Please show solutions.

Please show solutions.

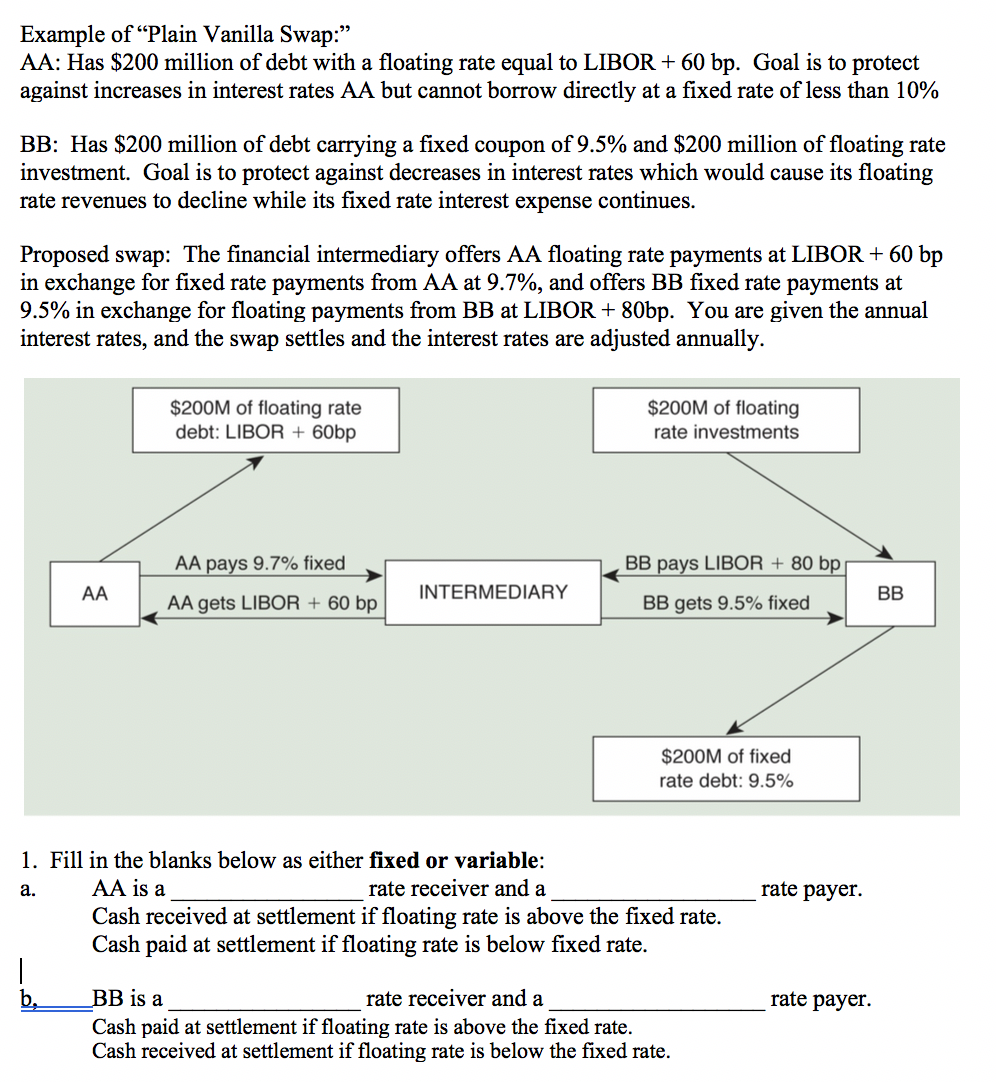

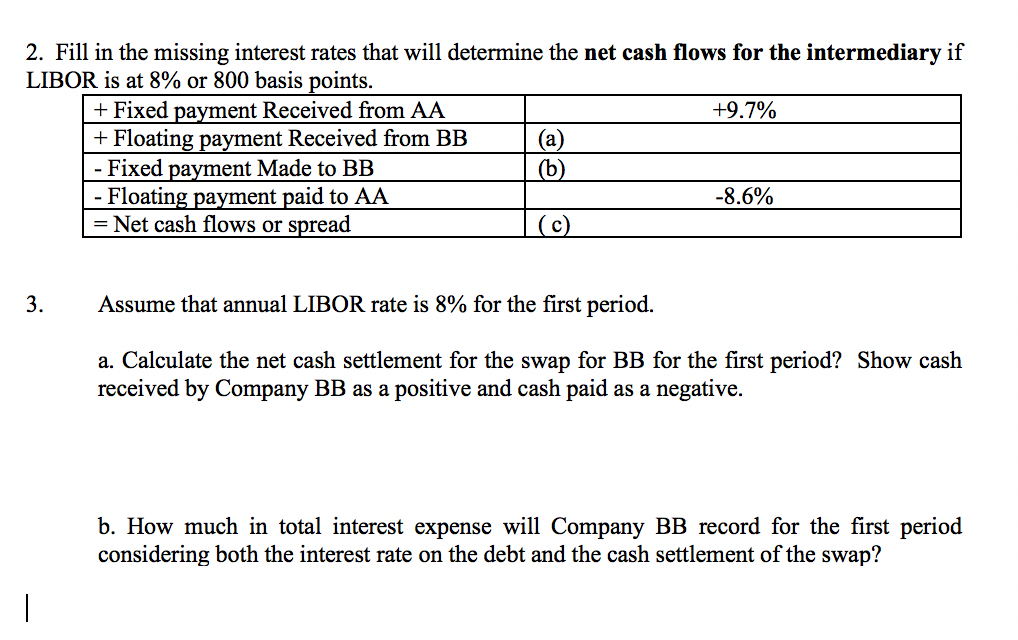

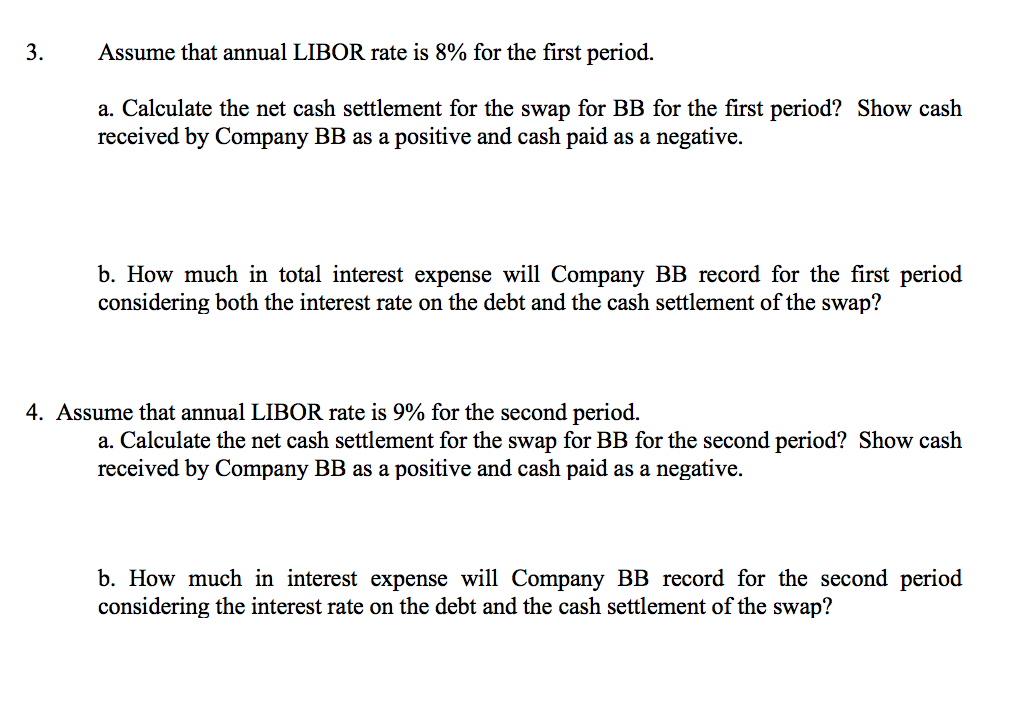

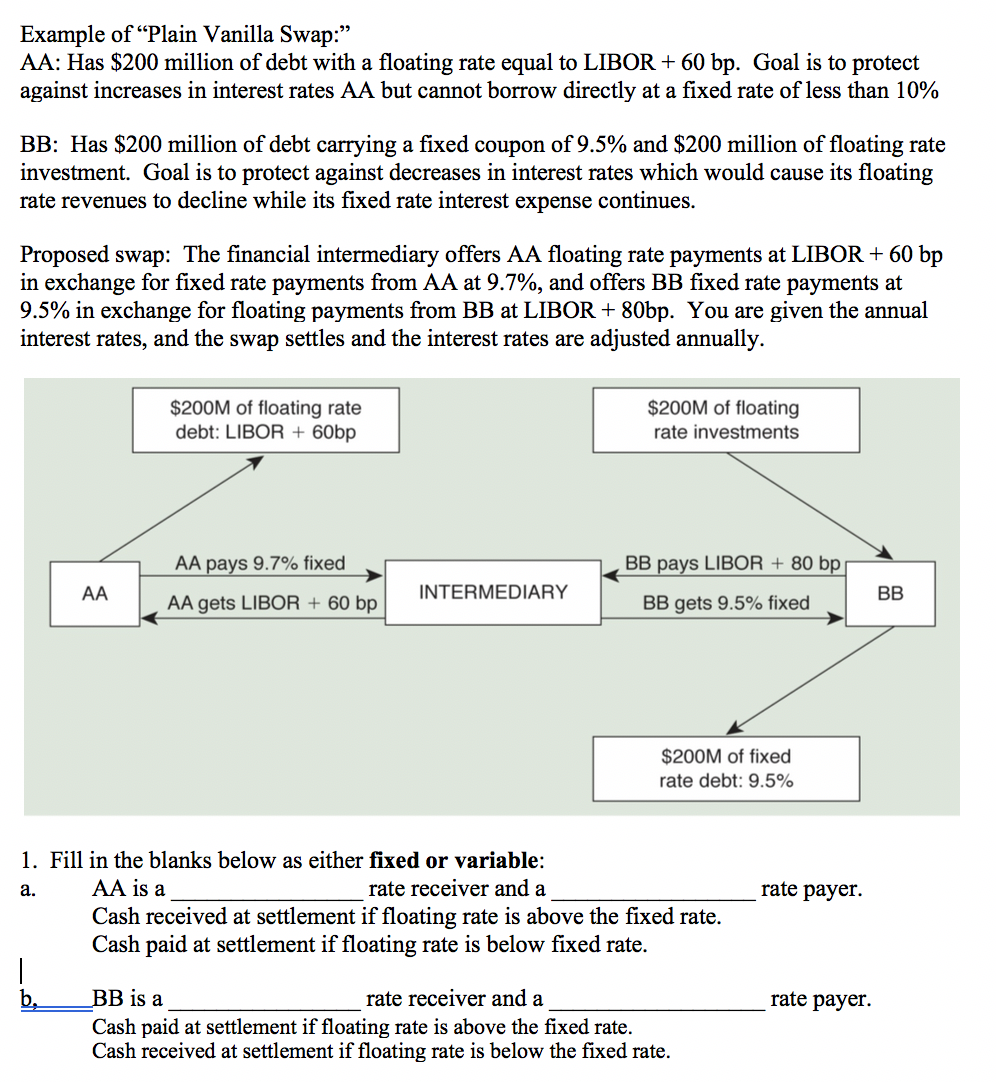

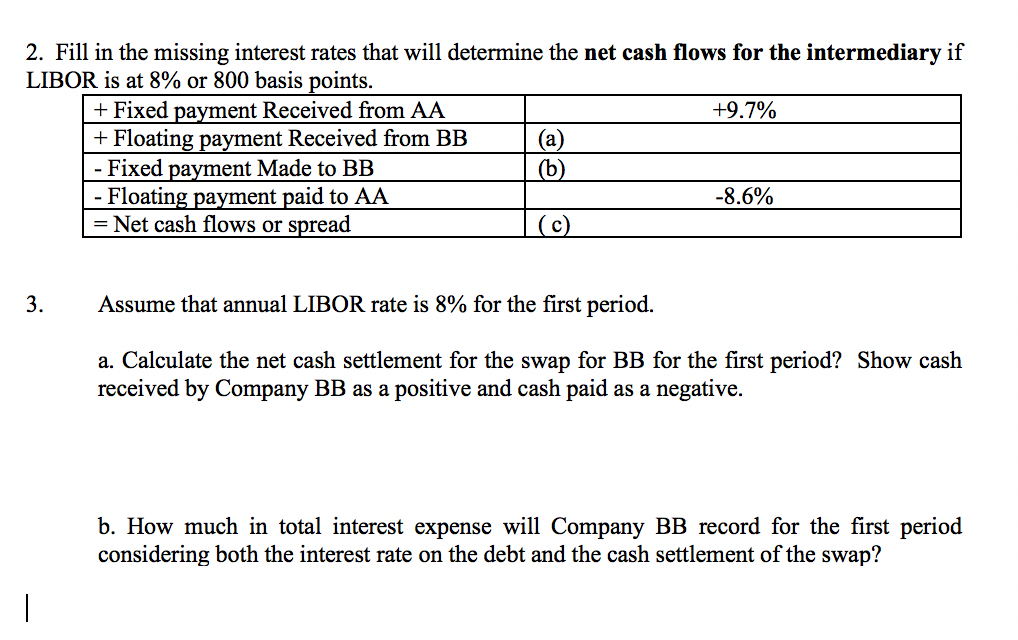

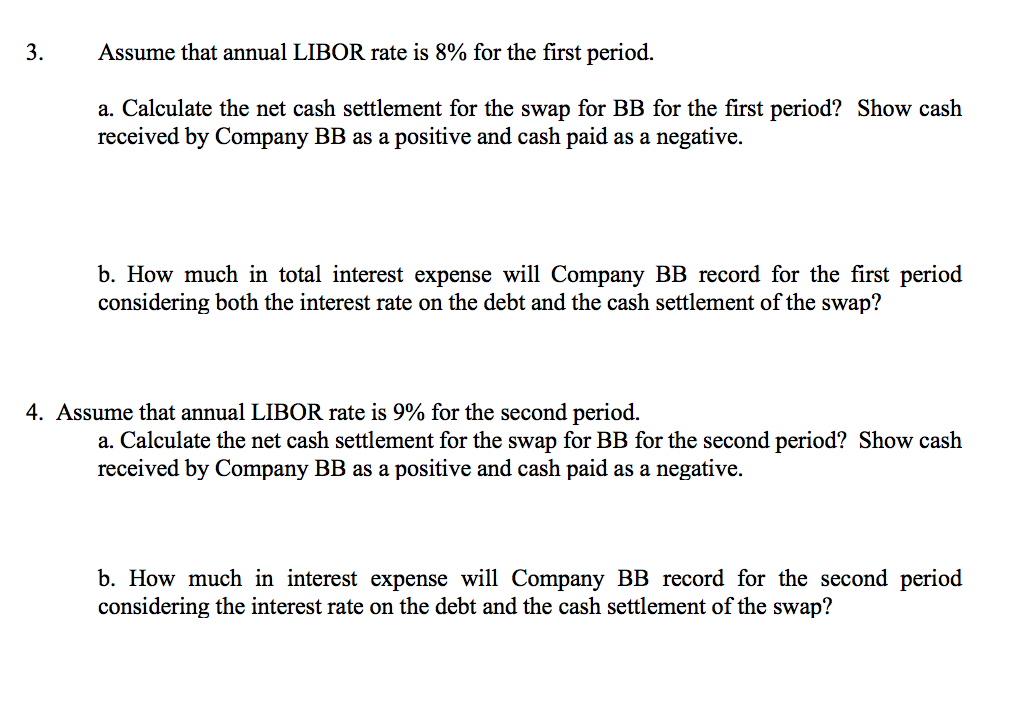

Example of "Plain Vanilla Swap:" AA: Has $200 million of debt with a floating rate equal to LIBOR + 60 bp. Goal is to protect against increases in interest rates AA but cannot borrow directly at a fixed rate of less than 10% BB: Has $200 million of debt carrying a fixed coupon of 9.5% and $200 million of floating rate investment. Goal is to protect against decreases in interest rates which would cause its floating rate revenues to decline while its fixed rate interest expense continues. Proposed swap: The financial intermediary offers AA floating rate payments at LIBOR + 60 bp in exchange for fixed rate payments from AA at 9.7%, and offers BB fixed rate payments at 9.5% in exchange for floating payments from BB at LIBOR + 80bp. You are given the annual interest rates, and the swap settles and the interest rates are adjusted annually. $200M of floating rate debt: LIBOR + 60bp $200M of floating rate investments AA pays 9.7% fixed