Answered step by step

Verified Expert Solution

Question

1 Approved Answer

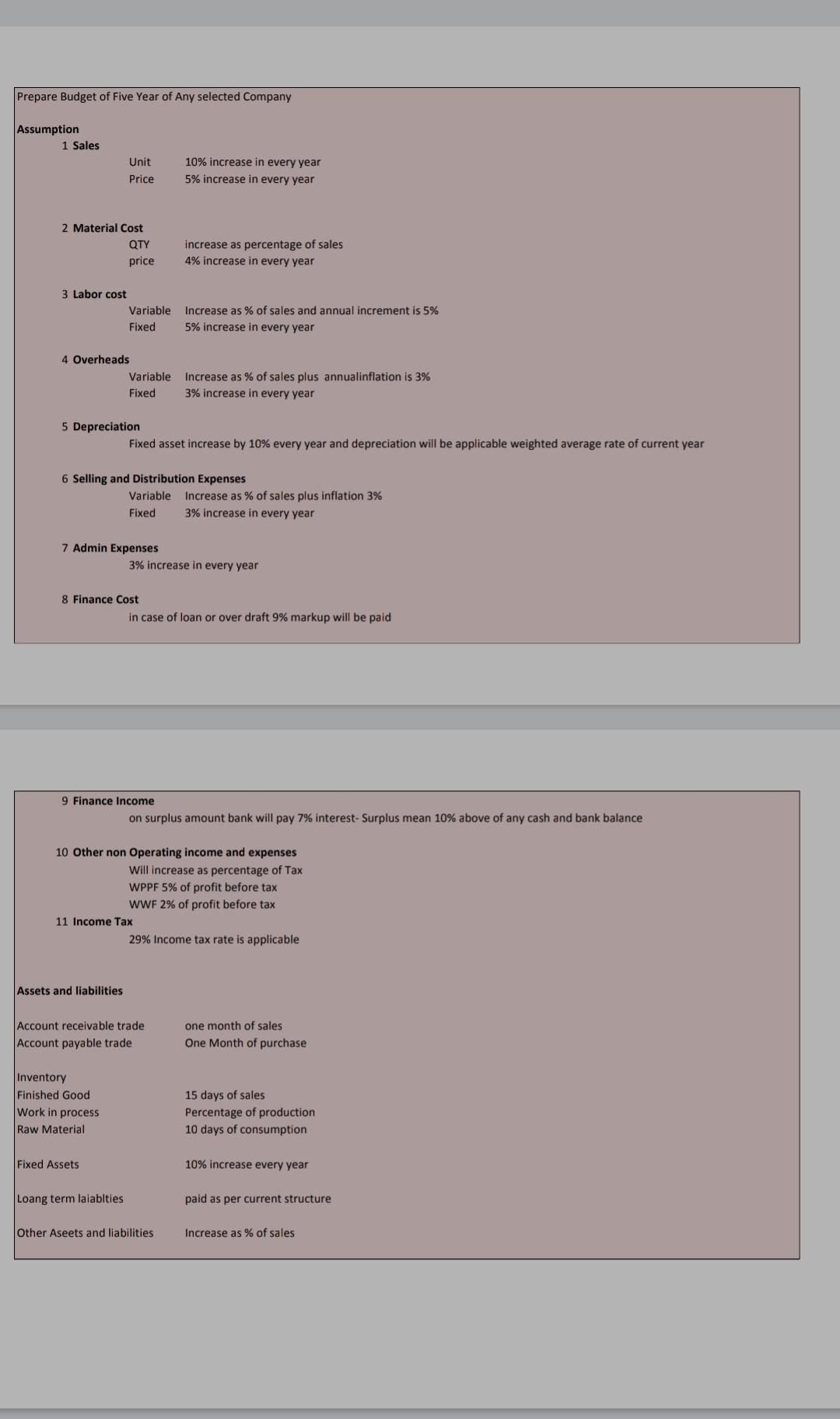

please show proper working and show all necessary computations Prepare Budget of Five Year of Any selected Company Assumption 1 Sales Unit Price 10% increase

please show proper working and show all necessary computations

Prepare Budget of Five Year of Any selected Company Assumption 1 Sales Unit Price 10% increase in every year 5% increase in every year 2 Material Cost QTY price increase as percentage of sales 4% increase in every year 3 Labor cost Variable Fixed Increase as % of sales and annual increment is 5% 5% increase in every year 4 Overheads Variable Fixed Increase as % of sales plus annualinflation is 3% 3% increase in every year 5 Depreciation Fixed asset increase by 10% every year and depreciation will be applicable weighted average rate of current year 6 Selling and Distribution Expenses Variable Increase as % of sales plus inflation 3% Fixed 3% increase in every year 7 Admin Expenses 3% increase in every year 8 Finance Cost in case of loan or over draft 9% markup will paid 9 Finance Income on surplus amount bank will pay 7% interest- Surplus mean 10% above of any cash and bank balance 10 Other non Operating income and expenses Will increase as percentage of Tax WPPF 5% of profit before tax WWF 2% of profit before tax 11 Income Tax 29% Income tax rate is applicable Assets and liabilities Account receivable trade Account payable trade one month of sales One Month of purchase Inventory Finished Good Work in process Raw Material 15 days of sales Percentage of production 10 days of consumption Fixed Assets 10% increase every year Loang term laiablties paid as per current structure Other Aseets and liabilities Increase as % of sales Prepare Budget of Five Year of Any selected Company Assumption 1 Sales Unit Price 10% increase in every year 5% increase in every year 2 Material Cost QTY price increase as percentage of sales 4% increase in every year 3 Labor cost Variable Fixed Increase as % of sales and annual increment is 5% 5% increase in every year 4 Overheads Variable Fixed Increase as % of sales plus annualinflation is 3% 3% increase in every year 5 Depreciation Fixed asset increase by 10% every year and depreciation will be applicable weighted average rate of current year 6 Selling and Distribution Expenses Variable Increase as % of sales plus inflation 3% Fixed 3% increase in every year 7 Admin Expenses 3% increase in every year 8 Finance Cost in case of loan or over draft 9% markup will paid 9 Finance Income on surplus amount bank will pay 7% interest- Surplus mean 10% above of any cash and bank balance 10 Other non Operating income and expenses Will increase as percentage of Tax WPPF 5% of profit before tax WWF 2% of profit before tax 11 Income Tax 29% Income tax rate is applicable Assets and liabilities Account receivable trade Account payable trade one month of sales One Month of purchase Inventory Finished Good Work in process Raw Material 15 days of sales Percentage of production 10 days of consumption Fixed Assets 10% increase every year Loang term laiablties paid as per current structure Other Aseets and liabilities Increase as % of salesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started