Please show me the steps and formulas so that I will be able to understand and solve myself.

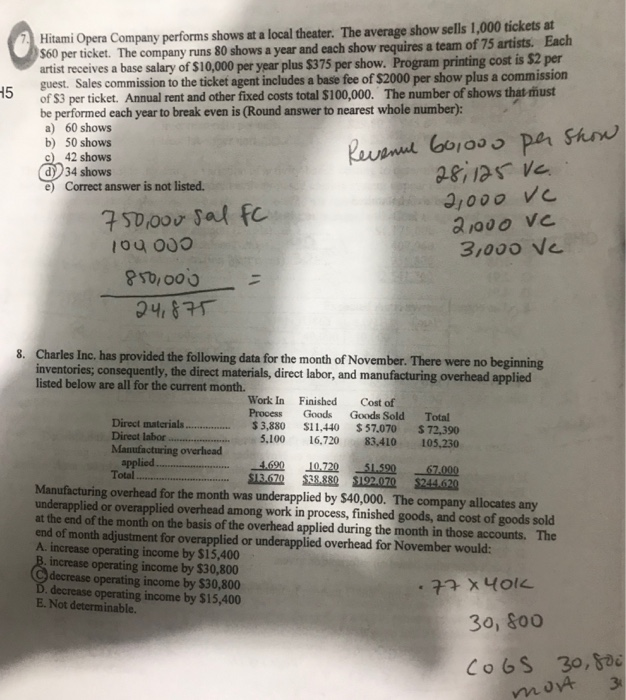

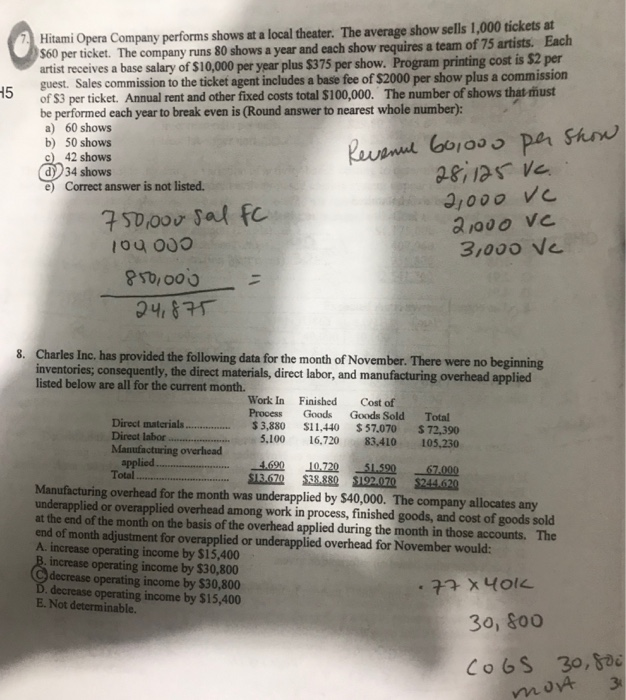

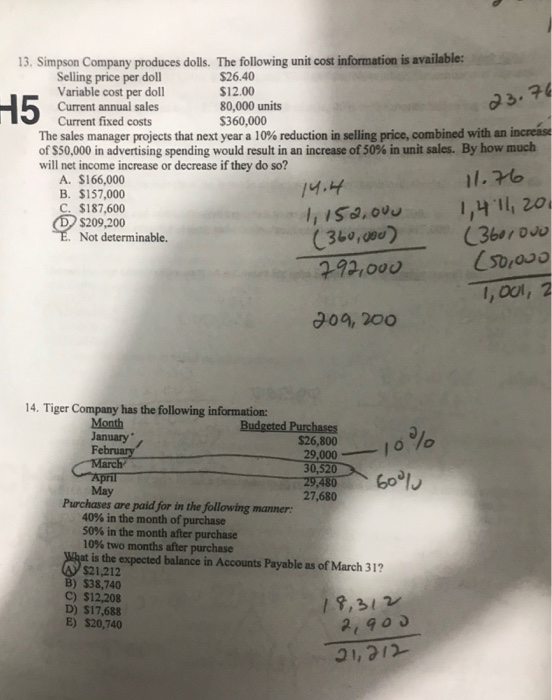

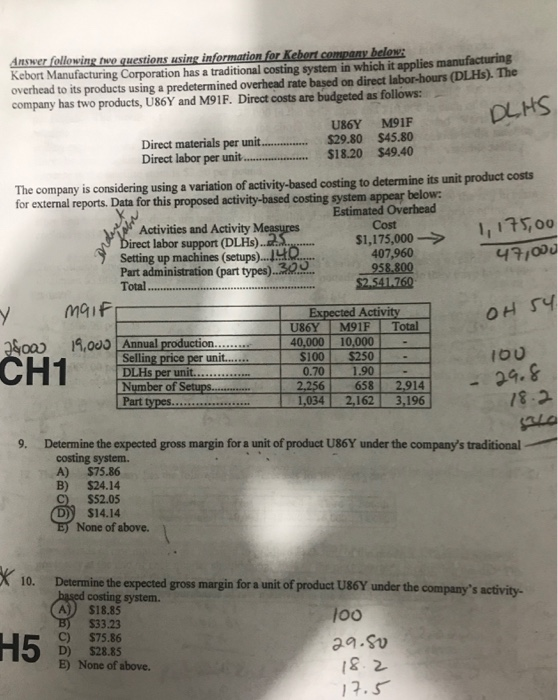

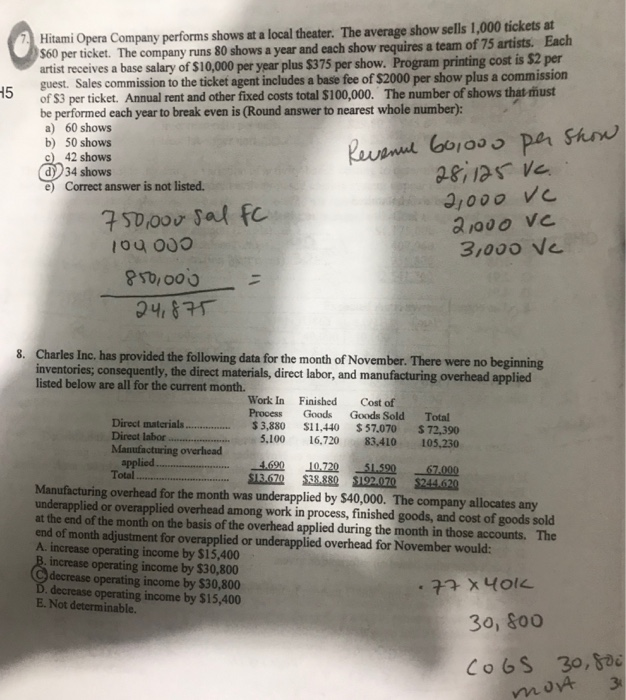

H5 Hitami Opera Company performs shows at a local theater. The average show sells 1,000 tickets at $60 per ticket. The company runs 80 shows a year and each show requires a team of 75 artists. Each artist receives a base salary of $10,000 per year plus $375 per show. Program printing cost is $2 per guest. Sales commission to the ticket agent includes a base fee of $2000 per show plus a commission of S3 per ticket. Annual rent and other fixed costs total $100,000. The number of shows that must be performed each year to break even is (Round answer to nearest whole number): a) 60 shows b) 50 shows c) 42 shows Revenue 60,000 per Show d) 34 shows e) Correct answer is not listed. 28:125 Vc. 750,000 sal FC 21000 VC 104 OJO 3,000 VC 850,000 24,875 2,000 Vc 8. Charles Inc, has provided the following data for the month of November. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month. Work In Finished Cost of Process Goods Goods Sold Total Direct materials $ 3,880 $11.440 $ 57,070 $ 72,390 Direet labor 5.100 16,720 83,410 105,230 Manufacturing overhead applied -4.620 10.720 51.590 67.000 Total S123.670 $28.880 $192.070 $244.620 Manufacturing overhead for the month