Answered step by step

Verified Expert Solution

Question

1 Approved Answer

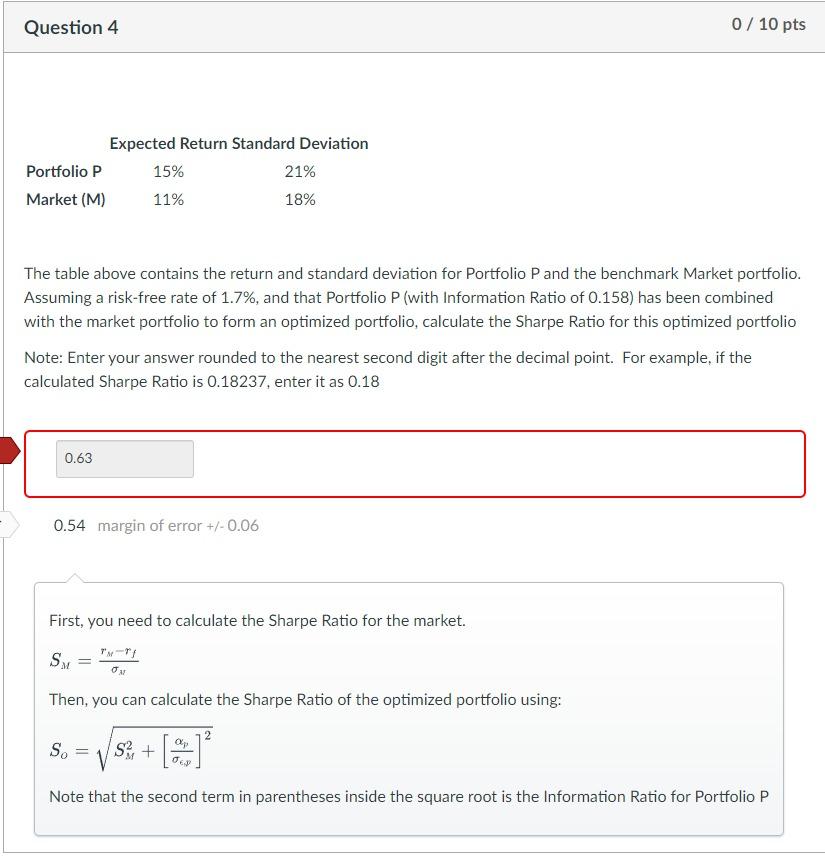

Please show step by step on Excel Question 4 0 / 10 pts Expected Return Standard Deviation Portfolio P 15% 21% Market (M) 11% 18%

Please show step by step on Excel

Question 4 0 / 10 pts Expected Return Standard Deviation Portfolio P 15% 21% Market (M) 11% 18% The table above contains the return and standard deviation for Portfolio P and the benchmark Market portfolio. Assuming a risk-free rate of 1.7%, and that Portfolio P(with Information Ratio of 0.158) has been combined with the market portfolio to form an optimized portfolio, calculate the Sharpe Ratio for this optimized portfolio Note: Enter your answer rounded to the nearest second digit after the decimal point. For example, if the calculated Sharpe Ratio is 0.18237, enter it as 0.18 0.63 0.54 margin of error +/- 0.06 First, you need to calculate the Sharpe Ratio for the market. S Then, you can calculate the Sharpe Ratio of the optimized portfolio using: S. s+a , op 0 Note that the second term in parentheses inside the square root is the Information Ratio for Portfolio PStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started