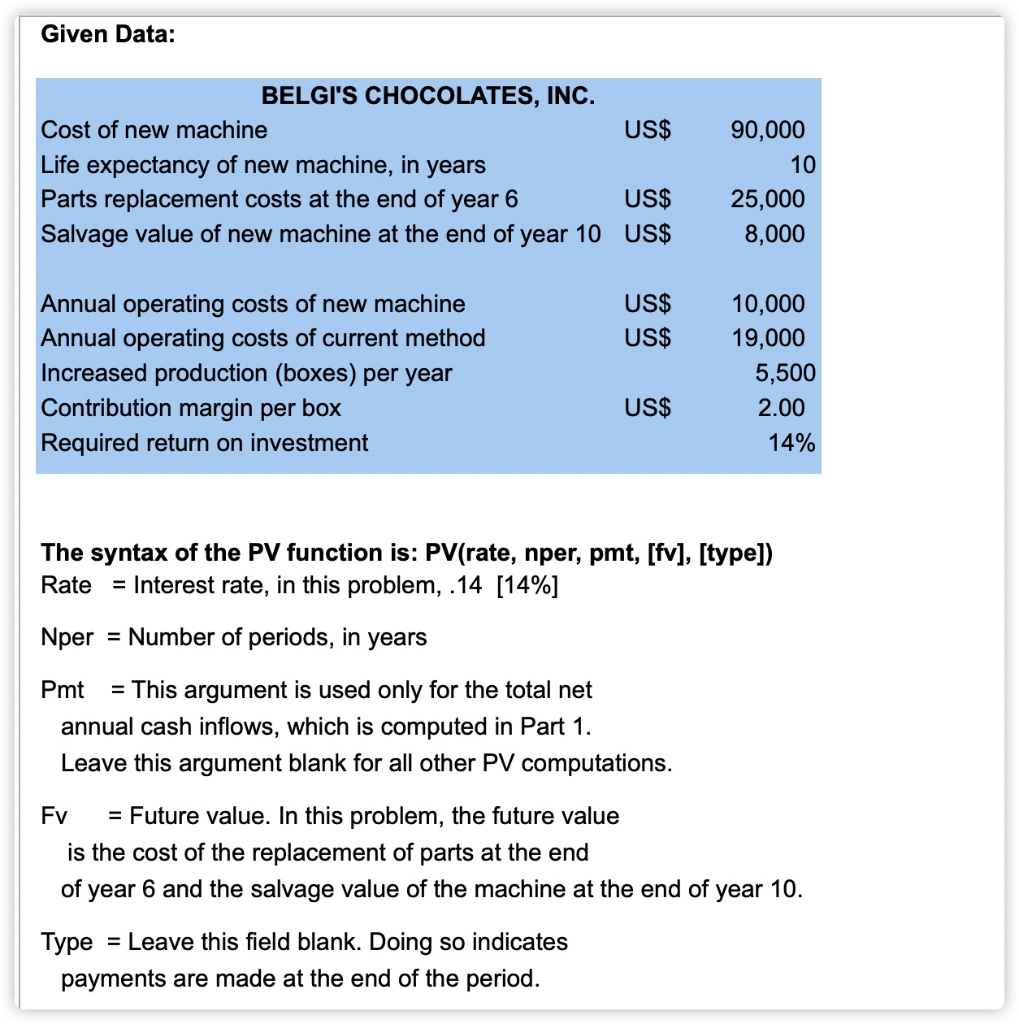

please show me the excel formula Given Data: BELGI'S CHOCOLATES, INC. Cost of new machine US$ Life expectancy of new machine, in years Parts replacement

