Please show solutions.

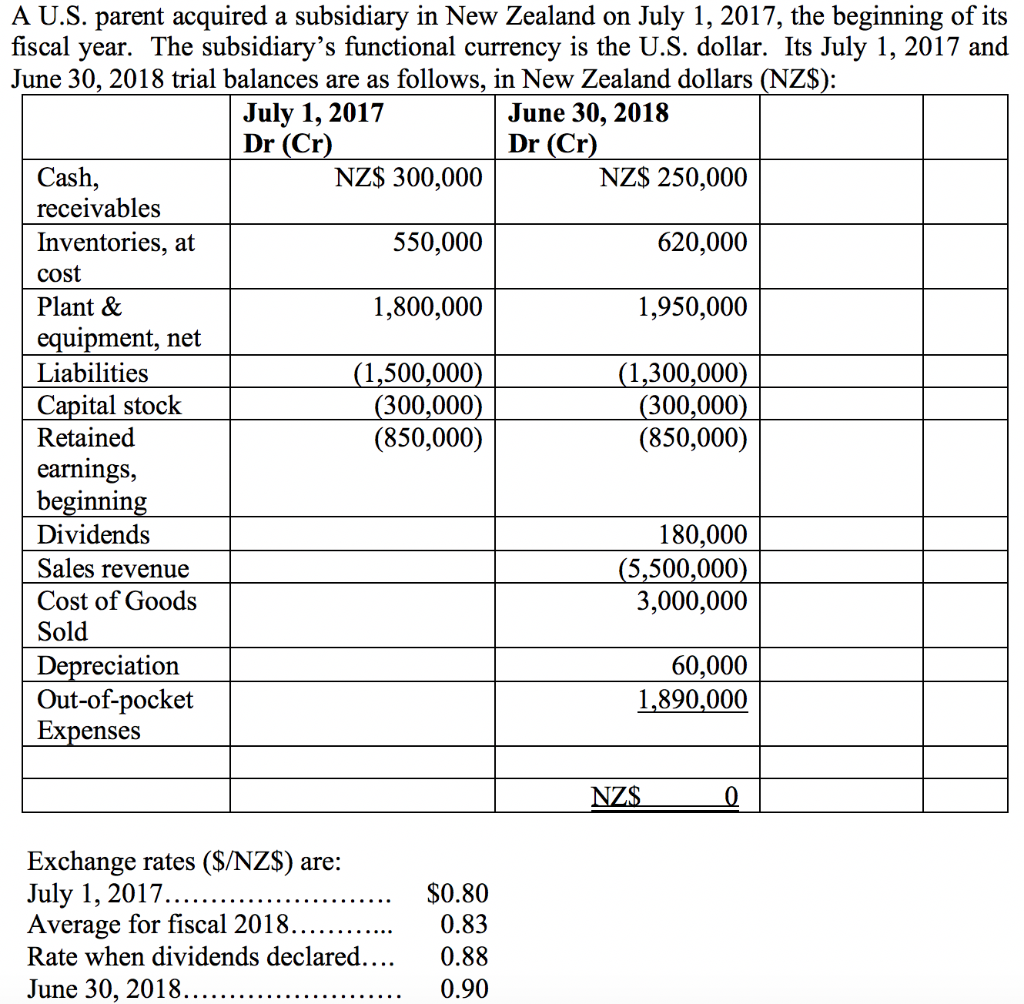

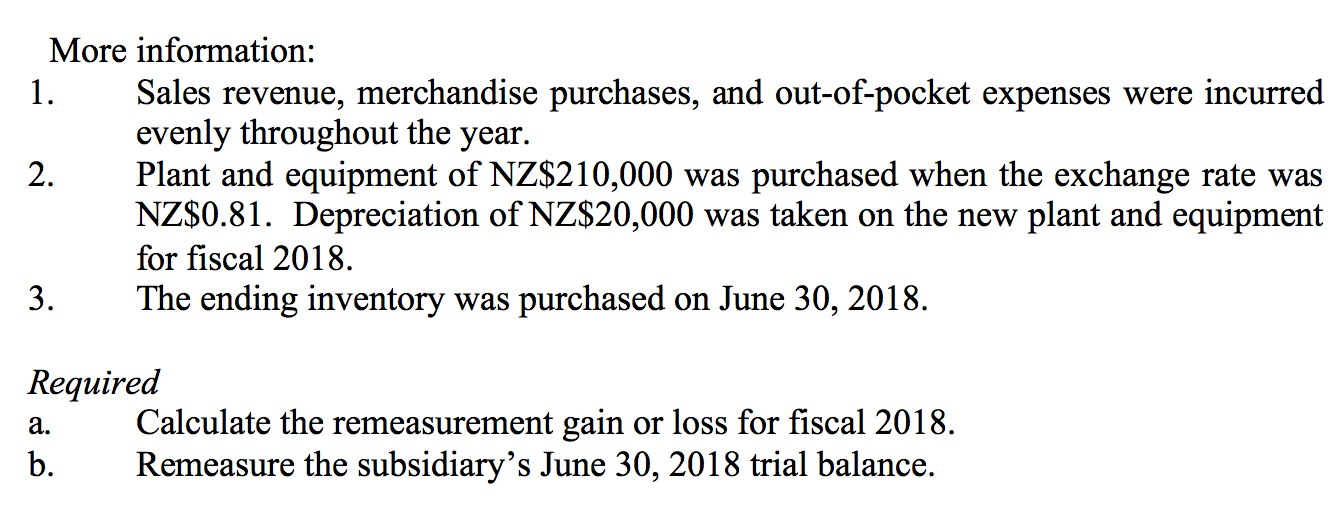

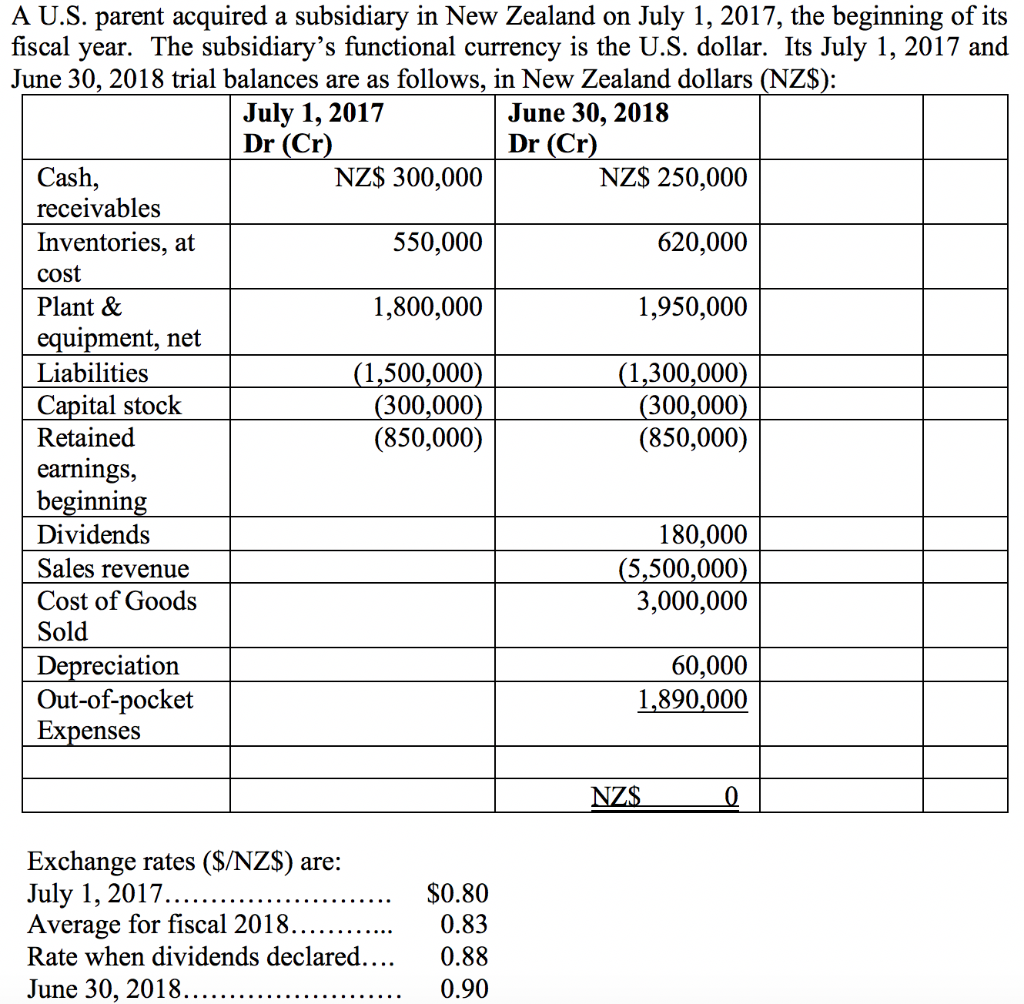

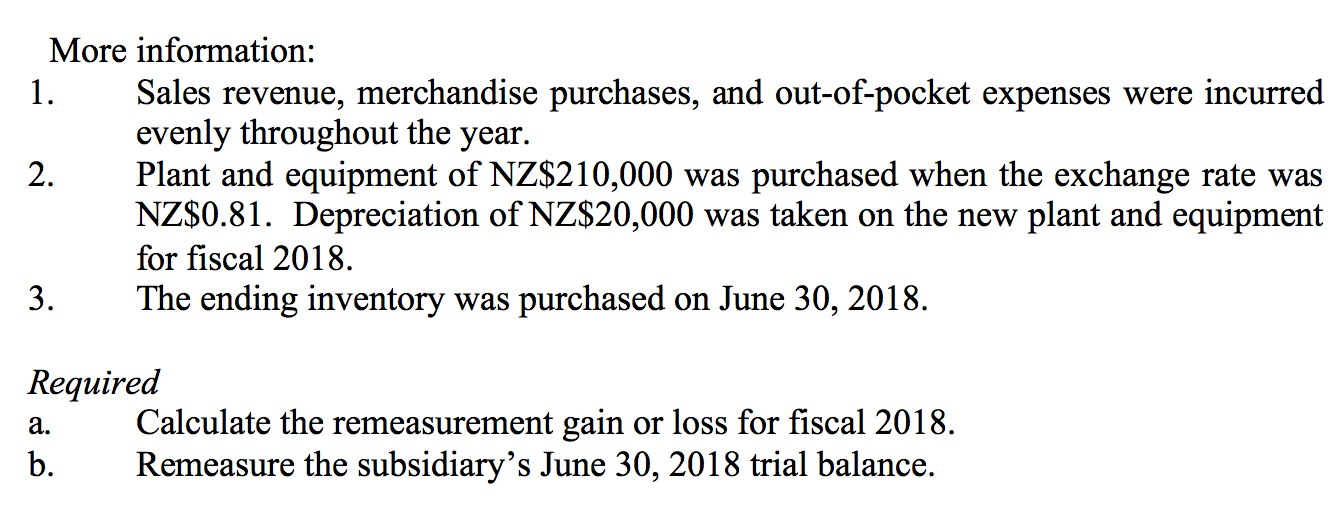

A U.S. parent acquired a subsidiary in New Zealand on July 1, 2017, the beginning of its fiscal year. The subsidiary's functional currency is the U.S. dollar. Its July 1, 2017 and June 30, 2018 trial balances are as follows, in New Zealand dollars (NZ$): July 1, 2017 June 30, 2018 Dr (Cr) Dr (Cr) Cash, NZ$ 300,000 NZ$ 250,000 receivables Inventories, at 550,000 620,000 cost Plant & 1,800,000 1,950,000 equipment, net Liabilities (1,500,000) (1,300,000) Capital stock (300,000) (300,000) Retained (850,000) (850,000) earnings, beginning Dividends 180,000 Sales revenue (5,500,000) Cost of Goods 3,000,000 Sold Depreciation 60,000 Out-of-pocket 1,890,000 Expenses I NZ$ 0 | Exchange rates ($/NZ$) are: July 1, 2017......... Average for