Answered step by step

Verified Expert Solution

Question

1 Approved Answer

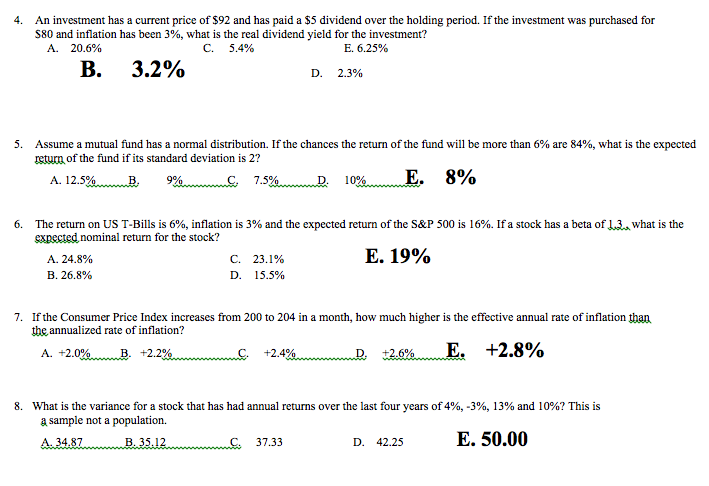

please show steps 4. An investment has a current price of $92 and has paid a S5 dividend over the holding period. If the investment

please show steps

4. An investment has a current price of $92 and has paid a S5 dividend over the holding period. If the investment was purchased for S80 and inflation has been 3%, what is the real dividend yield for the investment? A. 20.6% C. 5.4% E. 6.25% B. 3.2% D. 2.3% 5. Assume a mutual fund has a normal distribution. If the chances the return of the fund will be more than 6% are 84%, what is the expected uslumni.ihr: ii owi if it? siaucierd dswiai?H ?s 2? A. 12.5WB C. 7.5% D. 1096 6. The return on US T-Bills is 6%, inflation is 3% and the expected return of the S&P 500 is 16%. If a stock has a beta of 1.3 , what is the expected nominal return for the stock? E. 19% A. 24.8% B. 26.8% C. 23.1% D. 15.5% 7. If the Consumer Price Index increases from 200 to 204 in a month, how much higher is the effective annual rate of inflation than the annualized rate of inflation? A. +20% w w B. +2.23 wwwwwwww +2.42 E. +2.8 % wwwwwwD, +2.6% 8. what is the variance for a stock that has had annual returns over the last four years of496,-3%, 13% and 10%? This is a sample not a population B.SlwSs 37.33 E.50.00 D. 42.25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started