please show me the excel formula

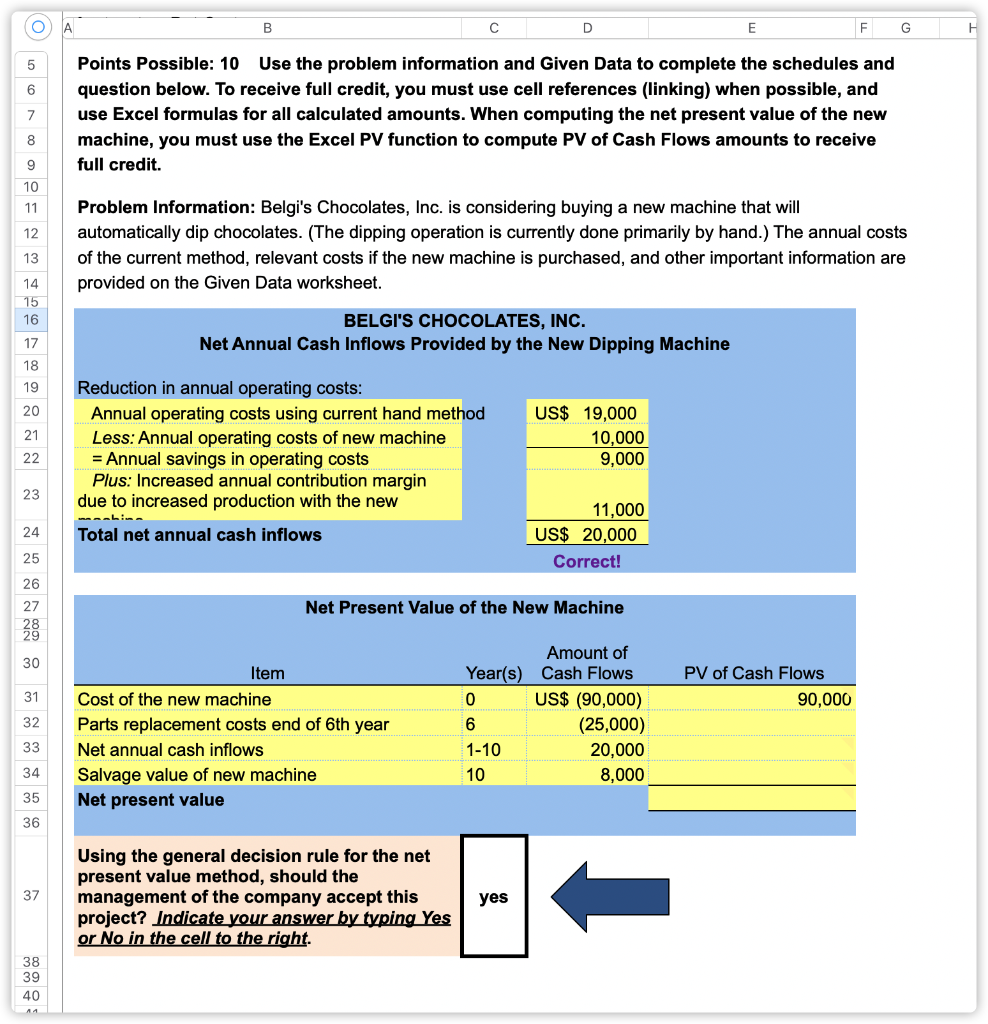

Given Data: BELGI'S CHOCOLATES, INC. Cost of new machine US$ Life expectancy of new machine, in years Parts replacement costs at the end of year 6 US$ Salvage value of new machine at the end of year 10 US$ 90,000 10 25,000 8,000 US$ US$ Annual operating costs of new machine Annual operating costs of current method Increased production (boxes) per year Contribution margin per box Required return on investment 10,000 19,000 5,500 2.00 14% US$ The syntax of the PV function is: PV(rate, nper, pmt, [fv], [type]) Rate = Interest rate, in this problem, .14 [14%] Nper = Number of periods, in years Pmt = This argument is used only for the total net annual cash inflows, which is computed in Part 1. Leave this argument blank for all other PV computations. FV = Future value. In this problem, the future value is the cost of the replacement of parts at the end of year 6 and the salvage value of the machine at the end of year 10. Type = Leave this field blank. Doing so indicates payments are made at the end of the period. A B D E F G 5 6 7 Points Possible: 10 Use the problem information and Given Data to complete the schedules and question below. To receive full credit, you must use cell references (linking) when possible, and use Excel formulas for all calculated amounts. When computing the net present value of the new machine, you must use the Excel PV function to compute PV of Cash Flows amounts to receive full credit. 8 9 10 11 12 Problem Information: Belgi's Chocolates, Inc. is considering buying a new machine that will automatically dip chocolates. (The dipping operation is currently done primarily by hand.) The annual costs of the current method, relevant costs if the new machine is purchased, and other important information are provided on the Given Data worksheet. 13 14 15 16 BELGI'S CHOCOLATES, INC. Net Annual Cash Inflows Provided by the New Dipping Machine 17 18 19 20 21 Reduction in annual operating costs: Annual operating costs using current hand method Less: Annual operating costs of new machine = Annual savings in operating costs Plus: Increased annual contribution margin due to increased production with the new US$ 19,000 10,000 9,000 22 23 24 Total net annual cash inflows 11,000 US$ 20,000 Correct! 25 26 27 Net Present Value of the New Machine 30 PV of Cash Flows 90,000 31 Amount of Year(s) Cash Flows 0 US$ (90,000) 6 (25,000) 1-10 20,000 10 8,000 Item Cost of the new machine Parts replacement costs end of 6th year Net annual cash inflows Salvage value of new machine Net present value 32 33 34 35 36 37 Using the general decision rule for the net present value method, should the management of the company accept this project? Indicate your answer by typing Yes or No in the cell to the right. yes 38 39 40Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started