Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show me the work and explain step by step. Make sure is correct. No EXCEL! 5. Electric Youth, Inc. (EY) is a perfume manufacturer.

please show me the work and explain step by step. Make sure is correct. No EXCEL!

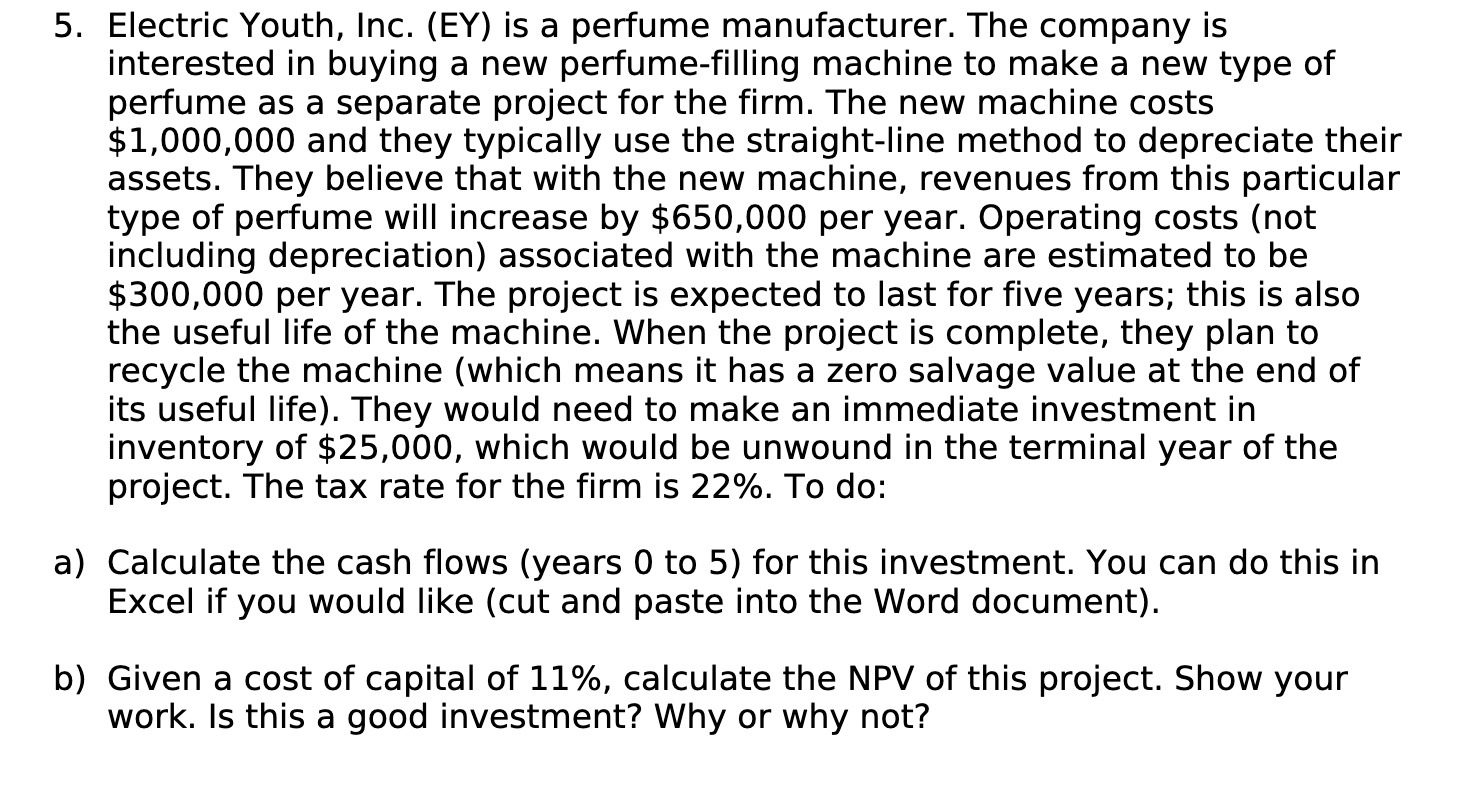

5. Electric Youth, Inc. (EY) is a perfume manufacturer. The company is interested in buying a new perfume-filling machine to make a new type of perfume as a separate project for the firm. The new machine costs $1,000,000 and they typically use the straight-line method to depreciate their assets. They believe that with the new machine, revenues from this particular type of perfume will increase by $650,000 per year. Operating costs (not including depreciation) associated with the machine are estimated to be $300,000 per year. The project is expected to last for five years; this is also the useful life of the machine. When the project is complete, they plan to recycle the machine (which means it has a zero salvage value at the end of its useful life). They would need to make an immediate investment in inventory of $25,000, which would be unwound in the terminal year of the project. The tax rate for the firm is 22%. To do: a) Calculate the cash flows (years 0 to 5 ) for this investment. You can do this in Excel if you would like (cut and paste into the Word document). b) Given a cost of capital of 11%, calculate the NPV of this project. Show your work. Is this a good investment? Why or why not

5. Electric Youth, Inc. (EY) is a perfume manufacturer. The company is interested in buying a new perfume-filling machine to make a new type of perfume as a separate project for the firm. The new machine costs $1,000,000 and they typically use the straight-line method to depreciate their assets. They believe that with the new machine, revenues from this particular type of perfume will increase by $650,000 per year. Operating costs (not including depreciation) associated with the machine are estimated to be $300,000 per year. The project is expected to last for five years; this is also the useful life of the machine. When the project is complete, they plan to recycle the machine (which means it has a zero salvage value at the end of its useful life). They would need to make an immediate investment in inventory of $25,000, which would be unwound in the terminal year of the project. The tax rate for the firm is 22%. To do: a) Calculate the cash flows (years 0 to 5 ) for this investment. You can do this in Excel if you would like (cut and paste into the Word document). b) Given a cost of capital of 11%, calculate the NPV of this project. Show your work. Is this a good investment? Why or why not Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started