Answered step by step

Verified Expert Solution

Question

1 Approved Answer

*please show solutions using excel formulas* DDD is debating the purchase of a new digital scanner. The scanner they acquired 3 years ago for $800,000

*please show solutions using excel formulas*

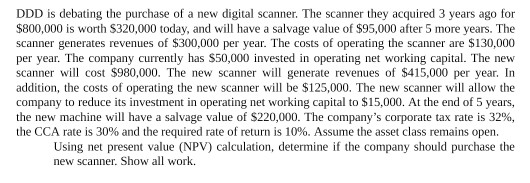

DDD is debating the purchase of a new digital scanner. The scanner they acquired 3 years ago for $800,000 is worth $320,000 today, and will have a salvage value of $95,000 after 5 more years. The scanner generates revenues of $300,000 per year. The costs of operating the scanner are $130,000 per year. The company currently has $50,000 invested in operating net working capital. The new scanner will cost $980,000. The new scanner will generate revenues of $415,000 per year. In addition, the costs of operating the new scanner will be $125,000. The new scanner will allow the company to reduce its investment in operating networking capital to $15,000. At the end of 5 years, the new machine will have a salvage value of $220,000. The company's corporate tax rate is 32%, the CCA rate is 30% and the required rate of return is 10%. Assume the asset class remains open. Using net present value (NPV) calculation, determine if the company should purchase the new scanner. Show all workStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started