was underapplied by $40,000. The company allocates any underapplied or overapplied overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts. The end of month adjustment for overapplied or underapplied overhead for November would: A. increase operating income by $15,400 B. increase operating income by $30,800 C decrease operating income by $30,800 D. decrease operating income by $15,400 E. Not determinable. 77 X Yok 30, 800 COGS 30,800 3 mort H5 Comment les 23.76 13. Simpson Company produces dolls. The following unit cost information is available: Selling price per doll $26.40 Variable cost per doll $12.00 80,000 units Current fixed costs $360,000 The sales manager projects that next year a 10% reduction in selling price, combined with an increase of $50,000 in advertising spending would result in an increase of 50% in unit sales. By how much will net income increase or decrease if they do so? A. $166,000 B. $157,000 C. $187,600 D$209,200 1, 152.000 E. Not determinable. 792,000 (50,000 11.76 1,4 11,201 (3601 DVD (360,000) 1,001, 2 209, 200 -10% 14. Tiger Company has the following information: Month Budgeted Purchases January $26,800 February 29,000 March 30,520 April 29,480 60% May 27,680 Purchases are paid for in the following manner: 40% in the month of purchase 50% in the month after purchase 10% two months after purchase What is the expected balance in Accounts Payable as of March 31? $21,212 B) $38,740 C) $12,208 D) $17,688 E) $20,740 18,312 2,900 31,212