BB pays LIBOR + 80 bp AA AA gets LIBOR + 60 bp INTERMEDIARY BB BB gets 9.5% fixed $200M of fixed rate debt: 9.5% 1. Fill in the blanks below as either fixed or variable: a. AA is a _rate receiver and a Cash received at settlement if floating rate is above the fixed rate. Cash paid at settlement if floating rate is below fixed rate. rate payer. b. rate payer. BB is a rate receiver and a Cash paid at settlement if floating rate is above the fixed rate. Cash received at settlement if floating rate is below the fixed rate. 2. Fill in the missing interest rates that will determine the net cash flows for the intermediary if LIBOR is at 8% or 800 basis points. + Fixed payment Received from AA +9.7% | + Floating payment Received from BB (a) - Fixed payment Made to BB (b) - Floating payment paid to AA -8.6% = Net cash flows or spread (C) - 3. Assume that annual LIBOR rate is 8% for the first period. a. Calculate the net cash settlement for the swap for BB for the first period? Show cash received by Company BB as a positive and cash paid as a negative. b. How much in total interest expense will Company BB record for the first period considering both the interest rate on the debt and the cash settlement of the swap? 3. Assume that annual LIBOR rate is 8% for the first period. a. Calculate the net cash settlement for the swap for BB for the first period? Show cash received by Company BB as a positive and cash paid as a negative. b. How much in total interest expense will Company BB record for the first period considering both the interest rate on the debt and the cash settlement of the swap? 4. Assume that annual LIBOR rate is 9% for the second period. a. Calculate the net cash settlement for the swap for BB for the second period? Show cash received by Company BB as a positive and cash paid as a negative. b. How much in interest expense will Company BB record for the second period considering the interest rate on the debt and the cash settlement of the swap? Example of "Plain Vanilla Swap:" AA: Has $200 million of debt with a floating rate equal to LIBOR + 60 bp. Goal is to protect against increases in interest rates AA but cannot borrow directly at a fixed rate of less than 10% BB: Has $200 million of debt carrying a fixed coupon of 9.5% and $200 million of floating rate investment. Goal is to protect against decreases in interest rates which would cause its floating rate revenues to decline while its fixed rate interest expense continues. Proposed