fiscal 2018. Rate when dividends declared.... June 30, 2018.... $0.80 0.83 0.88 0.90 More information: Sales revenue, merchandise purchases, and out-of-pocket expenses were incurred evenly throughout the year. Plant and equipment of NZ$210,000 was purchased when the exchange rate was NZ$0.81. Depreciation of NZ$20,000 was taken on the new plant and equipment for fiscal 2018. 3. The ending inventory was purchased on June 30, 2018. Required a. Calculate the remeasurement gain or loss for fiscal 2018. b. Remeasure the subsidiary's June 30, 2018 trial balance. A U.S. parent acquired a subsidiary in New Zealand on July 1, 2017, the beginning of its fiscal year. The subsidiary's functional currency is the U.S. dollar. Its July 1, 2017 and June 30, 2018 trial balances are as follows, in New Zealand dollars (NZ$): July 1, 2017 June 30, 2018 Dr (Cr) Dr (Cr) Cash, NZ$ 300,000 NZ$ 250,000 receivables Inventories, at 550,000 620,000 cost Plant & 1,800,000 1,950,000 equipment, net Liabilities (1,500,000) (1,300,000) Capital stock (300,000) (300,000) Retained (850,000) (850,000) earnings, beginning Dividends 180,000 Sales revenue (5,500,000) Cost of Goods 3,000,000 Sold Depreciation 60,000 Out-of-pocket 1,890,000 Expenses I NZ$ 0 | Exchange rates ($/NZ$) are: July 1, 2017......... Average for fiscal 2018. Rate when dividends declared.... June 30, 2018.... $0.80 0.83 0.88 0.90 More information: Sales revenue, merchandise purchases, and out-of-pocket expenses were incurred evenly throughout the year. Plant and equipment of NZ$210,000 was purchased when the exchange rate was NZ$0.81. Depreciation of NZ$20,000 was taken on the new plant and equipment for fiscal 2018. 3. The ending inventory was purchased on June 30, 2018. Required a. Calculate the remeasurement gain or loss for fiscal 2018. b. Remeasure the subsidiary's June 30, 2018 trial balance