Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show step by step calculations . no excel working Question 3: CLO 4 Capital Investment Decision (20 marks) a) ABC limited company looking to

please show step by step calculations . no excel working

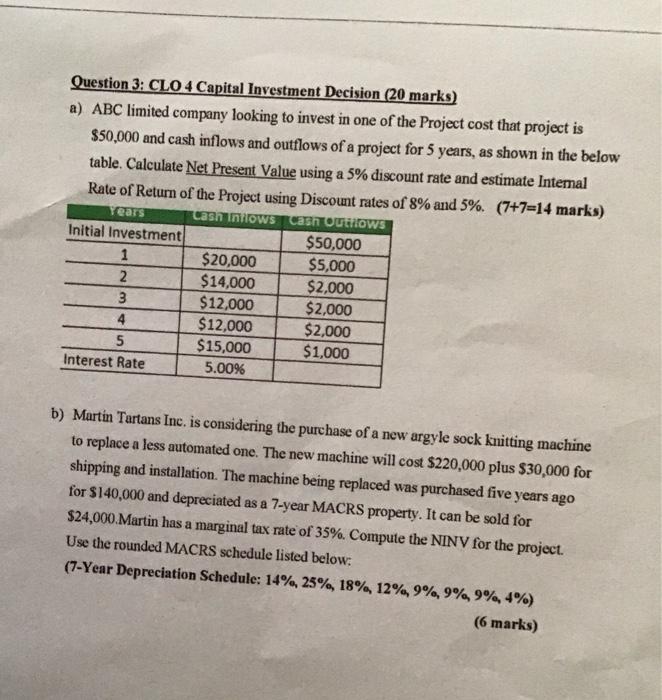

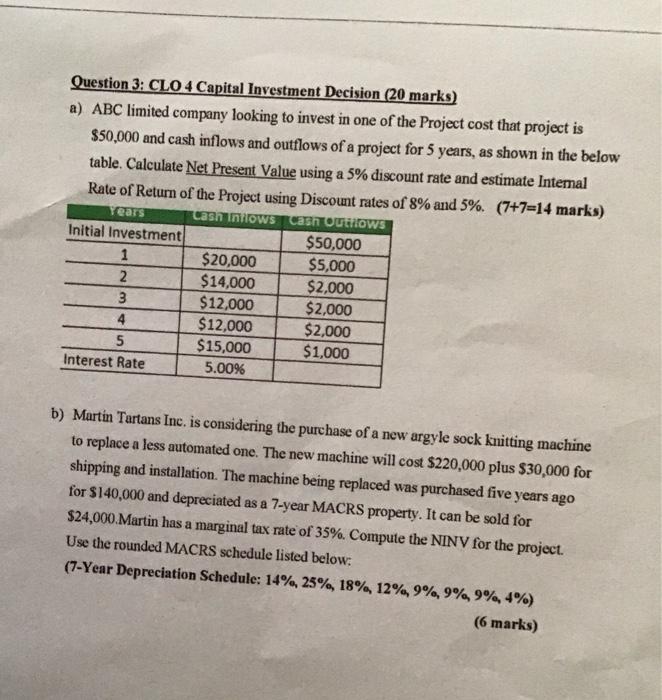

Question 3: CLO 4 Capital Investment Decision (20 marks) a) ABC limited company looking to invest in one of the Project cost that project is $50,000 and cash inflows and outflows of a project for 5 years, as shown in the below table. Calculate Net Present Value using a 5% discount rate and estimate Internal Rate of Return of the Project using Discount rates of 8% and 5%. (7+7=14 marks) Cash Inflows Cash Outflows Years Initial Investment 1 2 3 4 5 Interest Rate $20,000 $14,000 $12,000 $12,000 $15,000 5.00% $50,000 $5,000 $2,000 $2,000 $2,000 $1,000 b) Martin Tartans Inc. is considering the purchase of a new argyle sock knitting machine to replace a less automated one. The new machine will cost $220,000 plus $30,000 for shipping and installation. The machine being replaced was purchased five years ago for $140,000 and depreciated as a 7-year MACRS property. It can be sold for $24,000.Martin has a marginal tax rate of 35%. Compute the NINV for the project. Use the rounded MACRS schedule listed below: (7-Year Depreciation Schedule: 14%, 25%, 18%, 12%, 9%, 9%, 9%, 4%) (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started