swap: The financial intermediary offers AA floating rate payments at LIBOR + 60 bp in exchange for fixed rate payments from AA at 9.7%, and offers BB fixed rate payments at 9.5% in exchange for floating payments from BB at LIBOR + 80bp. You are given the annual interest rates, and the swap settles and the interest rates are adjusted annually. $200M of floating rate debt: LIBOR + 60bp $200M of floating rate investments AA pays 9.7% fixed BB pays LIBOR + 80 bp AA AA gets LIBOR + 60 bp INTERMEDIARY BB BB gets 9.5% fixed $200M of fixed rate debt: 9.5% 1. Fill in the blanks below as either fixed or variable: a. AA is a _rate receiver and a Cash received at settlement if floating rate is above the fixed rate. Cash paid at settlement if floating rate is below fixed rate. rate payer. b. rate payer. BB is a rate receiver and a Cash paid at settlement if floating rate is above the fixed rate. Cash received at settlement if floating rate is below the fixed rate. 2. Fill in the missing interest rates that will determine the net cash flows for the intermediary if LIBOR is at 8% or 800 basis points. + Fixed payment Received from AA +9.7% | + Floating payment Received from BB (a) - Fixed payment Made to BB (b) - Floating payment paid to AA -8.6% = Net cash flows or spread (C) - 3. Assume that annual LIBOR rate is 8% for the first period. a. Calculate the net cash settlement for the swap for BB for the first period? Show cash received by Company BB as a positive and cash paid as a negative. b. How much in total interest expense will Company BB record for the first period considering both the interest rate on the debt and the cash settlement of the swap? 3. Assume that annual LIBOR rate is 8% for the first period. a. Calculate the net cash settlement for the swap for BB for the first period? Show cash received by Company BB as a positive and cash paid as a negative. b. How much in total interest expense will Company BB record for the first period considering both the interest rate on the debt and the cash settlement of the swap? 4. Assume that annual LIBOR rate is 9% for the second period. a. Calculate the net cash settlement for the swap for BB for the second period? Show cash received by Company BB as a positive and cash paid as a negative. b. How much in interest expense will Company BB record for the second period considering the interest rate on the debt and the cash settlement of the swap

Please show solutions.

Please show solutions.