Answered step by step

Verified Expert Solution

Question

1 Approved Answer

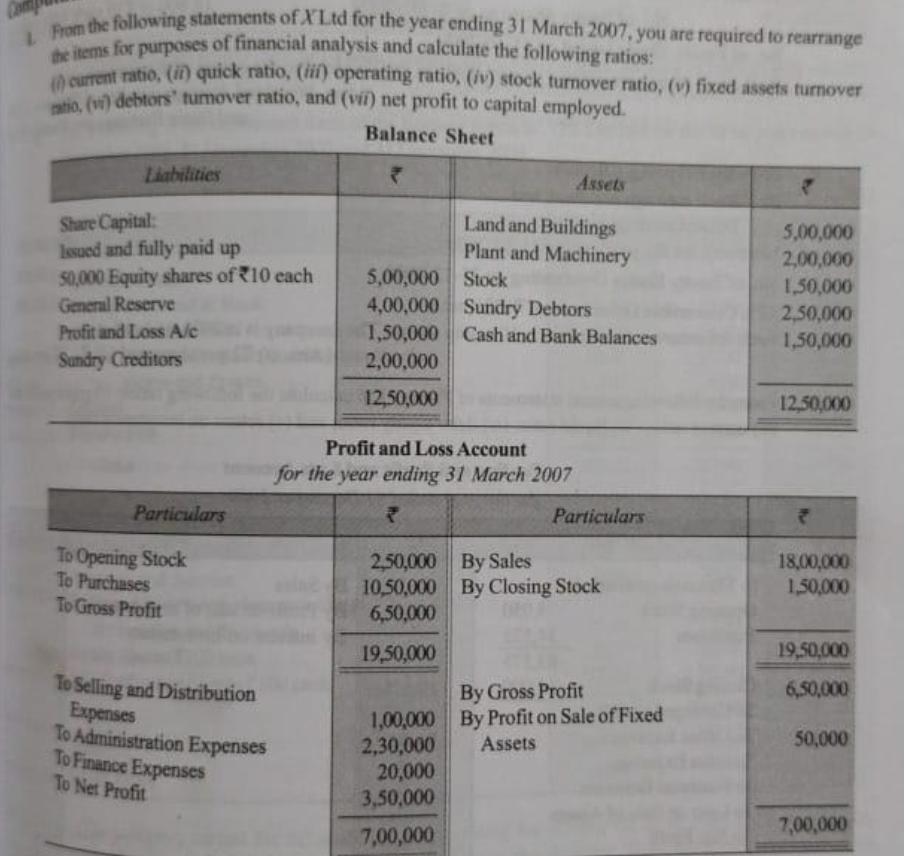

be following statements of XLtd tor the year ending 31 March 2007, you are required to rearrange the items for purposes of financial analysis

be following statements of XLtd tor the year ending 31 March 2007, you are required to rearrange the items for purposes of financial analysis and calculate the following ratios: rent ratio, (ii) quick ratio, (fii) operating ratio, (iv) stock turnover ratio, (v) fixed assets turnover n, (v) debtors' tumover ratio, and (vii) net profit to capital employed. Balance Sheet Liabilities Assets Share Capital: Issued and fully paid up 50,000 Equity shares of 10 each Gemeral Reserve Profit and Loss A/c Land and Buildings Plant and Machinery 5,00,000 2,00,000 5,00,000 Stock 4,00,000 Sundry Debtors 1,50,000 Cash and Bank Balances 1,50,000 2,50,000 1,50,000 Sundry Creditors 2,00,000 12,50,000 12,50,000 Profit and Loss Account for the year ending 31 March 2007 Particulars Particulars To Opening Stock To Purchases To Gross Profit 2,50,000 By Sales 10,50,000 By Closing Stock 6,50,000 18,00,000 1,50,000 19,50,000 19,50,000 To Selling and Distribution Expenses To Administration Expenses To Finance Expenses To Net Profit By Gross Profit 6,50,000 1,00,000 By Profit on Sale of Fixed 2,30,000 20,000 3,50,000 Assets 50,000 7,00,000 7,00,000

Step by Step Solution

★★★★★

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

1 st question answer i Current ratio Current assets Current liabilities Current ratio Stock DebtorsCash and bank Creditors Current ratio 1500002500001...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started