Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show step by step on how to solve each questions ans also how to slove on financial calculator. Thank you! Please read carefully and

Please show step by step on how to solve each questions ans also how to slove on financial calculator. Thank you!

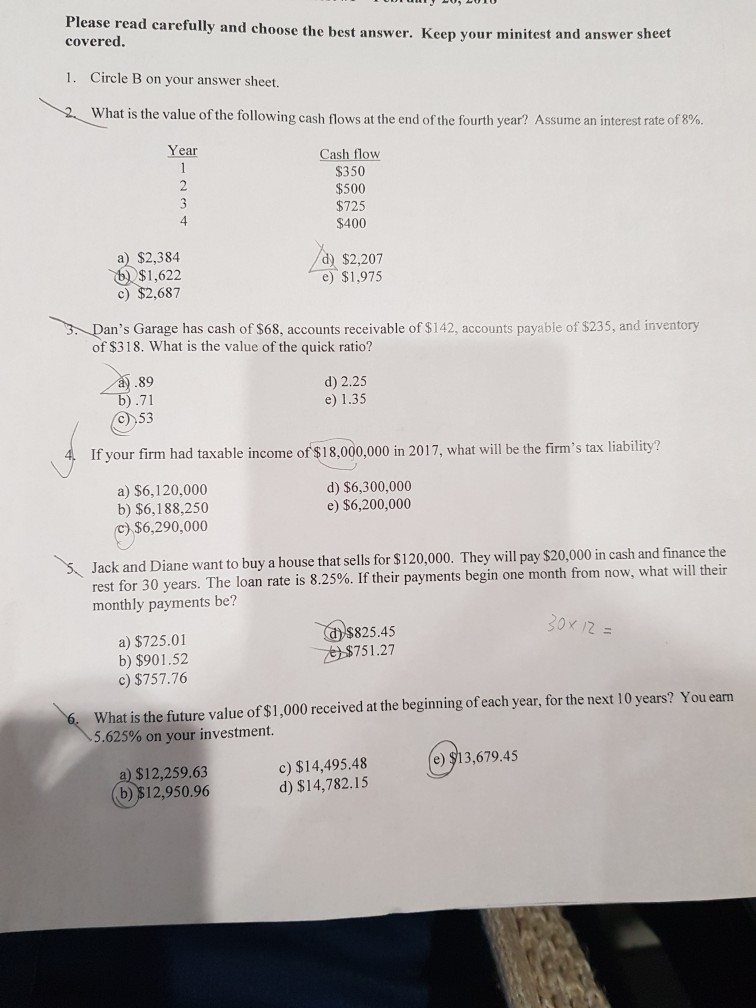

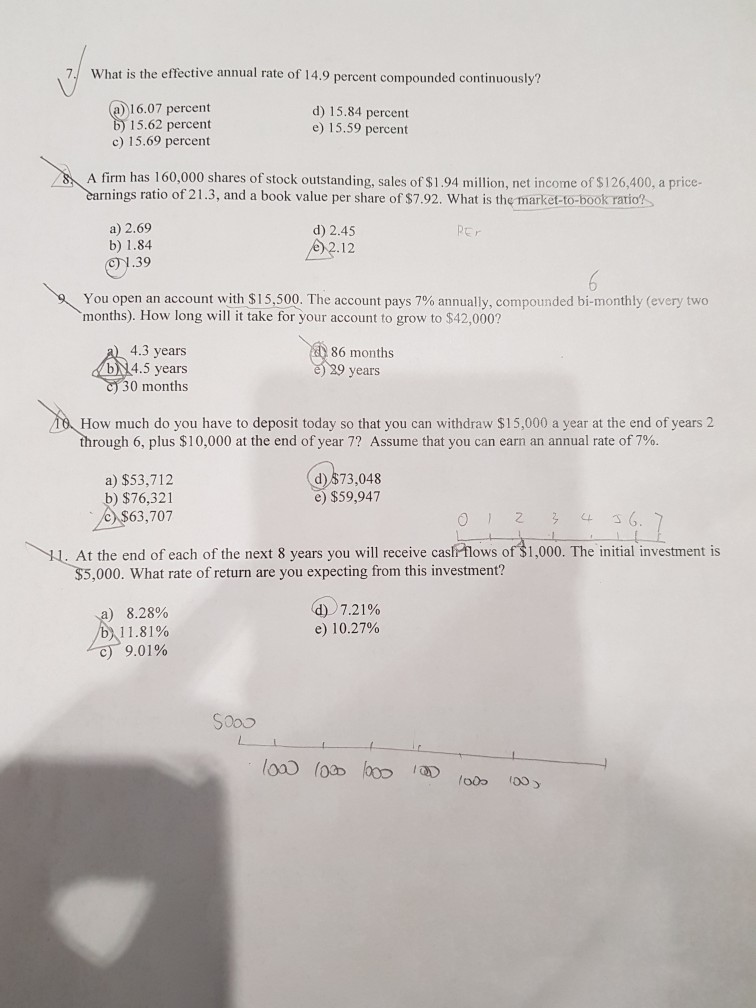

Please read carefully and choose the best answer. Keep your minitest and answer sheet covered 1. Circle B on your answer sheet. What is the value of the following cash flows at the end of the fourth year? Assume an interest rte of 8%. Year Cash flow $350 $500 $725 $400 4 a) $2,384 ),\$1,622 c) $2,687 d) $2,207 e) $1,975 Dan's Garage has cash of $68, accounts receivable of $142, accounts payable of $235, and inventory of $318. What is the value of the quick ratio? a.89 71 c) 53 d) 2.25 e) 1.35 If your firm had taxable income of$18,000,000 in 2017, what will be the firm's tax liability? a) $6,120,000 b) $6,188,250 $6,290,000 d) $6,300,000 e) $6,200,000 ance the Jack and Diane want to buy a house that sells for $120,000. They will pay $20,000 in cash and fin rest for 30 years. The loan rate is 8.25%. If their payments begin one month from now, what will their monthly payments be? a) $725.01 b) $901.52 c) $757.76 $825.45 $75 1.27 - What is the future value of $1,000 received at the beginning of each year, for the next 10 years? You ean 5.625% on your c) $14,495.48 d) $14,782.15 e) $13,679.4:5 $12,259.63 b)$12,950.90

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started